Fannie Mae's Profit Halved

05 Novembre 2015 - 2:50PM

Dow Jones News

Fannie Mae said profit was halved in the third quarter, as

declines in long-term interest rates hurt the value of the

mortgage-finance company's derivatives.

Fannie Mae said it expects to send the U.S. Treasury Department

$2.2 billion in December.

The company reported a profit of $1.96 billion for the third

quarter, down from $3.91 billion a year earlier.

The decline was driven by $2.59 billion in fair-value losses in

the quarter, compared with a loss of $207 million in the

year-earlier period. The losses stem from changes to the value of

the derivatives Fannie Mae uses to manage risk, triggered by

decreases in long-term interest rates.

Rival Freddie Mac on Tuesday posted its first quarterly loss in

four years, also driven mainly by an accounting discrepancy

involving the derivatives the company uses to protect against

interest-rate changes. The derivatives are recorded at market value

even though some of the hedged assets aren't, which resulted in a

discrepancy that Freddie said caused a $1.5 billion hit to

earnings.

Over the past few years, rising home prices and lower mortgage

defaults have bolstered the profits of Fannie and Freddie.

Now, those benefits are receding, making the companies more

susceptible to the need for taxpayer help should the housing market

turn south and as the government requires them to wind down their

capital reserves.

The companies remain caught between shareholders and

civil-rights groups who want to see them freed from government

control, a White House that believes the current system is broken,

and a Congress that can't come to agreement on what the future

system should be.

The government took over Fannie and Freddie in 2008 and

eventually infused them with $187.5 billion in bailout money. Since

then, the companies have become highly profitable, paying out $239

billion in dividends.

Fannie Mae said it will have sent the Treasury $144.8 billion

after the December payment.

In the third quarter, Fannie Mae's net interest income, which

includes fees from backing mortgages, grew to $5.59 billion from

$5.18 billion a year earlier, driven by higher guaranty fees.

In recent years, a larger portion of Fannie's net interest

income has been made up of guaranty fees, rather than interest

income earned on its retained mortgage portfolio assets. Fannie

said the shift reflects guaranty fee increases implemented in 2012

and shrinking of its retained mortgage portfolio.

Fannie Mae has said it expects its earnings this year and beyond

to be "substantially lower" due to the drop in income from its

retained mortgage portfolio assets, lower income from resolution

agreements, and lower credit-related income.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 05, 2015 08:35 ET (13:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

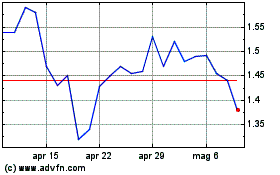

Grafico Azioni Fannie Mae (QB) (USOTC:FNMA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Fannie Mae (QB) (USOTC:FNMA)

Storico

Da Apr 2023 a Apr 2024