U.S. Dollar Declines After Sharp Plunge In Housing Starts

18 Aprile 2017 - 12:28PM

RTTF2

The U.S. dollar declined against its major counterparts in the

early New York session on Tuesday, as U.S. housing starts plunged

more than expected in March, adding to recent run of disappointing

data that indicates a slowdown in economy.

Data from the Commerce Department showed that the housing starts

plunged by 6.8 percent to an annual rate of 1.215 million in March

from an upwardly revised 1.303 million in February.

Economists had expected housing starts to drop by 2 percent to a

rate of 1.262 million from the 1.288 million originally reported

for the previous month.

The U.S. treasury yields also declined, with the benchmark yield

on 10-year note falling 2.21 percent, while that of 2-year

equivalent was down by 1.18 percent. Yields move inversely to bond

prices.

Meanwhile, the Commerce Department said building permits, an

indicator of future housing demand, jumped by 3.6 percent to a rate

of 1.260 million in March from a revised 1.216 million in

February.

Building permits had been expected to climb by 3.1 percent to a

rate of 1.250 million from the 1.213 million that had been reported

for the previous month.

Investors also focus on economic dialogue between the U.S. and

Japan aimed to boost bilateral trade agreement, after the Trump

administration scraped the 12-nation Trans-Pacific Partnership

trade pact as part of protectionist policy.

The U.S. Vice-President Mike Pence is in Japan to negotiate free

trade agreement that would result in opening doors for U.S. goods

in Japanese markets.

The currency has been trading in a negative territory in the

European session.

The greenback declined to 0.9989 against the Swiss franc, a

level unseen since March 30. The next possible support for the

greenback-franc pair is seen around the 0.985 region.

The greenback fell to near a 3-week low of 1.0700 against the

euro, from a high of 1.0637 hit at 8:00 pm ET. Continuation of the

greenback's downtrend may see it challenging support around the

1.08 mark.

The International Monetary Fund Managing Director Christine

Lagarde said that France's presidential election is adding to the

existing political uncertainty worldwide as it raises several

questions on the future of the euro area.

There is an uncertainty and growing concern about the outcome of

the French election, Lagarde said in an interview to a group of

European reporters.

The greenback retreated to 108.65 against the Japanese yen, from

a 4-day high of 109.22 set at 8:00 pm ET. The greenback is seen

finding support around the 106.00 level.

S&P Global Ratings maintained the sovereign rating of Japan

at 'A+' with 'stable' outlook.

The rating agency said the economy's strong external position,

prosperous and diversified economy, political stability, and stable

financial system balance its very weak public finances.

The greenback dropped to a 4-1/2-month low of 1.2757 against the

Sterling, off its early 4-day high of 1.2515. Further weakness may

take the greenback to a support around the 1.30 area.

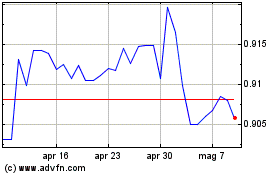

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Mar 2024 a Apr 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Apr 2023 a Apr 2024