Chemicals Tie-Up Weighed -- WSJ

31 Ottobre 2017 - 8:02AM

Dow Jones News

By Dana Mattioli and Dana Cimilluca

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 31, 2017).

LyondellBasell Industries NV has made a takeover approach to

Braskem SA, according to people familiar with the matter, eyeing a

deal that could value the Brazilian petrochemical company at well

over $10 billion.

The talks are at an early stage, the people said, and there is

no guarantee there will be a deal.

Should there be one, it would be substantial: Braskem on Monday

had a market value of about 37 billion Brazilian reais ($11.4

billion) and nearly as much debt. LyondellBasell had a market value

of about $40 billion.

It would also be the second-largest Brazilian M&A deal,

according to Dealogic. There has only been one double-digit-billion

dollar deal in the country, according to the data provider's

records: a $43 billion acquisition of oil-and-gas assets by

Petrobras, announced in 2010.

LyondellBasell and Braskem operate in similar product lines but

different geographies. Products include polyethylene, which is used

in everyday items such as garbage bags and milk jugs. A deal would

also give LyondellBasell access to faster-growing Latin American

markets.

LyondellBasell is a Netherlands-based chemicals-and-polymer

producer with a big presence in Houston. It was formed in 2007 when

Dutch chemical company Basell International Holdings BV paid $12.7

billion to buy Houston-based Lyondell Chemical Co. The deal loaded

the company with more than $20 billion in debt just before global

commodity markets tumbled in the global financial crisis. A little

more than a year after the merger, LyondellBasell filed for

bankruptcy.

It emerged from bankruptcy in 2010 after eliminating about $5

billion in debt. Ukrainian-born billionaire Len Blavatnik's holding

company, Access Industries, is a significant backer. Recently,

executives of the chemical company have indicated they have a big

M&A appetite.

Braskem is co-owned by state oil firm Petroleo Brasileiro SA,

known as Petrobras, and construction firm Odebrecht SA, which owns

just over half of the voting shares. The company, which says it is

the biggest producer of polypropylene in the U.S., had sales of

55.5 billion reais last year.

Odebrecht said in a statement that it "continues to work on

alternatives that may add value to Braskem and its shareholders,

and reaffirms its intention to keep Braskem as one of the group's

investments."

The chemicals sector has been a hotbed of merger activity of

late. On Monday, Akzo Nobel NV and U.S. rival Axalta Coating

Systems Ltd. said they are in talks to join forces in a merger of

equals that would create a multibillion-dollar coating and paints

giant.

Earlier this year, Dow Chemical Co. and DuPont Co. completed

their roughly $60 billion merger, which they expect to follow with

a three-way breakup. Last year, industrial-gas giants Praxair Inc.

and Germany's Linde AG agreed to combine.

Write to Dana Mattioli at dana.mattioli@wsj.com and Dana

Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

October 31, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

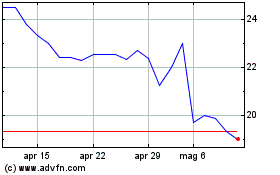

Grafico Azioni BRASKEM PNA (BOV:BRKM5)

Storico

Da Mar 2024 a Apr 2024

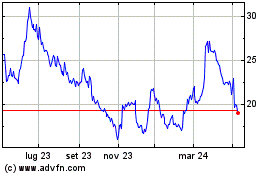

Grafico Azioni BRASKEM PNA (BOV:BRKM5)

Storico

Da Apr 2023 a Apr 2024