Euro Advances As Eurozone GDP Matches Flash Estimate, German ZEW Index Climbs

16 Maggio 2017 - 9:20AM

RTTF2

The euro climbed against its most major counterparts in the

European session on Tuesday, after German investor sentiment

improved in May and the euro area economy expanded as initially

estimated in the first quarter, indicating improved growth

prospectus in the currency bloc.

Flash data from Eurostat showed that gross domestic product

climbed 0.5 percent sequentially, the same pace of growth as seen

in the fourth quarter. The rate came in line with preliminary flash

estimate published on May 3.

On a yearly basis, GDP growth slowed slightly to 1.7 percent

from 1.8 percent in the fourth quarter. The annual rate also

matched initial estimate.

Survey data from the Mannheim-based Centre for European Economic

Research/ZEW showed that German economic confidence continued to

improve in May.

The ZEW Indicator of Economic Sentiment rose 1.1 points to 20.6

in May. This was the highest score since August 2015 but below the

expected level of 22.0.

The current conditions index climbed 3.8 points to 83.9

points.

Preliminary data from Eurostat showed that the euro area trade

surplus increased in March from a month ago, as exports rose and

imports fell.

The seasonally adjusted trade surplus rose to a 3-month high of

EUR 23.1 billion in March from EUR 18.8 billion in February.

Economists had expected a surplus of EUR 18.7 billion for the

month.

Meanwhile, European shares are trading mixed, as a stronger euro

weighed on regional exporters and London copper prices slipped on

concerns over slowing economic growth in China.

The Washington Post reported that U.S. President Donald Trump

revealed "highly classified information" about a planned Islamic

State Operation to two top Russian officials last week, with

lawmakers calling the alleged disclosures "inexcusable" and "deeply

disturbing."

However, U.S. National Security Adviser H.R. McMaster denied the

accuracy of published reports, saying the conversation covered only

a range of common threats and did not include operations not

already known publicly.

The euro showed mixed performance in the Asian session. While

the euro held steady against the yen and the pound, it fell against

the franc. Against the greenback, the euro rose.

The euro firmed to 1.1059 against the greenback, a level unseen

since November 2016. The euro is likely to find resistance around

the 1.12 mark.

Having fallen to 124.59 against the Japanese yen at 10:30 pm ET,

the euro advanced to more than a 1-year high of 125.64.

Continuation of the euro's uptrend may see it challenging

resistance around the 128.00 region.

Figures from the Ministry of Economy, Trade and Industry showed

that Japan's tertiary activity index decreased unexpectedly in

March.

The tertiary activity index dropped 0.2 percent month-over-month

in March, after remaining flat in February. Meanwhile, economists

had expected a 0.1 percent increase for the month.

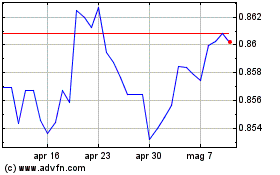

The euro strengthened to 0.8579 against the pound, its strongest

since April 7. The pair ended Monday's trading at 0.8511. The euro

is seen finding resistance around the 0.87 area.

Data from the Office for National Statistics showed that UK

inflation accelerated to the highest since 2013 largely due to

higher air fares in April.

Inflation rose more-than-expected to 2.7 percent in April from

2.3 percent in March. Inflation was forecast to rise to 2.4

percent.

The 19-nation currency spiked up to an 11-day high of 1.5100

against the loonie, near a 1-year high of 1.6107 against the kiwi

and an 8-month high of 1.4950 against the aussie, off its early

lows of 1.4951, 1.5906 and 1.4774, respectively. The next possible

resistance for the euro is seen around 1.52 against the loonie,

1.62 against the kiwi and 1.51 against the aussie.

The euro held steady at 1.0946 against the franc, after touching

a 4-day peak of 1.0960 at 4:30 am ET. The pair was valued at 1.0937

when it finished Monday's trading.

Looking ahead, U.S. building permits, housing starts and

industrial production for April are set for release in the New York

session.

At 11:30 am ET, the European Central Bank Governing Council

member Ewald Nowotny speaks about monetary policy at an event

hosted by the Principality of Liechtenstein, in Vienna.

The European Central Bank board member Benoit Coeure speaks at

the annual dinner of the ECB's Bond Market Contact Group in

Frankfurt, Germany at 1:00 pm ET.

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Mar 2024 a Apr 2024

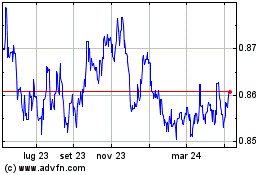

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Apr 2023 a Apr 2024