Freddie Mac Starts Pilot Program With Looser Standards

20 Settembre 2016 - 7:40AM

Dow Jones News

Mortgage-finance giant Freddie Mac and two nonbank lenders are

loosening income and documentation requirements for mortgage

applicants in a new pilot program.

The changes announced Monday are designed to help boost mortgage

originations among first-time buyers, applicants with

low-to-moderate incomes and those who live in underserved

areas.

The moves come nearly a decade after the start of the mortgage

meltdown, as many consumers remain shut out of the housing market

largely because they can't meet the underwriting criteria that most

lenders require. Under the Freddie program, applicants will be able

use the income of people who will live with them but aren't going

to be on the mortgage to qualify.

In addition, income from second jobs that borrowers have held

for a relatively short period will be factored in. The pilot also

doesn't require bank statements that would show a paper trail of

how some borrowers save for their down payments.

Many of the pilot's features are similar to what Fannie Mae

currently allows on some mortgages it purchases but are new for

Freddie Mac, which is among the largest purchasers of mortgages in

the country. Freddie Mac says it purchases one in every four

mortgages originated by lenders in the U.S.

The changes, which went into effect on Monday, will apply to

people who sign up for a mortgage with Las Vegas-based Alterra Home

Loans or Tustin, Calif.,-based New American Funding. The companies'

specialties include lending to low-income and Hispanic borrowers.

The lenders will sell the mortgages they originate to Freddie

Mac.

The partnership has been in the works since late last year and

will be in effect for at least 12 months. Freddie Mac will

determine whether to expand it beyond pilot phase if performance

meets expectations. It declined to discuss any numbers it has as

goals for loan volume or the delinquency level it would like to

stay below.

The pilot isn't lowering down payment or credit score

requirements. Rather it is loosening income criteria, including for

applicants who have two jobs. Until now, Freddie Mac has required

that borrowers who show their income from a second job when

applying for a mortgage demonstrate that they have held that job

for at least 24 months, a period that in the pilot is reduced to 12

months. Separately, self-employed borrowers will have more options

to prove their business exists to the lenders.

In addition, borrowers who will be living with family or other

individuals for at least 12 months after they purchase the home

will be able to use those non-borrowers' income to get approved for

the mortgage. The income will be factored in to help improve the

borrowers' debt to income ratio, a key figure that compares

borrowers' monthly debt obligations to their gross monthly

income.

Paperwork requirements will also loosen up for some borrowers

who don't have bank statements to show how they have saved for

their down payment.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

September 20, 2016 01:25 ET (05:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

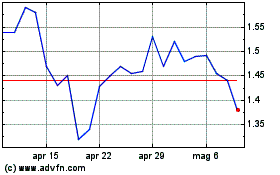

Grafico Azioni Fannie Mae (QB) (USOTC:FNMA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Fannie Mae (QB) (USOTC:FNMA)

Storico

Da Apr 2023 a Apr 2024