MARKET SNAPSHOT: Dow Industrials Set To Hover At Record As Banks Kick Off Earnings Season

14 Luglio 2017 - 3:05PM

Dow Jones News

By Barbara Kollmeyer, MarketWatch

Consumer prices, retail sales also headline a busy day

The Dow Jones Industrial Average was poised to hover around

record highs on Friday, though stock futures pointed to slight

caution with mixed earnings reports from major banks, including

J.P. Morgan Chase & Co. Citigroup Inc. and Wells Fargo.

Dow industrials futures were flat at 21,509, while those for the

S&P 500 were up by a point to 2,446.50. Nasdaq-100 futures rose

19 points to 5,816.

On Thursday, the Dow industrials logged its 24th record close

this year

(http://www.marketwatch.com/story/dow-aims-for-fresh-record-as-yellen-emboldens-bulls-2017-07-13),

driven by gains for the financial and retail sectors. The index

rose 0.1% to finish at 21,553.09. The S&P 500 index added 0.2%

while the Nasdaq Composite picked up 0.2%, its fifth-straight

positive close.

Need to Know:Here's a quirkier game plan for markets that are

'priced for perfection'

(http://www.marketwatch.com/story/heres-a-quirkier-game-plan-for-markets-that-are-priced-for-perfection-2017-07-14)

On the whole, it has been a winning week for stocks, led by a

nearly 2% gain for the Nasdaq, a roughly a 1% gain for the S&P

500 and a 0.7% rise for the DJIA ahead of Friday's session. Dovish

comments from Federal Reserve Chairwoman Janet Yellen in Capitol

Hill testimony boosted stocks this week.

Friday marks a big day for the start of second-quarter earnings

season as major banks haved reported ahead of the bell.

Stocks to watch: J.P. Morgan(JPM) beat expectations on both

revenue and profit, but shares gave up an early initial gain to

turn about 1% lower.

Citi (C) reported earnings that were better than expected

(http://www.marketwatch.com/story/citigroup-tops-profit-and-revenue-estimates-2017-07-14),

but it did show signs of a slowdown in trading, with overall

trading revenue down 4% and fixed-income trading revenue off 6%.

Shares of the bank were trading up 0.4% after initially slipping

more than 1%.

Wells Fargo & Co.(WFC) reported second-quarter results that

were better than expected but shares traded lower in premarket.

Ahead of those results, Wall Street had been expecting banks to

deliver a weak quarter, potentially kicking off the latest in a

string of disappointing earnings seasons

(http://www.marketwatch.com/story/bank-earnings-expect-another-meh-quarter-of-weak-trading-revenue-2017-07-10).

The shine has come off the sector as hopes have faded that

President Donald Trump will push through structural reforms and

boost the economy. Disappointment from banks could weigh on the

broader market, warned some.

"Soft financial results could dent the appetite and pull...U.S.

stocks down from their all-time high levels," said Ipek

Ozkardeskaya, senior market analyst at LCG, in a note to

clients.

Read:Four key sectors to watch closely this earnings season

(http://www.marketwatch.com/story/four-key-sectors-to-watch-closely-this-earnings-season-2017-07-13)

(http://www.marketwatch.com/story/four-key-sectors-to-watch-closely-this-earnings-season-2017-07-13)Data

on tap:The consumer price index

(http://www.marketwatch.com/story/inflation-goes-nowhere-in-june-cpi-shows-2017-07-14),

or cost of living, was unchanged last month, largely due to lower

gasoline prices. Economists polled by MarketWatch expect the

consumer-price index rose 0.1% month-on-month in June, while core

inflation is seen coming in at 0.2%.

Retail sales dropped 0.2% in June.

At 9:15 a.m., June industrial production and capacity

utilization will be released.

Dallas Fed President Robert Kaplan will speak on Fed and

monetary policy in Mexico City at 9:30 a.m. Eastern.

Other markets: In Asia , markets ended the day with modest

gains. European stocks

(http://www.marketwatch.com/story/european-stocks-waver-but-best-week-in-two-months-in-sight-2017-07-14)

stocks were mixed, but still looking at the best week in two

months. A stronger British pound was weighing on the FTSE 100

(http://www.marketwatch.com/story/stronger-pound-holds-ftse-100-back-for-2nd-day-2017-07-14)

for a second day.

Oil prices firmed up, along with gold , while the dollar was

easing back slightly.

Read:Saudi Arabia's worst-case oil scenario might surprise you

()

(END) Dow Jones Newswires

July 14, 2017 08:50 ET (12:50 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

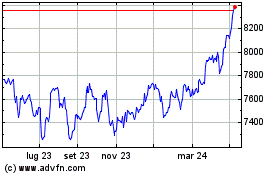

Grafico Indice FTSE 100

Da Mar 2024 a Apr 2024

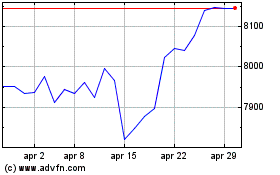

Grafico Indice FTSE 100

Da Apr 2023 a Apr 2024