Total Expands Natural Gas Business with $2 Billion Deal

08 Novembre 2017 - 9:21PM

Dow Jones News

By Sarah Kent

French oil company buys Engie's gas unit, expands footprint in

fast-growing market

Oil giant Total SA has agreed to buy French utility Engie SA's

liquefied-natural gas business for as much as $2 billion in a deal

that would eventually make it the second-largest LNG player among

Western energy firms.

The acquisition is a down payment on Total's strategic bet that

lower-carbon natural gas will replace coal and play a central role

in future power supply. More than any other major oil company,

Total has identified the power sector as a hedge against oil's

eventual decline and has been building a business around that

strategy.

"We think gas-to-power will become one of the main sources of

power in the future," Chief Executive Patrick Pouyanné said in an

interview. "This deal for us is perfectly in line with the strategy

we have described to expand along the gas-value chain."

LNG is gas that is super-chilled to the point that it becomes a

liquid, allowing it to be shipped around the world on tankers, much

like oil.

Total said it would pay $1.49 billion to acquire Engie's

interests in liquefaction plants in the U.S. and Egypt. The deal

also includes LNG import capacity in Europe, a fleet of 10 LNG

tankers and a portfolio of long-term sales and purchase agreements.

The deal may be subject to a further payment of $550 million if oil

markets improve in the coming years.

The deal will catapult Total into the upper ranks in the LNG

market with a market share of 10% by the end of the decade. By

2020, Total's LNG position among the big Western oil companies will

be second only to Royal Dutch Shell PLC, which made a massive bet

on natural gas in 2016 with its roughly $50 billion purchase of BG

Group. Total's new clout and access to export and import

infrastructure will give the company a competitive edge in the

expanding market, Mr. Pouyanne said.

The LNG business is growing at a rate of 5% to 6% a year,

attracting a range of new players and fueling competition for

access to customers and infrastructure capacity.

A wave of new LNG projects has pumped enough gas to send prices

lower in recent years to levels at which it is hard to make a

profit and left companies scrambling to open up new markets. Still,

the industry is betting that LNG will ride a wave of demand sparked

by efforts to shift away from coal to cleaner energy sources.

Total has set up a new division to focus on gas, renewables and

power. It bought a Belgian utility and a French battery storage

company last year. And it owns a majority stake in U.S. solar-power

provider SunPower, an investment that has struggled.

The acquisition caps a mini buying spree for Total as the

company made good on its promise to take advantage of opportunities

created by the low oil price. In August, the company shelled out

nearly $5 billion to acquire Danish conglomerate A.P.

Moeller-Maersk's oil business, extending its position in oil fields

in the North Sea.

"There's no need to do more," Mr. Pouyanné said. "Clearly for us

next year will be the year to consolidate."

The deal is expected to close in the middle of 2018.

Write to Sarah Kent at sarah.kent@wsj.com

(END) Dow Jones Newswires

November 08, 2017 15:06 ET (20:06 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

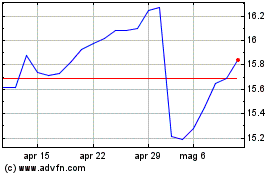

Grafico Azioni Engie (EU:ENGI)

Storico

Da Mar 2024 a Apr 2024

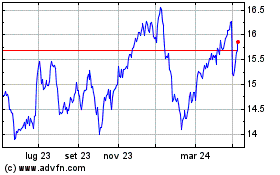

Grafico Azioni Engie (EU:ENGI)

Storico

Da Apr 2023 a Apr 2024