Citigroup's Last Proprietary Trader Walks Out the Door

18 Agosto 2016 - 4:10PM

Dow Jones News

Citigroup Inc.'s last real proprietary trader is leaving the

building.

Anna Raytcheva, a Citigroup trader who most recently ran a

proprietary trading desk at the New York bank, is leaving to open

her own hedge fund next year.

Ms. Raytcheva said in an interview this week that she expects to

leave the bank later this month. The move follows Citigroup's

decision earlier this year to close the proprietary trading desk

that Ms. Raytcheva ran.

The lender, run by Chief Executive Officer Michael Corbat, has a

long history with proprietary trading and has held on to the

strategy years longer than other big banks.

Proprietary traders at banks are high-paid employees that buy

and sell for the firm's own account, rather than to match investing

clients with securities.

The firm's trading roots go back to Salomon Brothers, whose

1980s trading exploits were featured in the book "Liar's Poker."

That firm was ultimately folded into Citigroup, whose billions of

dollars in trading losses during the financial crisis prompted

repeated taxpayer-led bailouts.

Banks used to routinely engage in proprietary trading. Citigroup

and other large banks including Goldman Sachs Group Inc. and Morgan

Stanley had multiple desks dedicated to the lucrative but risky

practice before the financial crisis.

But the "Volcker rule", part of the post-financial-crisis

regulatory overhaul, banned most types of proprietary trading and

shifted banks' trading activities to those on behalf of clients. To

comply with the rule, Citigroup sold or spun off businesses,

including an emerging-markets hedge fund and a private-equity unit.

It also closed down Citi Principal Strategies, its dedicated

proprietary trading desk, in January 2012.

Such retrenchment has been common at big banks over the last

five years, with proprietary traders decamping to hedge funds and

other less-regulated industries.

The Volcker rule makes exceptions for some assets, including

municipal bonds and other government securities. The five-person

unit that Ms. Raytcheva most recently ran, called the

strategic-trading desk, traded the bank's own money in U.S.

Treasurys and other securities issued by government agencies,

including mortgage firms Fannie Mae and Freddie Mac.

Citigroup still has some traders that can engage in

Volcker-compliant proprietary trades. But Ms. Raytcheva's desk was

the last stand-alone effort of any significant size at the bank,

people familiar with the matter said.

Citigroup closed the desk in May, saying that trading

opportunities had dried up and that the capital could be better

deployed in client-facing businesses. Also, Ms. Raytcheva said she

found it limiting to run a proprietary trading desk that could deal

only in a narrow set of financial instruments.

"The industry is going through a structural change," she said.

"I think there is an opportunity for smaller, more nimble players."

She also said she wanted to expand beyond focusing primarily on

U.S. macro trends.

Ms. Raytcheva, 44 years old, said her hedge fund, which doesn't

yet have a name, would focus on global bets in markets including

foreign exchange. Most of the other employees from Ms. Raytcheva's

former desk have stayed at the bank, trading on behalf of clients,

a bank spokeswoman said.

The Volcker rule isn't the only force that has reshaped

Citigroup since the crisis. As the rule was phased in over the past

few years along with tougher capital requirements, the bank has

focused on becoming smaller and less risky overall. Its

institutional bank has pared down the number of clients it serves

and sold various units, including a high-frequency trading

division.

In many ways, though, Citigroup has grown more tied to Wall

Street: It has shed retail branches and shut consumer operations in

many countries across the globe. Bank executives have also said

they would like to continue expanding the fixed-income trading

division, one of the most important units at Citigroup, even as

rivals retrench.

Ms. Raytcheva, who grew up in communist Bulgaria, joined Citi as

an interest-rate-options trader in 1994, four years before it

merged with Salomon Brothers parent Travelers Group. She rose

through the ranks of Citigroup's fixed-income unit and during the

2008 financial crisis held a senior role that involved managing

risk for the bank's corporate treasury department.

That job included overseeing mortgage securities that suffered

billions of dollars in losses along with the industry. "It was a

very challenging period, and there was a lot of hard work and

effort to navigate through that," Ms. Raytcheva said. "I have

learned from the crisis and it's made me that much better."

(END) Dow Jones Newswires

August 18, 2016 09:55 ET (13:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

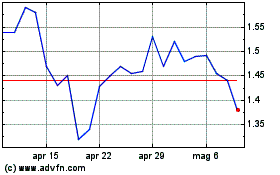

Grafico Azioni Fannie Mae (QB) (USOTC:FNMA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Fannie Mae (QB) (USOTC:FNMA)

Storico

Da Apr 2023 a Apr 2024