Today's Top Supply Chain and Logistics News From WSJ

19 Ottobre 2017 - 1:29PM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Bigger may no longer be better in the troubled world of

consumer-goods suppliers. Reckitt Benckiser Group PLC, one of the

world's biggest suppliers of retail brands, is splitting the

business into two divisions, the WSJ's Saabira Chaudhuri writes,

reasoning that tighter focus is more important than scale for

products like Lysol, Woolite and Mead Johnson baby food. Splitting

the business into home-and-hygiene products and consumer-health

goods makes Reckitt the latest supplier to act amid stalling sales

as consumer tastes in many key markets change fast. Shoppers are

gravitating toward smaller, local products and away from

mega-brands. Reckitt CEO Rakesh Kapoor says "channels have

changed," undercutting the scale advantage they've had in

distribution. Reckitt's separate divisions will share functions

such as procurement. Still, the split positions the business for

potentially more drastic action, and analysts are already looking

for bigger moves.

Mitsubishi Motors Corp. plans to build its way into a bigger

share of the global automotive market. The Japanese auto maker will

spend $5 billion over the next three years building new factories

and developing new cars, including electric vehicles, the WSJ's

Sean McLain reports, as it looks to expand sales in areas such as

China and restore profitability after a fuel-economy scandal.

Mitsubishi Motors is investing in its supply chain in part with the

help of Nissan Motor Co., which took a controlling stake in the

company about a year ago and also struck a cooperation pact with

France's Renault SA. The alliance is part of the broader move by

small car makers to team up for scale in auto manufacturing and

sales competition that's grown more global. Meeting goals of

boosting sales by more than 30% in the next three years and

doubling sales in China would give Mitsubishi Motors a bigger role

in that competition, and in the industry's move toward electric

cars.

U.S. officials plan to test whether state, local and federal

rules for drones can share the same airspace. They're preparing to

release a model program aimed at easing the regulatory logjam

around commercial use of drones, the WSJ's Andy Pasztor writes, by

linking Federal Aviation Administration rules to those of local

governments, including law enforcement agencies. It's an effort

that may seem more complicated than the technology behind the

unmanned aircraft because the regulations have to be tied to the

communications systems of drones while they're in fast-moving

operations. The basic idea is to have the FAA oversee commercial

drone operations between 200 feet and 400 feet in designated test

areas, with drones at lower altitudes primarily regulated by

states, counties or localities. Businesses including parcel

carriers are anxious to get things moving. But the drone-safety

debate has heated up lately amid reports of collisions involving

drones in the U.S. and Canada.

SUPPLY CHAIN STRATEGIES

Retailer Supreme is carving out a bigger role in apparel by

turning traditional inventory and distribution strategy upside

down. The underground streetwear brand has just 11 stores yet is

valued at more than teen retailer Abercrombie & Fitch Co. and

its global network of 900 outlets. The WSJ's Khadeeja Safdar

reports that it's limited distribution is its virtue as it builds a

following based on the scarcity of its products. The seller of

skateboarding T-shirts, hats and sweatshirts has tapped into the

zeitgeist of teens seeking hard-to-get looks that run counter to

the mass-produced goods that fill big industrial supply chains. The

recent sale of a roughly 50% stake to private-equity firm Carlyle

Group LP for about $500 million highlights questions about its

strategy, including whether a brand built by limiting distribution

can generate adequate growth. Supreme will likely come under

pressure to trade its carefully-cultivated scarcity for higher

volume, which risks making its supply chain and its clothing look

like those of troubled retailers.

QUOTABLE

IN OTHER NEWS

Economic activity grew at a measured pace across the U.S. in

September and October, according to the Federal Reserve. (WSJ)

U.S. housing starts fell last month for the fifth time in six

months amid hurricane-related shortages in labor and construction

materials. (WSJ)

Canadian factory sales rebounded in August, rising 1.6% on

strong auto demand and higher energy prices. (WSJ)

Blue Apron Holdings Inc. is laying off around 300 employees,

including fulfillment center staff. (WSJ)

EBay Inc.'s third-quarter profit jumped 25% to $523 million on

an 8% gain in gross merchandise volume. (WSJ)

TPG Capital hired former Ford Motor Co. chief executive Mark

Field as an adviser as it moves to expand supply chain-related

investments. (WSJ)

Delta Air Lines Inc. says it plans to take delivery of new

Bombardier Inc. jetliners built at an Airbus SE facility in

Alabama. (WSJ)

Qualcomm Inc.'s $39 billion acquisition of NXP Semiconductors is

set to close by the end of the year, paving the way for the chip

maker to be a major player in autonomous driving. (WSJ)

Private-equity group EQT will buy a medical-device maker

Clinical Innovations for about $250 million. (WSJ)

JD.com will merge membership and fulfillment systems with

Wal-Mart Stores Inc. in China, including use of the U.S. retailer's

inventory to fill online orders. (Nikkei Asian Review)

Canadian Pacific Railway Ltd.'s third-quarter net profit jumped

47% despite declining auto and grain shipments. (The Globe and

Mail)

Trucker YRC Worldwide Inc. lowered its 2017 financial outlook in

part because of the impact of hurricanes on operations.

(Reuters)

Global container throughput at ports is on track to grow 6.1%

this year, the fastest pace since 2011, according to Alphaliner.

(Lloyd's List)

Cargo tonnage moving through the expanded Panama Canal rose

22.2% in the fiscal year that ended Sept. 30, reaching a record.

(Seatrade-Maritime)

Foxconn Technology Group and venture firm IDG Capital will raise

$1.5 billion to fund startups in automotive technologies. (South

China Morning Post)

Indian refineries are exploring purchases of U.S. crude that

would open a new export market for American producers.

(MarineLink)

China's state-owned CITIC Group will take a controlling stake in

Myanmar's Kyauk Pyu seaport. (Deal Street Asia)

Third-quarter net profit at India's Blue Dart Express fell 3% as

rising expenses offset revenue growth. (Economic Times)

Amazon will take over the top six floors of the Macy's Inc.

Seattle store for office space. (Seattle Times)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

October 19, 2017 07:14 ET (11:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

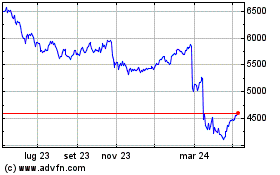

Grafico Azioni Reckitt Benckiser (LSE:RKT)

Storico

Da Mar 2024 a Apr 2024

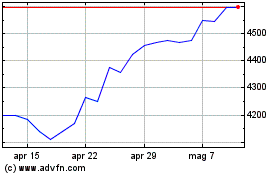

Grafico Azioni Reckitt Benckiser (LSE:RKT)

Storico

Da Apr 2023 a Apr 2024