(UNAUDITED IFRS FIGURES)

SUSTAINED REVENUE GROWTH AND ACCELERATED RESULTS

PROGRESSION

- REVENUE INCREASED 4.4%1

(+3.1% LIKE-FOR-LIKE) TO €18,221 MILLION

- IN THE THIRD QUARTER REVENUE

INCREASED +4.3%1

- GOOD COMMERCIAL MOMENTUM

- WASTE VOLUMES UP BY +3.3%

- EBITDA UP 1.7%1 TO

€2,359 MILLION FOR THE NINE MONTHS

- IN THE THIRD QUARTER EBITDA

INCREASED +4.8%1

- €190 MILLION IN COST SAVINGS

ACHIEVED DURING THE FIRST NINE MONTHS, INLINE WITH THE €250 MILLION

ANNUAL OBJECTIVE

- CURRENT EBIT IMPROVED

2.2%1 TO €1,049 MILLION FOR THE NINE MONTHS

- THIRD QUARTER CURRENT EBIT IMPROVED

+6.9%1

- CURRENT NET INCOME- GROUP SHARE

ALMOST STABLE AT €406 MILLION, UP 4.3%1 EXCLUDING

CAPITAL GAINS

- 2017 OBJECTIVES FULLY

CONFIRMED

Regulatory News:

Antoine Frérot, Veolia Environnement’s (Paris:VIE)

Chairman and CEO commented: “Veolia’s 9-month results

are satisfying, and support our strategy of growth and efficiency.

The solid development of our revenue is confirmed, as announced at

the beginning of the year. Good commercial momentum and revitalized

attractiveness of our offerings resulted in new contract awards

across all our businesses and geographies. For example, we have

signed a new 10-year hazardous waste treatment contract with Antero

Resources, an oil and gas producer in the United States, and

renewed the contract to operate the Le Mans wastewater treatment

plant for a period of 12 years. In addition, the successful

framework and execution of our efficiency programs allowed us to

achieve cost savings in line with our objectives. All in all, the

combination of profitable growth and cost savings translates into

an overall acceleration of EBITDA and earnings, in line with our

plan. These results allow me to fully confirm our objectives.”

Group consolidated revenue increased 3.7% (+4.4% at constant

exchange rates) from represented €17,569 million for the nine

months ended September 30, 2016 to €18,221 million for the nine

months ended September 30, 2017.

The unfavorable movement in exchange rates negatively impacted

revenue growth by 0.7% for the first nine months of 2017 (-€123

million). At constant consolidation scope and exchange rates (i.e.

like-for-like), revenue growth for the nine months amounted to

3.1%, as in the first half of 2017.

At constant exchange rates and excluding the impact of

construction and energy prices, nine-month revenue increased

4.9%.

- In France, revenue was almost stable

for the nine months (-0.7%), but grew 1.2% at constant

consolidation scope. Water was stable (+0.1%) but showed gradual

improvement due to volume growth (+1%) and price indexation which

improved to +0.4% in the third quarter after -0.3% in the first and

second quarters. The Waste business recorded a decline of 1.6%, but

at constant consolidation scope increased 2.9% due to good

commercial momentum, volumes up by 2.1% (+3.5% in Q3) and the

positive effect of higher recycled material prices.

- Europe excluding France revenue was up

sharply, +6.5% at constant exchange rates for the nine-month period

and up 8.1% during the third quarter. All regions recorded

sustained growth, with the exception of Italy (-2.8%). Germany

increased 4.9% due to good commercial performance in Waste and

higher paper prices. UK revenue improved 5.1% given continued

strong PFI performance, good commercial momentum and higher

recycled material prices. Central and Eastern Europe revenue

increased 10.3% due to good volumes in Energy given favorable

weather in the first half of 2017 and the contribution of the

Prague Left Bank district heating network, as well as good water

volumes. In addition, Nordic countries also posted good performance

with revenue up 12.2%, while the Iberian Peninsula grew revenue

11.5%.

- At constant exchange rates, the Rest of

the World segment continued to record strong revenue growth for the

nine-month period (+10.6%), with Q3 revenue up 9.4%. North America

revenue increased 11.6% due to the integration of Chemours’

sulfuric acid regeneration business and the benefit from higher

energy prices in the municipal business. Industrial services

revenue remains down. Revenue in Asia progressed 22%, with in

particular, 30.3% growth in China, which continues to benefit from

commercial successes. Japan and South Korea also recorded revenue

growth. Latin American revenue increased 22.4%, due to good

development in Argentina, Brazil and Columbia. Australia revenue

recovered, with third quarter revenue up 8.2%.

- Global Businesses revenue declined by

1.3% at constant exchange rates. Hazardous waste activities

continue to grow at a good pace (+4.5%). Veolia Water Technologies

construction revenue fell 8.7% during the nine-month period,

however YTD bookings increased 10%. The SADE business recorded a

good performance in France, but delays in the start-up of

international projects resulted in an overall revenue decline

(-2.9%).

Commercial reinforcement efforts launched a year ago continue

to bear fruit.

After the good commercial performance recorded during the first

half of 2017, including for example the award of several energy

services contracts in China to generate more than €860 million in

cumulative revenue, and the design, build and operation of the

largest waste-to-energy plant in Latin America, in Mexico

(cumulative revenue expected of €886 million), the Group has once

again signed several significant contracts during the third

quarter.

- In Water in France, Veolia notably was

awarded the operations contract for the Valenton wastewater

treatment plant for a 12-year period and expected cumulative

revenue of €400 million, as well as operations contracts for two

wastewater treatment plants in Lille for 5 years and Le Mans for 9

years.

- In the United States, in the oil and

gas sector, Antero Resources awarded Veolia a contract to treat

sludge generated from its West Virginia site for a period of up to

10 years and $70 million in cumulative revenue.

- In recycling, Veolia has established a

global industrial plastic recycling platform with a European

presence in France, the United Kingdom, Germany, Benelux and

Scandinavian countries, as well as an Asian presence in South Korea

and Japan.

- In addition, renewal rates for expiring

contracts remained very satisfactory across all the Group’s

businesses.

EBITDA increased 1.3% (+1.7% at constant exchange rates) to

€2,359 million for the nine months ended September 30,

2017.

- The variation in exchange rates

negatively impacted EBITDA by 0.4% (-€10 million).

- At constant exchange rates, EBITDA

growth accelerated during the third quarter with 4.8% growth, after

+0.4% growth in the first half of 2017.

- This improvement was driven by

continued solid revenue growth and cost savings which reached €190

million for the first nine months of 2017, in line with the €250

million annual objective. The weight from unfavorable transitory

and one-off items amounted to -€103 million during the nine months,

including only -€9 million for the third quarter, which made it

possible to benefit from operating leverage generated from top line

growth. The impact of movements in energy prices and recycled

material prices was not significant, (only +€1 million for the

nine-month period).

Current EBIT rose 1.3% (+2.2% at constant exchange rates) to

€1,049 million for the nine months ended September 30,

2017.

- The foreign exchange impact on current

EBIT amounted to -€9 million.

- At constant exchange rates, current

EBIT growth was driven mainly by the increase in EBITDA.

Depreciation and amortization, combined with principal payments on

operating financial assets, increased 2.4% at constant exchange

rates to €1,255 million (scope effect). The contribution from the

current net income of joint ventures and associates was €76

million, compared to €82 million for the prior year period due to

the impact of divestitures that more than offset strong growth in

China (€50 million for the first nine months of 2017 vs.

represented €38 million for the first nine months of 2016).

Current net income – Group share declined 1.6% (-0.7% at

constant exchange rates) to €406 million for the nine months ended

September 30, 2017. Excluding capital gains, current net income –

Group share increased 3.3% (+4.3% at constant exchange rates) for

the same period.

- The foreign exchange impact on current

net income – Group share amounted to -€4 million.

- The cost of net financial debt was

stable at €314 million.

- Current net income – Group share

included €14 million in financial capital gains, compared with

represented €33 million for the first nine months of 2016.

- The current tax rate was 25%.

Net financial debt declined to €8,419 million at September

30, 2017, compared with €8,883 million at September 30,

2016.

**********

Medium-term outlook*.

In view of the performance recorded during the first nine months

of 2017, the Group’s medium-term outlook is fully confirmed:

- 2017: a transition year

- Resumption of revenue growth

- Stable EBITDA, or moderate EBITDA

growth

- Increased efforts to reduce costs: more

than €250 million in cost savings

- 2018:

- Continuation of revenue growth

- Resumption of more sustained EBITDA

growth

- More than €300 million in cost

savings

- 2019:

- Continuation of revenue growth and full

impact of cost savings

- EBITDA between €3.3bn and €3.5bn

(excluding IFRIC 12)

*at constant exchange rates

Veolia group is the global leader in optimized resource

management. With over 163,000 employees worldwide, the Group

designs and provides water, waste and energy management solutions

that contribute to the sustainable development of communities and

industries. Through its three complementary business activities,

Veolia helps to develop access to resources, preserve available

resources, and to replenish them. In 2016, the Veolia group

supplied 100 million people with drinking water and 61 million

people with wastewater service, produced 54 million megawatt hours

of energy and converted 30 million metric tons of waste into new

materials and energy. Veolia Environnement (listed on Paris

Euronext: VIE) recorded consolidated revenue of €24.39 billion in

2016. www.veolia.com

Important disclaimer

Veolia Environnement is a corporation listed on the Euronext

Paris. This press release contains “forward-looking statements”

within the meaning of the provisions of the U.S. Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are

not guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are outside our

control, including but not limited to: the risk of suffering

reduced profits or losses as a result of intense competition, the

risk that changes in energy prices and taxes may reduce Veolia

Environnement’s profits, the risk that governmental authorities

could terminate or modify some of Veolia Environnement’s contracts,

the risk that acquisitions may not provide the benefits that Veolia

Environnement hopes to achieve, the risks related to customary

provisions of divesture transactions, the risk that Veolia

Environnement’s compliance with environmental laws may become more

costly in the future, the risk that currency exchange rate

fluctuations may negatively affect Veolia Environnement’s financial

results and the price of its shares, the risk that Veolia

Environnement may incur environmental liability in connection with

its past, present and future operations, as well as the other risks

described in the documents Veolia Environnement has filed with the

Autorités des Marchés Financiers (French securities regulator).

Veolia Environnement does not undertake, nor does it have, any

obligation to provide updates or to revise any forward looking

statements. Investors and security holders may obtain from Veolia

Environnement a free copy of documents it filed (www.veolia.com)

with the Autorités des Marchés Financiers.

This document contains "non‐GAAP financial measures". These

"non‐GAAP financial measures" might be defined differently from

similar financial measures made public by other groups and should

not replace GAAP financial measures prepared pursuant to IFRS

standards.

QUARTERLY FINANCIAL INFORMATION FOR THE NINE

MONTHS ENDED SEPTEMBER 30, 2017

A] PREFACE

Changes in concession standards

Under concession contracts with local authorities,

infrastructure is accounted, as appropriate, as an intangible

asset, a financial receivable, or a combination of the two. Veolia

may have a payment obligation vis-a-vis the grantor for the use of

the associated assets.

In July 2016, IFRIC published a verdict regarding these payments

and concluded that in the case of fixed payments required by the

operator, an asset and a liability should be recorded (intangible

model). Veolia identified the contracts concerned and has applied

the new IFRIC 12 measures retroactive to January 1, 2015. The most

significant contracts concerned are our water concessions in the

Czech Republic and Slovakia. September 30, 2016 figures have been

represented for the application of IFRIC 12. The impacts are

presented in the appendix to this press release.

Figures as of September 30, 2017 discussed in this press release

include the impact of adjustments resulting from the application of

IFRIC 12. Reflecting these adjustments, EBITDA was increased in the

amount of €160.9 million, Current EBIT in the amount of €70.9

million and Current net income, Group share in the amount of €3.6

million.

Lithuania

As of September 30, 2017, the ongoing withdrawal from Lithuania,

motivated by the end of a major contract and the sales process for

other activities, led the Group to transfer its Lithuanian

activities to discontinued operations in accordance with IFRS

5.

B] KEY FIGURES

(in € million) (4)

9 months endedSeptember 30,2016

published

IFRIC 12 andIFRS 5 (3)adjustments

9 months endedSeptember

30,2016represented

9 months endedSeptember

30,2017 includingIFRIC 12

∆

∆ atconstantexchangerates

Revenue 17,708 (139) 17,569 18,221

+3.7% +4.4% EBITDA 2,206 123 2,329

2,359 +1.3% +1.7% EBITDA margin 12.5%

13.3% 12.9%

Current EBIT (1) 979 56 1,035 1,049

+1.3% +2.2% Current net income - Group share

421 (9) 412 406 -1.6% -0.7%

Current net income – Group share, excluding capital gains and

losses on financial divestitures net of tax and minority interests

388 (9) 379 392 +3.3%

+4.3% Industrial investments 902 84 986

982 Net free cash flow (2) 3 (28) (25)

(63) Net Financial Debt 8,883 - 8,883

8,419

(1) Including the share of current net income of joint ventures

viewed as core Company activities and associates.

(2) Net free cash flow corresponds to free cash flow from

continuing operations, and is equal to the sum of EBITDA, dividends

received, changes in operating working capital and operating cash

flow from financing activities, less interest expense, net

industrial investments, taxes paid, renewal expenses, restructuring

costs and other non-current expenses.

(3) Adjustments as of September 30, 2016 concern the application

of IFRIC 12 and the transfer of activities in Lithuania to

discontinued operations pursuant to IFRS 5 (see Appendix).

(4) The indicators are defined in Section 3.8.3 of the 2016

Registration Document.

The main foreign exchange impacts were as follows:

Foreign exchange impacts as of

September 30, 2017(vs September 30, 2016 represented)

% €M Revenue -0.7% -122.7 EBITDA -0.4%

-9.5 Current EBIT -0.9% -8.9 Current net income excluding capital

gains and losses -0.9% -3.5 Net financial debt (vs. September 2016

represented) -1.6% -146 Net financial debt (vs. December 2016)

-2.8% -221

C] INCOME STATEMENT

1. GROUP CONSOLIDATED

REVENUE

Group consolidated revenue for the nine months ended September

30, 2017 was €18,221 million, compared with represented €17,568.8

million for the same period in 2016, up +4.4% at constant exchange

rates. Excluding Construction revenue2 and energy price effects,

revenue increased +4.9% at constant exchange rates.

As in the first two quarters, revenue growth was marked by

favorable momentum across mainly Europe excluding France and Rest

of the world in the third quarter of 2017:

∆ at constant exchange

rates Q1 2017 Q2 2017

Q3 2017 France

-1.5% -0.4% -0.3% Europe excluding France +7.2% +4.4%

+8.1% Rest of the world +11.8% +10.8% +9.4% Global Businesses

-3.2% +1.7% -2.7%

Group

+4.5% +4.4% +4.3% Total Group

excluding the impact of Construction activities and energy

prices +5.9% +4.1%

+4.7%

By segment, the change in

revenue compared with represented figures for the nine months ended

September 30, 2016 breaks down as follows:

2016 / 2017 change (in € million)

9 months endedSeptember

30,2016represented

9 monthsendedSeptember

30,2017

∆

∆ atconstantexchangerates

∆ at constantscope andexchangerates

France 4,065.5 4,036.8 -0.7% -0.7% +1.2% Europe, excluding

France 5,830.9 6,103.8 +4.7% +6.5% +4.8% Rest of the World 4,346.8

4,815.6 +10.8% +10.6% +5.2% Global Businesses 3,304.5 3,240.0 -2.0

% -1.3% -0.4% Other 21.1 24.8 +17.9%

+17.8% +17.8%

Group 17,568.8

18,221.0 +3.7% +4.4%

+3.1%

Revenue increased +1.2% at constant scope in France:

Water revenue increased +0.1%, while Waste revenue grew 2.9% at

constant scope.

- Water revenue was €2,198.7 million,

impacted by higher volumes (+1%) and stable commercial activity,

slightly offset by a reduction in tariff indexation (-0.2%);

- Waste revenue declined -1.6% compared

to the represented figures for the nine months ended September 30,

2016, but grew 2.9% at constant scope (adjusted for the impact of

the sale of Bartin Recycling on November 30, 2016) to €1,838.1

million. Continued good commercial momentum with significant

contract wins was accompanied by increased volumes and higher

recyclate prices.

Europe excluding France (excluding Lithuania which is

classified in discontinued operations) grew +6.5% at constant

exchange rates compared to the represented prior-year period, with

solid momentum in all key countries:

- In the United Kingdom, revenue

increased +5.1% at constant exchange rates to €1,497.7 million,

thanks to good waste performance driven by the contribution of

integrated contracts, the favorable impact of recyclate prices

(paper and ferrous and non-ferrous scrap metals) and contract wins

(St Albans, Southend on Sea, Army 2020);

- In Central and Eastern Europe, revenue

increased +10.3% at constant exchange rates compared to the

represented nine months ended September 30, 2016 to €2,050.2

million, boosted by:

- In Energy, a favorable weather impact

(+€35 million), an increase in heating and electricity volumes sold

in Poland and the contribution of the Prague heating network;

- In Water, increased volumes and new

extended Armenia contract;

- In Northern Europe, revenue increased

+4.6% at constant exchange rates compared to the represented prior

year period to €1,764.4 million. Germany, the main contributor

(€1,298.6 million) benefited from higher paper prices, a positive

price impact on industrial waste collection activities and new

contract wins in the Waste sector. In addition, acquisitions,

mainly in Sweden in the Waste sector, further contributed to the

improvement in revenue.

Strong revenue growth (+10.6% at constant exchange rates

compared to the represented nine months ended September 30, 2016)

in the Rest of the world segment, with strong growth

reported across most regions:

- Revenue rose +11.6% at constant

exchange rates to €1,520.8 million in North America, benefiting

from the integration of Chemours' Sulfur Products division assets

(+€106.9 million) and the acquisition of a building energy services

company (Enovity: +€26.4 million) in January 2017. Additionally,

robust Municipal and Commercial activities were boosted by higher

electricity and gas prices and volumes, offset by a contraction in

industrial services;

- Revenue growth was robust in Latin

America (+22.4% at constant exchange rates) thanks to tariff

increases in Argentina, the positive impact of the acquisition of

the Pedreira landfill site in Brazil in May 2016 and the start-up

of the Santa Marta contract (drinking water distribution) in

Colombia in April 2017;

- Asia reported significant revenue

growth of +22% at constant exchange rates. In China, strong revenue

growth (+30.3%) was due to new contracts (Sinopec, Hongda, Heijian

Biomass and Hangzhou WEE) in the Industrial Water and industrial

services sectors, and growth in volumes sold in the Municipal

Energy and Waste sectors. Revenue growth in Japan was also driven

by the development of Municipal Water activities and the

contribution of plastic recycling activities purchased in August

2016. In Korea, the acquisition of Uniken in Industrial Waste had a

favorable impact on revenue;

- Revenue increased in the Pacific zone

(+2.9% at constant exchange rates for the nine months ended

September 30, 2017). In the Waste business, increased volumes

following the opening of new processing sites (Banksmeadow and MBT

Woodlawn) were partially offset by a decrease in industrial

services (loss of Rio Tinto contract);

- In Africa and the Middle East, revenue

declined by -1.9% at constant exchange rates.

Global Businesses: -1.3% decline in revenue at constant

exchange rates compared to the represented nine months ended

September 30, 2016:

- Solid growth in Hazardous Waste

activities (+4.5% at constant exchange rates), mainly due to an

improvement in the oil recycling business;

- Design & Build activities remain

down by -8.7% at constant exchange rates, in line with the Veolia

Water Technologies business restructuring, although bookings

improved (+10%). Growth in SADE activities in France, however,

partially offset international delays.

The increase in revenue between the nine months ended 2016

and 2017 breaks down by main impact as

follows:

The foreign exchange impact on revenue was -€122.7

million (-0.7% of revenue) and mainly reflects fluctuations in the

UK pound sterling (-€139.9 million), the Argentine peso (-€15.2

million), the Chinese renminbi (-€12.8 million), the Australian

dollar (+€26.1 million), the Czech crown (+€13.5 million) and the

Brazilian real (+€13.1 million).

The consolidation scope impact (+€225.2 million) mainly

concerns developments in 2016 and 2017: in 2016, the integration of

Chemours’ Sulfur Products division assets in the United States

(+€106.9 million), Prague Left Bank, renamed Veolia Energie Praha,

in the Czech Republic (+€20.5 million) and the Pedreira landfill

site in Brazil (+€16.5 million), as well as the sale of Bartin

Recycling in the Waste business in France (-€104.9 million); in

2017, the acquisition of Enovity in the United States (+€26.4

million), Uniken in South Korea (+€18.0 million), the takeover of

Ta-ho in Taiwan (+€28.7 million) and Corvara and Hans Andersson in

Sweden (+€19.2 million), which offset the sale of the FM AB

business in Sweden (-€8.1 million). At constant scope and exchange

rates, revenue grew +3.1%.

Construction revenue contracted by -€67 million (-€8

million in Q3 2017, compared with +€15 million in Q2 2017 and -€74

million in Q1 2017) following a decrease in Construction activity

under concession agreements, slightly offset by the recovery of

SADE activities in France.

Energy and recyclate prices had an impact of €72 million

(versus -€119 million for the nine months ended September 30,

2016).

Commercial momentum improved significantly

(Commerce/Volumes impact) contributing +€423 million

(compared with +€110 million for the nine months ended September

30, 2016):

- A volume effect of +€207 million in

line with higher volumes sold in Central Europe (particularly

electricity and heating sales), good waste volumes in France, the

United Kingdom and Germany, and further growth in energy volumes in

China;

- A commercial effect of +€186 million,

encompassing the development of new industrial assets in Europe and

Asia (Sinopec contract: €63 million);

- A weather impact of +€30 million:

highly favorable impact in Central Europe (+€35 million) partially

offset by North America (-€6 million).

Favorable price effects (+€119 million) are tied to

positive tariff indexation in Germany in Waste, in Central Europe

in Water and the significant impact of higher prices in

Argentina.

By business, the increase

in revenue for the nine months ended September 30, 2017 compared to

the represented period for the prior year breaks down as

follows:

(in € million)

9 months endedSeptember 30,2016

represented

9 months endedSeptember

30,2017

∆

∆ atconstantexchangerates

∆ at constant FXand excludingconstruction

&energy prices

∆ at constantscope andexchange rates

Water 8,036.2 8,058.9 +0.3% +0.6% +1.8%

+0.8% Waste 6,316.4 6,641.6 +5.1% +6.7% +6.8% +4.2% Energy

3,216.2 3,520.5 +9.5% +9.4%

+8.9% +6.9%

Group 17,568.8

18,221.0 +3.7% +4.4%

+4.9% +3.1%

WATER

Water revenue increased slightly by +0.6% at constant exchange

rates and 1.8% at constant exchange rates excluding Construction

revenue and energy price effects, compared with represented figures

for the nine months ended September 30, 2016. This improvement can

be explained as follows:

- Higher volumes in France, Central

Europe (notably the new extended Armenia contract) , Asia (Sinopec

contract), and a positive commercial impact lead to an overall

increase of +1.9%;

- Tariff increases in Central Europe and

Latin America;

- A slight decrease in Construction

revenue (-0.9%) following a slowdown in activity.

WASTE

Waste revenue rose +6.7% at constant exchange rates compared

with represented figures for the nine months ended September 30,

2016 (+4.2% at constant scope and exchange rates), due to:

- A scope impact of +2.6%, mostly related

to the acquisition of the Chemours’ Sulfur Products division assets

in the United States (+€106.9 million), the acquisition of Pedreira

in Brazil (+€16.5 million) and external growth transactions in

Asia, partially offset by the sale of Bartin (-€105 million);

- Commercial and volume effects of +1.5%:

slowdown in Waste volumes in the United States (Industrial services

still weak) offset by numerous contract wins, particularly in

France, the UK and Germany;

- A positive price effect of +1.0%;

- The favorable impact of higher

recyclate prices (+1.5%) and particularly paper.

ENERGY

Energy revenue rose +9.4% at constant exchange rates compared

with represented figures for the nine months ended September 30,

2016 (+6.9% at constant consolidation scope and exchange rates).

This improvement can be explained as follows:

- The positive volume and commerce effect

of +5%, due to higher volumes of energy sold in Central Europe,

China and the United States and new energy efficiency contracts in

Asia and Europe;

- A favorable weather impact of €30

million (+0.9%) mostly in Poland and the Czech Republic;

- A slightly positive price effect of

+0.4%: lower heat and electricity prices in Europe were mostly

offset by higher prices in the United States;

- A scope impact of +2.5%, related to the

acquisition of Prague Left Bank and Gesten in 2016 and an energy

efficiency business in the United States (Enovity) in 2017.

2. EBITDA

Group consolidated EBITDA for the nine months ended September

30, 2017 was €2,358.7 million, up 1.7% at constant exchange rates

compared to the represented prior year period. The EBITDA margin

decreased from represented 13.3% for the nine months ended

September 30, 2016 to 12.9% for the nine months ended September 30,

2017.

Changes in EBITDA by segment

were as follows:

In France, EBITDA improved:

- In the Water business, EBITDA improved

significantly in the nine months ended September 30, 2017, thanks

to significant cost savings and higher volumes (+1%), partially

offset by squeezed margins due to negative tariff indexation and

contractual renegotiations;

- In the Waste business, EBITDA also

increased, benefiting from cost savings and the impact of

commercial developments.

EBITDA stabilized in Europe excluding France (excluding

Lithuania) as a result of several impacts:

- In Central and Eastern Europe, EBITDA

improved mainly thanks to a favorable weather impact in Energy and

good volumes in Water;

- In the United Kingdom, good operating

performance was partially offset by plant outages and one-off

dismantling costs;

- Lower EBITDA in Northern Europe, mainly

due to favorable non-recurring items in the first-half of 2016

(litigation payment and insurance claim reimbursement).

EBITDA grew in the Rest of the World:

- Increased EBITDA in the United States

was mainly due to changes in consolidation scope, with the

successful integration of Chemours’ Sulfur Products division assets

and progression in Energy, with the acquisition of Enovity,

partially offset by the sale of West Coast energy assets. The

decline in industrial services was partial offset by the

restructuring measures previously implemented;

- EBITDA growth in Latin America was

mainly due to price increases in Argentina and the impact of

acquisitions in Brazil and a new contract in Colombia;

- Sustained EBITDA growth in China across

all businesses: Municipal and Industrial Energy, Industrial Water

(Sinopec) and Waste (landfill volumes and growth in hazardous

waste).

In the Global Businesses segment, the benefits of

restructuring at Veolia Water Technologies and the good performance

of Hazardous waste activities were offset by the non-recurrence of

2016 favorable impacts (favorable outcome of a contract

termination). Veolia Water Technologies is pursuing its

transformation plan with the standardization of its offerings,

purchasing savings and a decrease in selling and administrative

costs.

The increase in EBITDA between the nine months ended 2016 and

2017 breaks down by impact as

follows:

- The foreign exchange impact on

EBITDA was -€9.5 million and mainly reflects the depreciation of

the UK pound sterling (-€18.1 million) and the Chinese renminbi

(-€3.3 million), partially offset by the appreciation of the Czech

crown (+€4.6 million), the Polish zloty (+€3.2 million), the

Brazilian real (+€2.7 million), and the Australian dollar (+€2.2

million).

- The consolidation scope impact

(+€52.6 million) mainly concerns developments in 2016: the

integration of Chemours’ Sulfur Products division assets in the

United States, Prague Left Bank in the Czech Republic, and the

Pedreira landfill site in Brazil.

- Commerce and volume impacts

totaled +€33 million thanks to strong commercial momentum (notably

in Asia), good water volumes in Europe, higher waste volumes and

favorable weather conditions over the first nine months. These

favorable items were partially offset by the impact (albeit weaker)

of contract negotiations in France Water, contract losses in Italy

and a downturn in industrial service activities in North America

and the Pacific.

- Energy and recyclate prices

positively impacted EBITDA (+€1 million): heating and electricity

prices changed in line with the purchase price of fuel used to

produce heat and electricity (decrease in Central Europe and

increase in the U.S.). The positive impact of higher recyclate

prices in the United Kingdom was offset by increased fuel costs in

Waste in France.

- The -€104 million price squeeze

includes in particular the negative impact of the start-up of new

activities.

- Cost savings plans contributed

€190 million, consistent with the annual objective of €250 million.

They mainly cover operational efficiency (46%) and purchasing

(31%), and were achieved across all geographic zones: France (32%),

Europe excluding France (26%), Rest of the World (25%), Global

Businesses (15%) and Corporate (2%).

- Transitory costs and one-off

items mainly concern the absence of the favorable impact of

one-off items recorded in the first nine months of 2016 (litigation

payment in Belgium, insurance claim reimbursement received in

Germany, favorable contract termination at Veolia Water

Technologies) and additional insurance and maintenance costs

(particularly in the United Kingdom) incurred in the first half of

2017.

3. CURRENT EBIT

Group consolidated Current EBIT for the nine months ended

September 30, 2017 was €1,049.2 million, up +2.2% at constant

exchange rates compared to the represented figures for the

prior-year period.

The reconciling items between EBITDA and Current EBIT for the

nine months ended September 30, 2017 and 2016 are as follows:

(in € million)

9 months endedSeptember 30,2016

represented

9 months endedSeptember 30,

2017

EBITDA 2,329.0 2,358.7 Renewal

expenses (202.5) (206.7) Depreciation and amortization (*)

(1,231.1) (1,255.5) Provisions, fair value adjustments & other:

58.3 76.9

- Current impairment of property, plant and equipment, intangible

assets and operating financial assets

1.9 10.5

- Net charges to operating provisions, fair value adjustments and

other

36.3 57.2

- Capital gains or losses on industrial divestitures

20.1 9.2 Share of current net income of joint ventures and

associates 81.6 75.8

Current EBIT

1,035.3 1,049.2

(*) Including principal payments on operating financial assets

(OFA) of -€120.1 million for the nine months ended September 30,

2017 (compared with -€140.4 million for the nine months ended

September 30, 2016.)

The increase in Current EBIT at constant exchange rates

reflects:

- EBITDA growth at constant exchange

rates;

- the increase in depreciation and

amortization charges at constant exchange rates, in line with

consolidation scope impacts, primarily in the Unites States

following the acquisition of Chemours’ assets in July 2016, as well

as in Brazil;

- the favorable change in net operating

provision reversals, in particular captive insurance provisions

(+€12 million);

- a decline in capital gains or losses on

industrial divestitures in the nine months ended September 30,

2017;

- Share of current net income of joint

ventures and associates was +€75.8 million versus +€81.6 million in

2016; improved performance of Chinese concessions were offset by

sales of assets in United Kingdom.

The foreign exchange impact on Current EBIT was -€8.9 million

and mainly reflects fluctuations in the pound sterling (-€10.5

million), Brazilian real (+€1.6 million), Czech crown (+€2.3

million), Chinese renminbi (-€3.1 million), and Australian dollar

(+€1.2 million).

4. CURRENT NET

INCOME

Current net income attributable to owners of the Company was

€406 million for the nine months ended September 30, 2017, compared

with represented €412 million for the nine months ended September

30, 2016. Excluding capital gains and losses on financial

divestitures net of tax and minority interests, current net income

attributable to owners of the Company rose 4.3% at constant

exchange rates to €392 million from represented €379 million for

the nine months ended September 30, 2016.

D] FINANCING

Net free cash flow was -€63 million for the nine months

ended September 30, 2017, versus represented -€25 million for the

nine months ended September 30, 2016.The change in net free cash

flow compared with the represented nine months ended September 30,

2016 mainly reflects the increase in restructuring and other costs

(-€40 million).

Net FCF excluding WCR seasonality for the nine months ended

September 30, 2017 amounted to €619 million.

Overall, net financial debt amounted to €8,419 million at

September 30, 2017, compared with represented €7,812 million at

December 31, 2016.

In addition to the change in net free cash flow (including the

change in operating WCR), net financial debt was impacted by net

financial investments of -€248 million, as well as favorable

exchange rate fluctuations totaling €221 million in the first nine

months of the year and dividends paid.

APPENDIX

Reconciliation of 2016 published data for the nine months

ended September 30, 2016 with represented data1

(In €m)

Sept 30, 2016published

IFRIC 12Adjustment

(2)

IFRS 5Adjustment

(5)

Sept

30,2016represented

Revenue 17,707.6 0.0 -138.8

17,568.8

EBITDA (a)

2,206.4 151.4 -28.8

2,329.0

Current EBIT (3) 978.8 69.6 -13.1

1,035.3 Operating income 828.4 69.6 -13.1

884.9 Current net income – Group share 421.4

0.5 -9.5

412.4 Gross industrial investments (b)

-902 -84 0

-986 Of which change in concession WCR

0 -80 0

-80 Interest on operating assets - IFRIC

12 (c)

0.0 -67.3 0.0

-67.3 Net free cash

flow (4) 3 0 -28

-25 Net financial

debt -8,883 0 0

-8,883

(1) Unaudited figures

(2) See below

(3) Including the represented share of current net income of

joint ventures and associates for the nine months ended September

30, 2016.

(4) The IFRIC 12 adjustment has no impact on net Free Cash Flow

(a)+(b)+(c)=0)

(5) In order to ensure the comparability of periods, the

accounts for the nine months ended September 30, 2016 have been

adjusted for the reclassification of the Group's activities in

Lithuania to "Net income (loss) from discontinued operations"

pursuant to IFRS 5

IFRIC 12

In the income statement, the adjustments resulting from this

clarification drive an increase in EBITDA and Current EBIT. In

effect, the concession fee formerly accounted for as a charge is

eliminated and then reallocated between interest expense and

repayment of the recognized debt. At the same time, a depreciation

charge for the asset is recognized and then deferred taxes are

adjusted accordingly.

On the balance sheet, the liability related to the fixed

payments is classified within concession liabilities and broken

down between current and non-current liabilities according to

maturity. The liability balance relating to the adjustments is

greater than the corresponding net asset value: in effect, the

asset depreciation rate is linear, while the reimbursement rate is

progressive ("constant annuity formula,” with reduction in the

interest portion in favor of the principal repayment).

The increase in EBITDA resulting from the application of the

clarification is offset by the liability repayment (classified in

CAPEX) and interest payments. As a result, these adjustments have

no impact on net free cash flow or net financial debt.

1 At constant exchange rates.At current consolidation scope and

exchange rates: revenue up 3.7%, EBITDA up 1.3%, current EBIT up

1.3%, and current net income-group share was down 1.6%, though up

3.3% excluding capital gains.

2 Construction activities encompass the activities of Veolia

Water Technologies, SADE and Sede.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171106006378/en/

Group Media RelationsLaurent ObadiaSandrine GuendoulTél :

+ 33 (0)1 85 57 42 16sandrine.guendoul@veolia.comorInvestor

& Analyst RelationsRonald Wasylec - Ariane de LamazeTel. :

+ 33 (0)1 85 57 84 76 / 84 80Terri Anne Powers (USA)Tel. : + 1 630

218 1627

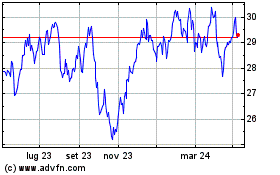

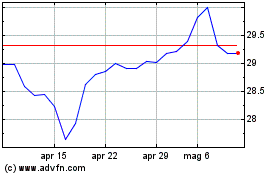

Grafico Azioni Veolia Environnement (EU:VIE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Veolia Environnement (EU:VIE)

Storico

Da Apr 2023 a Apr 2024