Pound Rises After U.K. Jobs Report

12 Aprile 2017 - 8:12AM

RTTF2

The British pound strengthened against the other major

currencies in the European session on Wednesday, after data showed

that the average earnings bonus rose more-than-expected in

March.

Data from the Office for National Statistics showed that the

average earnings including bonus advanced 2.3 percent annually,

slightly faster than the expected 2.2 percent. Excluding bonus,

earnings grew 2.2 percent.

The UK unemployment rate remained unchanged at the lowest level

seen since 1975.

The ILO jobless rate held steady at 4.7 percent in three months

to February, in line with expectations. It has not been lower since

June to August 1975.

The employment rate was 74.6 percent in three months to

February, which was the joint highest since comparable records

began in 1971.

The claimant count rose slightly to 2.2 percent in March from

2.1 percent in February. The number of people claiming jobseekers'

allowances increased by 25,500 from prior month.

Meanwhile, the European stocks inched higher as investors put

geopolitical worries aside and turned their focus to the

first-quarter earnings season.

Geopolitical tensions eased somewhat after China's President Xi

Jinping called for a "peaceful" resolution to tensions over North

Korea, in a phone conversation with U.S. President Donald

Trump.

Also, investors shrugged off political uncertainty in France

after a new poll on Tuesday showed that far-left candidate Jean-Luc

Melenchon's support increased by 7 percentage points in the French

presidential race. In the Asian trading today, the pound held

steady against its major rivals.

In the European trading, the pound rose to a 9-day high of

1.2517 against the U.S. dollar, from an early low of 1.2480. The

pound may test resistance around the 1.27 region.

Against the euro and the Swiss franc, the pound advanced to near

2-month highs of 0.8478 and 1.2595 from early lows of 0.8505 and

1.2559, respectively. If the pound extends its uptrend, it is

likely to find resistance around 0.83 against the euro and 1.27

against the franc.

The pound edged up to 137.33 against the yen, from an early near

3-month low of 136.52. On the upside, 142.00 is seen as the next

resistance level for the pound.

Looking ahead, U.S. import price index for March and U.S. crude

oil inventories data are slated for release in the New York

session.

At 10:00 am ET, the Bank of Canada's interest rate decision is

due to be announced.The economists expect the bank to hold rates at

0.50 percent.

At 11:15 am ET, Bank of Canada Governor Stephen Poloz and Bank

of Canada Senior Deputy Governor Carolyn Wilkins will hold a press

conference on Monetary Policy Report in Ottawa.

At 10:00 am ET, Federal Reserve Bank of Dallas President Robert

Kaplan will participate in moderated question-and-answer session

before the Cornerstone Credit Union League Annual Meeting in Fort

Worth, Texas.

At 2:00 pm ET, U.S. monthly Federal budget balance is set to be

published.

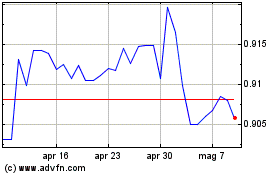

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Mar 2024 a Apr 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Apr 2023 a Apr 2024