Genworth, China Oceanwide Chart Path to Regulatory Approval of Deal

25 Ottobre 2016 - 7:00AM

Dow Jones News

Genworth Financial Inc.'s proposed buyout by a Chinese

conglomerate drew skepticism in the market that the deal would get

done, even as some state regulators are privately embracing the

possible acquisition, according to people familiar with the

matter.

Richmond, Va.-based insurer Genworth has struggled under

mounting costs of older long-term-care policies, which have

generous provisions for paying nursing homes, other facilities and

personal aides for older people. Separate to the deal, Genworth on

Sunday announced the latest in a series of charges to bolster

reserves, with regulators viewing the acquisition as a potential

lifeline for the firm.

In addition to agreeing to be acquired for $2.7 billion,

Genworth also will receive a cash injection of $1.1 billion as part

of the deal.

Executives of Genworth, which also sells mortgage insurance, and

its acquirer, China Oceanwide Holdings Group Co., began meeting

with insurance regulators several months ago to discuss ways to

structure a deal to improve odds of approval, according to

Genworth's chief executive and the people familiar with the

matter.

Some of those regulators, who would have to contend with a firm

failure, should it ever occur, believe the deal would be a good

solution for Genworth, according to people familiar with their

thinking.

China Oceanwide "has been working very closely with the

regulators and providing the kind of financial information they

want," Genworth CEO Thomas McInerney said in an interview. "I think

we've done a good job in talking with [regulators], understanding

their concerns and issues, and we've tried to structure the deal"

to address those matters.

There is no certainty the deal will be approved; representatives

of some state insurance departments where China Oceanwide must win

approval declined to comment Monday. A spokesman for Virginia's

regulator confirmed it had been in touch with Genworth, but

declined to comment further.

A person familiar with the matter confirmed that China Oceanwide

has made efforts to help state regulators understand the firm and

its suitability as an acquirer of Genworth, putting its application

for control on good footing. Regulators in Delaware, New York,

North Carolina and Virginia, as well as in Australia, Canada,

China, Mexico and officials at mortgage-finance companies Fannie

Mae and Freddie Mac must sign off on the transaction for it to be

completed. In addition, the transaction must be reviewed by the

Committee on Foreign Investment in the U.S. and similar foreign

investment review boards elsewhere.

The regulatory review process is expected to take several

months.

Despite the assurances, Genworth's shares fell more than 10% at

one point Monday, indicating some investors don't think the deal

will be completed. They finished the day's trading down 8.1% at

$4.79, below the proposed deal price of $5.43 a share.

Analysts at CreditSights cited "significant concerns that

regulators may not authorize the deal." Other analysts provided

some skepticism, noting the inability of Anbang Insurance Group Co.

to obtain approval for a $1.6 billion acquisition announced in

November 2015 for Fidelity & Guaranty Life.

Two people in the regulatory community, who declined to be

named, said the deals aren't comparable. They said Anbang hadn't

provided detailed financial information sought by New York's

Department of Financial Services about Anbang's ownership

structure, with a reticence that appears unique to Anbang.

Anbang withdrew its deal application in New York in May, two

people said.

Mr. McInerney called the China Oceanwide deal the best option to

emerge from Genworth's two-year review of strategies stemming from

its woes with long-term-care insurance.

Genworth and other long-term-care insurers have acknowledged

underpricing their older policies, with miscalculations on the

number of claims to ultimately be filed and many other items. The

business also has been hurt by continued ultralow interest rates,

as insurers invest premiums paid by customers until claims come

due. Losses on the policies have totaled more than $2 billion over

the years, according to Genworth.

There is no guarantee under the pact that China Oceanwide would

add more capital than announced in the deal if reserves prove short

in the future.

In February, S&P Global Ratings downgraded Genworth's

life-insurance units to below investment grade, citing reduced

profitability and other factors.

Genworth and China Oceanwide began talking nine months ago, Mr.

McInerney said, and reached out to regulators in the U.S. and

abroad.

Howard Mills, leader of the global insurance regulatory practice

at Deloitte LLP and a former New York insurance commissioner, said

deal approvals can get a lift if the insurer being acquired has

financial woes.

Speaking generally, he said regulators can conclude that

"improving the financial strength of a company serves

consumers."

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

October 25, 2016 00:45 ET (04:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

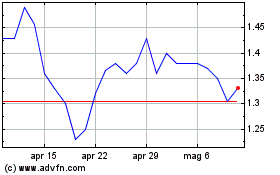

Grafico Azioni Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Storico

Da Apr 2023 a Apr 2024