New Rules Curbing Wall Street Pay Announced

21 Aprile 2016 - 4:40PM

Dow Jones News

WASHINGTON—U.S. regulators on Thursday released proposed Wall

Street incentive-compensation rules that would place stricter

limits on top executives' pay.

The proposal, in the works for five years and jointly written by

six agencies, would overhaul how pay is crafted for a wide swath of

high-level employees at banks, investment advisers, broker dealers

and credit unions, as well as top managers at mortgage-finance

companies Fannie Mae and Freddie Mac.

Under the rules, senior executives at the largest institutions

would have to hold back more than half of their pay for four years,

more than the three years that has become common practice in the

industry. The move would provide firms up to seven years to "claw

back" bonuses if it turns out an executive's actions hurt the

institution. Though financial institutions already use clawbacks,

the proposed rules would codify them for the first time as a

government policy to revoke top officials' incentive pay if firms

have to reinstate financial results.

New details of the plan were released publicly Thursday at a

board meeting of the National Credit Union Administration. Five

other regulators, including the Securities and Exchange Commission

and the Federal Deposit Insurance Corp., are expected to vote on

the measure in the coming weeks. All six regulators were involved

in crafting the proposal released Thursday, and all six will have

to sign off on the final version of the rule for it to become

binding.

The comment period ends July 22.

Write to Donna Borak at donna.borak@wsj.com and Andrew Ackerman

at andrew.ackerman@wsj.com

(END) Dow Jones Newswires

April 21, 2016 10:25 ET (14:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

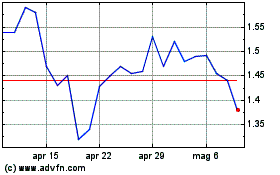

Grafico Azioni Fannie Mae (QB) (USOTC:FNMA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Fannie Mae (QB) (USOTC:FNMA)

Storico

Da Apr 2023 a Apr 2024

Notizie in Tempo Reale relative a Fannie Mae (QB) (OTCMarkets): 0 articoli recenti

Più Fannie Mae (QB) Articoli Notizie