EUROPE MARKETS: European Stocks Mark Time As Investors Stay Focused On Fed Decision

20 Settembre 2017 - 2:40PM

Dow Jones News

By Carla Mozee, MarketWatch

Thyssenkrupp shares rises on Tata deal news; Spain shares under

pressure

European stocks wavered Wednesday, with investors seeming to

hold off before the U.S. Federal Reserve's policy decision, even as

they assessed deal news from Thyssenkrupp and other corporate

updates.

The Stoxx Europe 600 index was down less than 1 point at 382.80,

with financial and tech shares leading declining sectors. But

telecoms and utility shares were among the advancing sectors. On

Tuesday, the pan-European benchmark closed up 0.1%.

(http://www.marketwatch.com/story/european-stocks-slip-as-traders-wait-for-fed-rate-update-2017-09-19)

Most major European indexes were little changed before the

highly anticipated release of the Fed's policy statement

(http://www.marketwatch.com/story/hey-fed-boss-janet-yellen-inflation-is-still-low-and-stocks-are-soaring-what-say-you-2017-09-18)

and the press conference by Fed Chairwoman Janet Yellen. Germany's

DAX 30 index slipped 0.1% and France's CAC 40 index ticked up by

0.1%. The U.K.'s FTSE 100 was fractionally higher

(http://www.marketwatch.com/story/ftse-100-edges-up-as-fed-decision-takes-center-stage-2017-09-20).

But Spain's IBEX 35 lost the most, down 1.2%, following news

that police in Spain arrested some Catalonian officials

(http://www.marketwatch.com/story/catalan-officials-arrested-in-spain-ahead-of-banned-independence-vote-2017-09-20)

for their alleged involvement in planning a vote on Catalonia's

secession from Spain. That ballot is set for Oct. 1, and has been

declared illegal by the Spanish government.

The U.S. central bank is widely expected to keep interest rates

on hold but to start unwinding its $4.5 trillion balance sheet

(http://www.marketwatch.com/story/feds-balance-sheet-unwind-will-be-moment-of-truth-for-financial-markets-2017-09-18).

Analysts said the statement may be followed by moves in several

asset classes, such as stocks, currencies and gold.

"Any caution on the economic outlook is likely to push out the

prospect that we could see another rate rise this year, and we

shouldn't forget that the problem of the [U.S.] debt ceiling has

been pushed out into December," said Michael Hewson, chief market

analyst at CMC Markets UK.

"If that remains unresolved by the time of the December meeting,

then it makes the prospect of a rate move even less likely," he

said in a note.

The euro bought $1.2003, slightly up from $1.1994 late Tuesday

in New York. But the euro has climbed about 14% against the

greenback this year.

"Depending on the post-Fed USD-appetite, the EURUSD could return

to its 200-hour moving average (1.1962), or pursue its short-term

positive trend," said LGC senior market analyst Ipek

Ozkardeskaya.

The Fed policy decision is due at 7 p.m. London time, or 2 p.m

Eastern Time. Yellen's press conference is set to start at 2:30

p.m. Eastern Time.

Stock movers: Thyssenkrupp AG (TKA.XE) shares climbed 3.6% after

the company said it and Tata Steel Ltd. (500470.BY) will combine

their European steel operations

(http://www.marketwatch.com/story/thyssenkrupp-tata-seal-european-steel-deal-2017-09-20).

The new company would be the second-largest steel producer in

Europe after ArcelorMittal (MT) . ArcelorMittal shares rose

1.1%.

Fortum Oyj (FORTUM.HE) leapt 4.8%, as the Finnish utility is in

advanced talks over a 3.76 billion euro ($4.51 billion) bid for

E.ON SE's (EONGY)stake in Germany-based energy company Uniper SE

(http://www.marketwatch.com/story/fortum-in-talks-on-45-billion-uniper-stake-bid-2017-09-20)(UN01.XE).

E.On shares rose 3% and Uniper shares climbed 6.4%.

Kingfisher PLC (KGF.LN) shares popped up 6.2%. The home

improvement retailer said it's on track to meet targets in the

second year of its five-year restructuring plan, as it raised its

dividend. But Kingfisher's first-half profit fell 6%

(http://www.marketwatch.com/story/kingfisher-pretax-profit-hurt-by-weak-french-sales-2017-09-20),

and it stayed cautious in its outlook for its core U.K. and French

markets.

Shares of Inditex SA (ITX.MC) fell 1.7% after the Spanish

retailer's Zara chain had a bigger-than-expected decline in

profitability

(http://www.marketwatch.com/story/zara-parent-inditex-profit-up-but-margin-falls-2017-09-20),

triggered in part by currency fluctuations. Overall, the autumn and

winter sales season got off to a more robust start than expected,

the company said.

Deutsche Telekom AG shares (DTEGY) was up 1.4%, extending gains

logged Tuesday. Those moves followed a CNBC report that Sprint

Corp. (S) is in talks to merge with Deutsche Telekom's T-Mobile US

Inc. (TMUS) unit.

Data: The U.K.'s Office for National Statistics said retail

sales rose by a faster-than-expected rate of 1% in August

(http://www.marketwatch.com/story/uk-retail-sales-rise-faster-than-expected-2017-09-20).

That sending the pound on a brief rally above $1.3600, visiting

levels not since June 2016, just after the Brexit referendum.

Read:Don't call the German election boring--it could be huge

leap or setback for the eurozone

(http://www.marketwatch.com/story/dont-call-the-german-election-boring-it-could-mean-a-huge-shift-for-the-eurozone-2017-09-18)

(http://www.marketwatch.com/story/dont-call-the-german-election-boring-it-could-mean-a-huge-shift-for-the-eurozone-2017-09-18)Also

read:German election: Who's Merkel up against and what are their

chances?

(http://www.marketwatch.com/story/german-election-whos-merkel-up-against-and-how-could-they-shape-the-new-government-2017-08-31)

(END) Dow Jones Newswires

September 20, 2017 08:25 ET (12:25 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

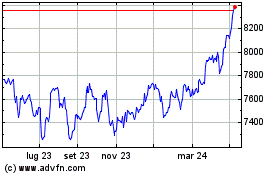

Grafico Indice FTSE 100

Da Mar 2024 a Apr 2024

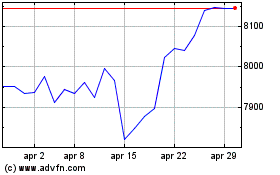

Grafico Indice FTSE 100

Da Apr 2023 a Apr 2024