ADRs End Higher; ABB, Embraer Decline

09 Febbraio 2017 - 12:47AM

Dow Jones News

International stocks trading in New York closed higher

Wednesday.

The BNY Mellon index of American depositary receipts gained

0.28% to 130.96. The European index edged up 0.08% to 122.27. The

Asian index improved 0.44% to 150.71. The Latin American index rose

1.4% to 223.35, and the emerging-markets index increased 0.96% to

265.93.

ABB Ltd. (ABB, ABBN.EB, ABB.SK) and Embraer SA. (ERJ, EMBR3.BR)

were among the companies with ADRS that traded actively.

Swiss engineering giant ABB said Wednesday that lower

restructuring costs helped boost fourth-quarter profit despite a

slight drop in revenue. ADRS fell 3.6% to $22.61.

Workers at the BHP Billiton Ltd.-controlled Escondida mine in

Chile, the world's largest copper-mining operation, are expected to

strike Thursday, driving up copper prices on fears of a shortage of

the metal and expectations it could trigger stoppages at other

mines. ADRs of BHP (BHP, BHP.AU) fell 1.2% to $38.70.

Brazil on Wednesday opened a trade dispute with Canada,

criticizing the Canadian government's latest round of financial

support for struggling aircraft maker Bombardier Inc., a rival of

Brazil's Embraer. Brazil filed a request for consultations with the

World Trade Organization in Geneva, alleging Canada isn't living up

to its obligations under global trade rules--the first step in

launching a formal complaint with the WTO. If Brazil and Canada

fail to resolve the matter in the next 60 days, a WTO-appointed

panel will be asked to rule on Brazil's allegation. Embraer's ADRs

fell 3% to $22.34.

Drugmaker Sanofi SA (SNY) has addressed all of the manufacturing

deficiencies at the French plant where its new, promising

rheumatoid arthritis treatment will be produced, Chief Executive

Olivier Brandicourt said Wednesday. In October, the U.S. Food and

Drug Administration had rejected sarilumab, a treatment being

developed jointly by Sanofi and Regeneron Pharmaceuticals Inc.,

over deficiencies found at the plant. ADRs rose 2.4% to $41.21.

Swiss seed and pesticide maker Syngenta AG (SYT, SYNN.EB) Chief

Executive Erik Fyrwald said Wednesday he expects government-owned

China National Chemical Corp.'s proposed $43 billion acquisition to

close in the second quarter. ADRs rose 2% to $86.45.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

February 08, 2017 18:32 ET (23:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

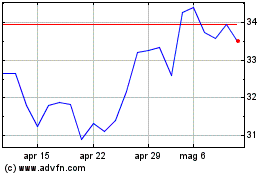

Grafico Azioni EMBRAER ON (BOV:EMBR3)

Storico

Da Mar 2024 a Apr 2024

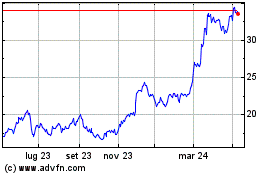

Grafico Azioni EMBRAER ON (BOV:EMBR3)

Storico

Da Apr 2023 a Apr 2024