EUROPE MARKETS: European Stocks Struggle Near 2-month Lows As Euro Rises

28 Giugno 2017 - 11:18AM

Dow Jones News

By Carla Mozee, MarketWatch

French consumer confidence at 10-year high

European stocks dropped Wednesday, pulled down by a rising euro,

which looked headed for its highest level in a year on worries the

European Central Bank may start winding down monetary stimulus.

The Stoxx Europe 600 gave up 0.8% to 382.84, on track for its

lowest close since April 21, FactSet data showed. All sectors fell,

with tech, utilities and basic materials losing the most.

Stocks on the pan-European benchmark were keying off losses for

the major U.S. indexes on Tuesday

(http://www.marketwatch.com/story/wall-street-stocks-on-track-to-slip-hurt-again-by-a-drop-for-techs-2017-06-27).

Those moves came as declines for technology shares deepened and

after Senate Republicans delayed a vote on health care legislation,

casting doubt on the Trump administration's ability to deliver on

its pro-growth program.

See:Invest in these European underperformers now before Daniel

Loeb does

(http://www.marketwatch.com/story/invest-in-these-european-underperformers-now-before-daniel-loeb-does-2017-06-28)

A leap in the euro against the dollar was also putting pressure

on stocks, as a stronger euro can cut into sales of goods made by

European exporters to overseas clients.

The shared currency traded at $1.1370, rising toward $1.1400,

where it hasn't traded since early June 2016. It changed hands at

$1.1340 late Tuesday in New York.

The euro started its upswing from $1.12 on Tuesday after ECB

President Mario Draghi said in a speech that "a considerable

degree" of stimulus is needed in the eurozone, a step back from the

more dovish language used in earlier speeches.

Read:ECB's Draghi hints at winding down eurozone QE

(http://www.marketwatch.com/story/ecbs-draghi-hints-at-winding-down-of-eurozone-qe-2017-06-27)

"Draghi stole the show ... when he said they may change policy

to keep stance unchanged," said Kathy Lien, BK Asset Management's

managing director of FX strategy.

"In other words, he's suggesting that the ECB could soon move

from their current accommodative stance to a neutral one," she said

in a note late Tuesday.

In light of positive eurozone data, few can question Draghi's

optimism and for this reason, the move in the euro could extend as

high as $1.15, Lien said.

Indexes: In Frankfurt, the export-heavy DAX 30 lost 0.8% at

12,566.96. In London, the FTSE 100 pulled back 0.5% to 7,494.65,

while France's CAC 40 index flopped down 0.8% to 5,218.48.

Stock movers: ABN Amro Group NV (ABN.AE) fell 2.3% after the

Dutch government cut its stake in the bank to 63% from 70%.

Royal Philips NV (PHG) lost 1.6% after the Dutch

health-technology company said it is buying Spectranetics Corp.

(SPNC)for 1.9 billion euros ($2.15 billion).

(http://www.marketwatch.com/story/royal-philips-to-buy-spectranetics-for-215-bln-2017-06-28)

Bunzl PLC shares (BZLFY) climbed 4.1% after the distribution and

outsourcing group said revenue for the first half of the year

increased by 7%

(http://www.marketwatch.com/story/bunzl-revenue-rises-7-buys-3-more-businesses-2017-06-28)

and that it's bought three businesses as part of its growth

strategy.

Economic docket: Investors on Wednesday received upbeat data

from France, where consumer confidence hit its highest since June

2007

(http://www.marketwatch.com/story/french-consumer-confidence-at-highest-in-10-years-2017-06-28),

said statistics agency Insee.

(END) Dow Jones Newswires

June 28, 2017 05:03 ET (09:03 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

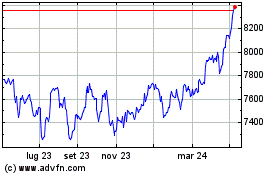

Grafico Indice FTSE 100

Da Mar 2024 a Apr 2024

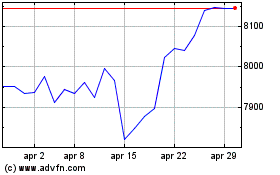

Grafico Indice FTSE 100

Da Apr 2023 a Apr 2024