Generali, Fitch alza giudizio su obbligazioni grazie ad azione management

26 Agosto 2015 - 9:31PM

Annunci Borsa (Testo)

26/08/2015 COMUNICATO STAMPA

Generali, Fitch alza giudizio su obbligazioni grazie ad azione

management

·

Confermato rating IFS del Gruppo a A-, outlook stabili, a seguito

rafforzamento patrimoniale e performance operativa

Trieste  L'agenzia di rating Fitch ha comunicato oggi di aver

rivisto al rialzo da BBB+ a A- il rating delle obbligazioni senior

di Generali; da BBB a BBB+ il rating dell'obbligazione subordinata

1 mld 4,125% e da BBB- a BBB il rating di tutte le altre

obbligazioni subordinate. L'agenzia, inoltre, ha confermato a A- il

rating IFS di Generali e delle sue società : Fitch ha spiegato che

ha rivisto al rialzo da A- ad A il rating IFS unconstrained, che

non considera le limitazioni legate al rating sovrano italiano, ma

l'applicazione di un sovereign constraint (che limita il rating ad

un massimo di un notch superiore a quello dell'Italia) vincola il

giudizio finale a A-. Gli outlook sono confermati stabili. Fitch ha

spiegato che il rating rispecchia il rafforzamento patrimoniale del

Gruppo, la prospettiva che la performance operativa continui ad

essere solida e che l'azione del management prosegua nel preservare

il capitale e ridurre la leva finanziaria. L'agenzia di rating

sottolinea, inoltre, che Generali ha un'elevata flessibilitÃ

finanziaria, come dimostrato, ad esempio, dalle attività di

pre-finanziamento portate avanti negli ultimi due anni. La

decisione di Fitch riflette anche la recente revisione dei criteri

relativi al notching per il settore assicurativo. In allegato il

comunicato stampa emesso da Fitch.

Media Relations T +39.040.671085 press@generali.com Investor

Relations T +39.040.671202 +39.040.671347 generali_ir@generali.com

www.generali.com

IL GRUPPO GENERALI Il Gruppo Generali è uno tra i maggiori

assicuratori globali con una raccolta premi complessiva superiore a

70 miliardi nel 2014. Con 78.000 collaboratori nel mondo al

servizio di 72 milioni di persone assicurate in oltre 60 Paesi, il

Gruppo occupa una posizione di leadership nei Paesi dell'Europa

Occidentale ed una presenza sempre più significativa nei mercati

dell'Europa Centro-orientale ed in quelli asiatici.

FITCH UPGRADES GENERALI'S IDR TO 'A-'; AFFIRMS IFS AT 'A-'; OUTLOOK

STABLE

Fitch Ratings-Frankfurt/London-26 August 2015: Fitch Ratings has

upgraded Assicurazioni Generali SpA's (Generali) Long-term Issuer

Default Rating (IDR) to 'A-' from 'BBB+' and affirmed the Insurer

Financial Strength (IFS) ratings for Generali and its core

subsidiaries at 'A-'. The Outlooks are Stable. Fitch has also

upgraded Generali's senior notes to 'A-' from 'BBB+', EUR1bn 4.125%

subordinated notes to 'BBB+' from 'BBB' and all other subordinated

notes to 'BBB' from 'BBB-'. A full list of rating actions is at the

end of this commentary. The ratings reflect Fitch's recently

updated notching criteria for the insurance sector, published on 14

July 2015. The updated notching criteria appear in Section VI of

the insurance master criteria report 'Insurance Rating

Methodology'. The upgrade of the IDR reflects the upgrade of the

unconstrained IFS as well as the change in the application of the

sovereign constraint, which now is applied as the last step in the

ratings process . No rating can exceed the sovereign constraint,

which Fitch has set at 'A-' for Generali, one notch higher than the

sovereign rating of Italy (BBB+). The unconstrained IFS rating of

Generali and its core subsidiaries is 'A', and its unconstrained

IDR is 'A-'. Both unconstrained ratings were upgraded by one notch.

KEY RATING DRIVERS The ratings reflect the improvement in

Generali's capital position and Fitch's expectations that

Generali's operations will remain strong and that management's

ongoing focus will be to preserve capital and reduce financial

leverage. Generali's Fitch Prism factor-based model (FBM) score

remained 'Strong' at end-2014, unchanged from end-2013. However,

the score is now very close to the 'Very Strong' level, reflecting

the improvement in Generali's capitalisation. Nonetheless, Fitch

believes that Generali's capital is vulnerable to stress due to its

substantial exposure to Italian sovereign debt and its high

investment leverage. Furthermore, Generali's significant levels of

goodwill and intangibles negatively affect the quality of its

capital. Generali's ratings are heavily influenced by the group's

exposure to Italian sovereign debt (EUR58bn or 2.5x consolidated

shareholders' funds at end-1H15). This represents a large

concentration risk and a potential source of volatility for capital

adequacy. The group's exposure to Italian sovereign debt, which is

to match domestic liabilities in Italy, is underlined by the

application of the sovereign constraint on its ratings. Generali's

Fitch-calculated financial leverage ratio (FLR) was high at 35% at

end-2014, unchanged from end-2013. However, the group has already

implemented measures to reduce financial debt. Fitch estimates that

by at end-1H15 the FLR had declined to 32%. Fixed-charge coverage

(FCC), including unrealised and realised gains and losses, was low

at 5.1x in 2014, up from 4.1x in 2013. Fitch expects FCC to improve

over time as the group deleverages and the new debt is expected to

have lower coupons than the existing outstanding notes. Fitch also

considers Generali has high financial flexibility, as demonstrated,

for example, by pre-funding activities carried out during the past

two years.

Operating performance has been strong over the past two years. The

positive trend continued in 1H15, with operating result up 11.3% to

EUR2.8bn, the best 1H result within the past eight years. Despite

Generali's efforts to grow its non-life business, its earnings

remain highly dependent on life insurance and investment markets.

As the group is reducing its strategic equity holdings, Fitch

believes its earnings will be more resilient to equity market

volatility in 2015 and beyond. RATING SENSITIVITIES An upgrade of

Generali's ratings is unlikely in the medium term given the group's

large exposure to Italian government debt. However, an upgrade

could occur if Italy's rating were upgraded to the 'A' category,

while at the same time Generali's FLR, as calculated by Fitch,

falls to below 30% and its Prism FBM score reaches 'Very Strong'.

Generali's ratings could be downgraded if its Prism FBM score were

to fall below 'Strong' for a prolonged period or its FLR rises to

more than 35%. Generali's ratings are also likely to be downgraded

if Italy is downgraded. The rating actions are as follows:

Assicurazioni Generali SpA: IDR upgraded to 'A-' from 'BBB+'; IFS

affirmed at 'A-'; Outlook Stable Generali Iard: IFS affirmed at

'A-'; Outlook Stable Generali Vie: IFS affirmed at 'A-'; Outlook

Stable Generali Deutschland Holding AG: IFS affirmed at 'A-';

Outlook Stable Generali Deutschland Pensionskasse AG: IFS affirmed

at 'A-'; Outlook Stable Cosmos Versicherung AG: IFS affirmed at

'A-'; Outlook Stable Cosmos Lebensversicherungs-AG: IFS affirmed at

'A-'; Outlook Stable AachenMuenchener Lebensversicherung AG: IFS

affirmed at 'A-'; Outlook Stable Generali Lebensversicherung AG:

IFS affirmed at 'A-'; Outlook Stable AachenMuenchener Versicherung

AG: IFS affirmed at 'A-'; Outlook Stable Generali Versicherung AG:

IFS affirmed at 'A-'; Outlook Stable Central Krankenversicherung

AG: IFS affirmed at 'A-'; Outlook Stable Generali Espana, S.A. de

Seguros Y Reaseguros: IFS affirmed at 'A-'; Outlook Stable Generali

Versicherung AG (Austria): IFS affirmed at 'A-'; Outlook Stable

Envivas Krankenversicherung AG: IFS affirmed at 'A-'; Outlook

Stable Advocard Rechtsschutzversicherung AG: IFS affirmed at 'A-';

Outlook Stable Dialog Lebensversicherungs-AG: IFS affirmed at 'A-';

Outlook Stable Generali (Schweiz) Holding AG: IDR upgraded to 'BBB'

from 'BBB-'; Outlook Stable Generali's debt ratings are as follows:

Assicurazioni Generali SpA Senior unsecured debt upgraded to 'A-'

from 'BBB+' EUR1bn 4.125% subordinated note upgraded to 'BBB+' from

'BBB' Other subordinated debt upgraded to 'BBB' from 'BBB-'

Generali Finance BV (guaranteed by Assicurazioni Generali SpA)

Subordinated debt upgraded at 'BBB' from 'BBB-' Contact: Primary

Analyst Dr Stephan Kalb Senior Director +49 69 7680 76118 Fitch

Deutschland GmbH Neue Mainzer Str. 46-50

60311 Frankfurt am Main Secondary Analyst Harish Gohil Managing

Director +44 20 3530 1257 Committee Chairperson Chris Waterman

Managing Director +44 20 3530 1168 Media Relations: Elaine

elaine.bailey@fitchratings.com. Bailey, London, Tel: +44 203 530

1153, Email:

Additional information is available on www.fitchratings.com

Applicable Criteria Insurance Rating Methodology (pub. 14 Jul 2015)

https://www.fitchratings.com/creditdesk/reports/report_frame.cfm?rpt_id=868367

ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND

DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY

FOLLOWING THIS LINK: HTTP://FITCHRATINGS.COM/

UNDERSTANDINGCREDITRATINGS. IN ADDITION, RATING DEFINITIONS AND THE

TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE AGENCY'S PUBLIC

WEBSITE 'WWW.FITCHRATINGS.COM'. PUBLISHED RATINGS, CRITERIA AND

METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. FITCH'S

CODE OF CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, AFFILIATE

FIREWALL, COMPLIANCE AND OTHER RELEVANT POLICIES AND PROCEDURES ARE

ALSO AVAILABLE FROM THE 'CODE OF CONDUCT' SECTION OF THIS SITE.

FITCH MAY HAVE PROVIDED ANOTHER PERMISSIBLE SERVICE TO THE RATED

ENTITY OR ITS RELATED THIRD PARTIES. DETAILS OF THIS SERVICE FOR

RATINGS FOR WHICH THE LEAD ANALYST IS BASED IN AN EU-REGISTERED

ENTITY CAN BE FOUND ON THE ENTITY SUMMARY PAGE FOR THIS ISSUER ON

THE FITCH WEBSITE.

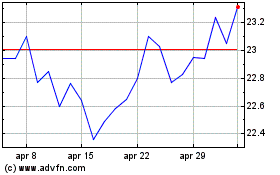

Grafico Azioni Generali (BIT:G)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Generali (BIT:G)

Storico

Da Apr 2023 a Apr 2024