NZ Dollar Rises As Asian Markets Traded In Positive Territory

13 Luglio 2017 - 4:57AM

RTTF2

The New Zealand dollar strengthened against other major

currencies in the Asian session on Thursday, as Asian stock markets

traded in positive territory. This followed the overnight gains on

Wall Street after Federal Reserve Chair Janet Yellen's testimony

before Congress indicated that the central bank will gradually

tighten policy and also reduce the size of its $4.5 trillion

balance sheet. Also, higher commodity prices lifted resources

stocks.

The crude oil futures rose above $45 a barrel on Wednesday, as

U.S. crude oil inventories last week dropped the most in ten

months.

In other economic news, data from the General Administration of

Customs showed that China's exports increased at a

faster-than-expected pace in June.

Similarly, imports surged 17.2 percent in June from a year ago,

bigger than the expected growth of 14.5 percent.

In dollar terms, exports grew 11.3 percent year-over-year in

June, faster than the 8.9 percent rise economists had forecast.

The trade surplus totaled $42.8 billion in June versus the

expected surplus of $42.6 billion.

Data from ANZ Bank showed that the consumer confidence in New

Zealand slowed in July. The bank's consumer confidence index fell

1.9 percent on month to a score of 125.4.

Data from Statistics New Zealand showed that food prices in New

Zealand were up an unadjusted 0.2 percent on month in June.

Seasonally adjusted, food prices slid 0.3 percent. On a yearly

basis, food prices climbed 3.0 percent after rising 3.1 percent in

the previous month.

Data from the Real Estate Institute of New Zealand showed that

New Zealand's house prices increased in June from a year ago, while

the volume of sales plunged. The national median house price index

rose 5.8 percent year-over-year to NZ$529,000 in June. However,

median prices dropped 1.0 percent, month-on-month.

On a seasonally adjusted basis, national median prices grew 6.3

percent in June from a year ago.

Wednesday, the NZ dollar showed mixed trading against its major

rivals. While the kiwi fell against the euro, the yen, and the

Australian dollar, it rose against the U.S. dollar.

In the Asian trading, the NZ dollar rose to a 6-day high of

0.7297 against the U.S. dollar, from yesterday's closing value of

0.7259. The kiwi may test resistance around the 0.74 region.

Against the yen, the euro, and the Australian dollar, the kiwi

advanced to 2-day highs of 82.42, 1.5671 and 1.0546 from

yesterday's closing quotes of 82.14, 1.5719 and 1.0574,

respectively. If the kiwi extends its uptrend, it is likely to find

resistance around 84.00 against the yen, 1.52 against the euro and

1.03 against the aussie.

Looking ahead, Swiss PPI for June is due to be released at 3:15

am ET.

In the New York session, Canada new housing price index for May,

U.S. PPI for June and U.S. weekly jobless claims for the week ended

July 8 are slated for release.

At 10:00 am ET, Federal Reserve Chair Janet Yellen is expected

to testify on the Semiannual Monetary Policy Report before the

Senate Banking Committee, in Washington DC.

At 11:30 am ET, Federal Reserve Bank of Chicago President

Charles Evans is expected to speak about the economy and monetary

policy at the Annual Rocky Mountain Economic Summit in Idaho,

U.S.

At 1:00 pm ET, Federal Reserve Governor Lael Brainard is

scheduled to speak about monetary policy at the National Bureau of

Economic Research, in Massachusetts.

At 2:00 pm ET, U.S. Federal monthly budget statement is slated

to publish.

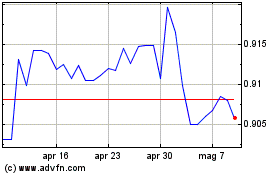

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Mar 2024 a Apr 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Apr 2023 a Apr 2024