Pound Strengthens After U.K. Economic Growth Exceeds Forecasts

25 Ottobre 2017 - 8:05AM

RTTF2

The pound advanced against its major opponents in early European

deals on Wednesday, after a data showed that UK economy expanded

more than expected in the third quarter.

Figures from the Office for National Statistics showed that

gross domestic product grew 0.4 percent sequentially in three

months ended September. The statistical office revised its second

quarter growth to 0.4 percent from 0.3 percent.

GDP was forecast to rise 0.3 percent in the third quarter.

On a yearly basis, the economy expanded 1.5 percent, in line

with expectations.

Another report from ONS showed that the index of services

climbed 0.2 percent in August from July. In three months to August,

services output rose 0.4 percent from previous quarter.

Speaking before the parliamentary committee, Brexit minister

David Davis said he expects the transition deal with the EU to be

agreed early in 2018.

Davis also revealed that a new trade deal is likely to be agreed

before Article 50 talks conclude in March 2019.

The pound held steady against its major rivals in the Asian

session, with the exception of the franc.

The pound climbed to 0.8921 against the euro, from a low of

0.8973 hit at 3:00 am ET. If the pound advances further, 0.88 is

possibly seen as its next resistance level.

Survey results from Ifo Institute showed that Germany's business

confidence improved in October.

The business confidence index rose unexpectedly to 116.7 from

revised 115.3 in the previous month. The expected reading was

115.0.

Having fallen to a 5-day low of 1.3110 against the greenback at

3:00 am ET, the pound advanced to 1.3186 following the data. The

pound is seen finding resistance around the 1.33 region.

The pound advanced to 1.3084 against the franc, its strongest

since September 27. This may be compared to a low of 1.2985 hit at

3:15 am ET. On the upside, 1.32 is likely seen as the next

resistance for the pound.

Data from the UBS investment bank showed that the Swiss

consumption indicator remained slightly above the long-term average

in September.

The consumption indicator rose to 1.56 points in September from

revised 1.50 in August. The indicator was underpinned by

significantly higher expectations in the retail industry.

The pound strengthened to more than a 3-week high of 150.53

against the yen, off its previous low of 149.28. Continuation of

the pound's uptrend may see it challenging resistance around the

152.00 region.

Looking ahead, U.S. durable orders and new home sales for

September and Federal housing finance agency's house price index

for August are due in the New York session.

At 10:00 am ET, the Bank of Canada announces its decision on

interest rates. Economists expect the benchmark rate to remain at

1.00 percent.

The BoC Governor Stephen Poloz and Deputy Governor Carolyn

Wilkins will host a press conference in Ottawa at 11:15 am ET.

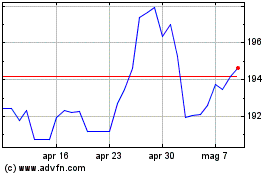

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

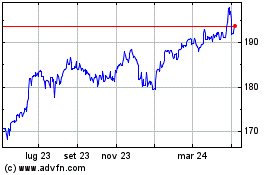

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024