Fannie Mae to Send $3 Billion Dividend to Treasury

03 Novembre 2016 - 2:10PM

Dow Jones News

Fannie Mae said it would send a $3 billion dividend payment to

the U.S. Treasury in December as revenue declined in its latest

quarter, but profit soared due to accounting benefits and

fluctuating interest rates.

The mortgage-finance company posted net income of $3.2 billion

for the third quarter, up from $1.24 billion a year prior and $2.95

billion in the second quarter. Revenue dropped 4.1% from a year

prior to $5.61 billion.

The increased profit was driven primarily by fluctuating

interest rates, which hurt the value of derivatives Fannie uses to

manage risk. Sister company Freddie Mac on Tuesday posted a

third-quarter profit increase for the same reason.

The percentage of Fannie-backed mortgages more than 90 days

delinquent continued to fall, declining to 1.24% from 1.32% in the

second quarter and 1.59% in the same quarter a year prior.

Fannie reduced its total loss reserves, which is an estimate on

how many probable losses the company has on its books, to $23.1

billion from $24.2 billion last quarter and $30 billion last

year.

The increased profits come as Fannie's and Freddie's regulator

and some lawmakers have expressed concern over their dwindling

capital reserves. Under the terms of the companies' bailout

agreement with the Treasury, they send profits above their

established capital reserve to the government, but these buffers

are slated to wind down to zero dollars by 2018.

So far, that drop in reserves hasn't caused Fannie or Freddie to

require more bailout money. Fannie reported a net worth of $4.2

billion as of Sept 30.

Still, any blip in the housing market or volatility in the

derivatives values could cause Fannie or Freddie to need taxpayer

funds.

In all, after the quarter's dividend, the company will have sent

$154.4 billion to the Treasury, compared with the $117.1 billion

infusion it has received.

Fannie's large increase in profits emphasizes an accounting

quirk that impacts both Fannie's and Freddie's quarterly

profitability.

Fannie and Freddie have large investment portfolios whose

values, like those of all bonds, rise and fall as interest rates

change. The companies use derivatives to hedge interest-rate risk,

but for accounting purposes, the derivatives and other hedging

instruments are valued at a different time than the hedged assets,

causing large profits or losses to appear in the short term.

Fannie Mae took $496 million in fair-value losses in the

quarter, compared with a loss of $2.59 billion in the prior-year

period.

Fannie buys loans from lenders, wraps them into securities and

provides guarantees to make investors whole if the loans

default.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

November 03, 2016 08:55 ET (12:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

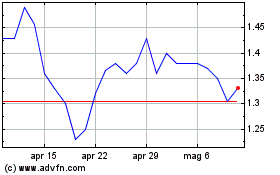

Grafico Azioni Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Storico

Da Apr 2023 a Apr 2024