Pound Falls On Brexit Uncertainty

08 Agosto 2017 - 9:44AM

RTTF2

The pound dropped against its major counterparts in European

deals on Tuesday amid uncertainty over ongoing Brexit talks, after

the UK government reportedly refused to accept GBP 36 billion

divorce bill to quit the European Union.

Downing Street dismissed weekend reports that Britain is

prepared to pay up to 40 billion to clinch a free trade deal with

the EU, as Tory MPs criticized the claim.

The Brexit negotiations have not started smooth from the British

side, the former head of the Foreign Office Simon Fraser told BBC

Radio 4 on Monday.

"We haven't put forward a lot because, as we know, there are

differences within the cabinet about the sort of Brexit that we are

heading for and until those differences are further resolved I

think it's very difficult for us to have a clear position," Fraser

said.

Meanwhile, Wokingham MP John Redwood described The Sunday

Telegraph report as "completely ridiculous."

"We all know they will talk about trade before March 2019

because it's in their interest to do so. We have absolutely no need

to pay them a penny, to get them to talk about something they need

to talk about."

The pound traded mixed against its major rivals in the Asian

session. While the pound held steady against the yen and the euro,

it rose against the franc and the greenback.

The pound slipped to an 11-day low of 1.2652 against the franc,

from a high of 1.2700 hit at 10:00 pm ET. The next possible support

for the pound is seen around the 1.24 region.

Data from the State Secretariat for Economic Affairs showed that

Switzerland's unemployment rate remained stable in July.

The jobless rate held steady at seasonally adjusted 3.2 percent

in July. On an unadjusted basis, the unemployment rate was 3

percent, the same as in June.

The pound fell to 143.65 against the Japanese yen, a level

unseen since June 28. Continuation of the pound's downtrend may see

it challenging support around the 142.00 level.

Survey figures from the Cabinet Office showed that a measure of

peoples' assessment of the Japanese economy decreased unexpectedly

in July.

The current index of Economy Watchers' survey dropped to 49.7 in

July from 50.0 in June, which was the highest score since December

2015.

The pound that closed Monday's deals at 0.9050 against the euro

dropped to near a 1-year low of 0.9075. On the downside, 0.92 is

likely seen as the next support level for the pound.

Data from Destatis showed that Germany's trade surplus increased

in June as the decline in imports was larger than the fall in

exports.

Exports declined 2.8 percent in June from May, when they climbed

1.5 percent. Likewise, imports slid 4.5 percent, in contrast to

May's 1.3 percent increase.

Reversing from an early high of 1.3054 against the dollar, the

pound edged down to 1.3019. The pound may locate support around the

1.27 area.

Looking ahead, U.S. NFIB small business index and Canada housing

starts data, both for July, are due to be released in the New York

session.

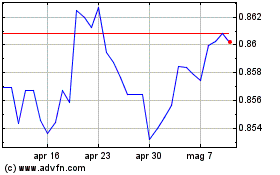

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Mar 2024 a Apr 2024

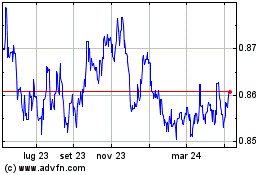

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Apr 2023 a Apr 2024