Fannie Mae Unveils Mortgage Program to Help Minority Borrowers

25 Agosto 2015 - 8:00PM

Dow Jones News

Fannie Mae wants to make it easier for working-class and

multigenerational households to get mortgages.

The mortgage-finance company said Tuesday that it will roll out

a program this year that lets lenders include income from

nonborrowers within a household, such as extended family members,

toward qualifying for a loan.

The move is expected to open up mortgage access to a segment of

the population that doesn't fit the typical family structure and

has had trouble obtaining mortgages. In households of some minority

groups, such as Hispanics, it is common to have extended family

members contributing income to the cost of housing, though until

now that income couldn't be used to help qualify for a loan.

The new program, which is only open to low-income borrowers or

those living in low-income or minority-dominated areas, will also

in some cases let nonoccupant borrowers, such as parents,

contribute income toward qualifying for a loan. Families with

boarders will also be allowed to count that rent toward

qualifying.

Fannie officials said their research indicated that extended

households have incomes as stable or more stable than other kinds

of households.

Fannie Mae and competitor Freddie Mac don't make loans. They buy

them from lenders, package them into securities and provide

guarantees to make investors whole if the loans default.

After the financial crisis, Fannie, Freddie and lenders greatly

strengthened the requirements borrowers had to meet to get loans.

The moves, such as increasing down-payment and credit-score

requirements, had the effect of lowering default rates for

homeowners but also shut out from the mortgage market many

borrowers who previously qualified.

Over the past couple of years, Fannie, Freddie and lenders have

loosened some of those restrictions. In late 2014 and early 2015,

Fannie and Freddie, for example, reintroduced programs that allow

down payments of as little as 3%, down from the previous 5%

minimum.

However, some advocates for increased minority homeownership

have argued that the companies should also make changes reflecting

the unique characteristics of the minority groups that are making

up an increasing share of new households.

Some groups, for example, have pushed the Federal Housing

Finance Agency, which regulates Fannie and Freddie, to adopt more

modern credit-scoring models that can take into account rent or

utility payments, which would help minority borrowers with scant

credit history.

Some lenders believe that such changes are critical to

addressing the country's changing demographics. In the next decade,

three in four new households will be formed by minorities,

according to researchers at the Urban Institute.

To qualify for loans under Fannie's new program, borrowers must

make less than 80% of their area's median income, buy a home in a

low-income census tract, or make less than 100% of the area's

median and buy a home in a high-minority census tract or designated

natural disaster area.

Fannie said the new program, which starts in late 2015, will

allow down payments of as little as 3%.

Write to Joe Light at joe.light@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 25, 2015 13:45 ET (17:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

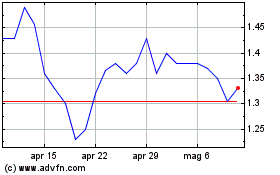

Grafico Azioni Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Storico

Da Apr 2023 a Apr 2024