By Liza Lin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 11, 2017).

Millions of Chinese consumers will be glued to their smartphones

Saturday, buying shoes, clothes, cosmetics and more in an annual

shopping extravaganza known as Singles Day.

Yujing Liu won't be one of them.

"Singles Day really turns me off," says Ms. Liu, a professional

translator in Beijing.

The 26-year-old has been bombarded in recent weeks with text

messages on her phone and pop-up ads on her computer screen

imploring her to place advance orders. "There is too much

advertising, and deliveries are slow, " she says. "If there's

anything I need, I make sure I buy it two to three weeks before the

day."

Singles Day, which derives its name from the date Nov. 11, or

11/11, was originally conceived as a day for China's legions of

unmarried young adults to celebrate their lack of attachments.

The day was unremarkable until 2009, when e-commerce giant

Alibaba Group Holding Ltd. turned Singles Day into an online

shopping event. It has since become the marquee event for the

Chinese retail platform and a hallmark of the country's shopping

calendar, setting new sales records each year. Last year, Alibaba

said sales hit $17.8 billion, topping the $12.8 billion American

consumers spent on the four days after Thanksgiving.

To reach new records each year, Alibaba has had to add new

incentives, including pushing preorders, marketing games and

creating fresh promotions.

But almost a decade in, Singles Day is starting to lose its

cachet, according to a survey by marketing data firm AdMaster. Less

than 65% of the consumers polled said they would participate in

this year's Singles Day, versus 84% in 2015.

One reason: With everyone rushing to buy, deliveries after

Singles Day can be slow, the survey found. Competing shopping

festivals, including rival JD.com Inc.'s 18-day promotion in June,

have also dimmed its appeal.

"Double 11 used to be special," says James Bay, managing partner

of marketing and branding agency Possible, in Shanghai. "But if

everyday is Christmas, then there is no value to December

25th."

An Alibaba spokesperson said the company has "record engagement"

for Singles Day this year among shoppers and merchants, and its

efforts to blend online shopping with physical stores are a driving

factor.

Even so, Alibaba Chief Executive Daniel Zhang Alibaba

acknowledged last week that the company needs to keep experimenting

with retail technologies to meet customer needs.

The tech company this year is setting up pop-up shops in malls

where customers can try on lipstick in virtual mirrors and then

order straight from a touch screen. Alibaba is also adding virtual

fitting rooms, where consumers can upload photos of themselves and

have clothing items superimposed on their picture.

Brands that sell on Alibaba's Tmall business-to-consumer site,

meanwhile, are involved in their own one-upmanship, offering

live-streaming celebrity endorsements and limited-edition products.

France's L'Oréal SA is testing new vending machines, selling

perfumes and moisturizers, in malls. Buyers scan a product's QR

code and pay with their mobile phone. MAC Cosmetics plans to launch

limited-edition makeup sets, sold exclusively on Tmall.

"The bar has definitely been raised for what you need to do to

attract consumers," said Joe Nora, marketing director at Export

Now, which helps brands including Victoria's Secret with their

China e-commerce strategy. "A static display ad is going to be

overlooked."

Alibaba will kick off Singles Day with a marathon stage show

Saturday in Shanghai, featuring singers Pharrell Williams and

Jessie J and tennis star Maria Sharapova. It will be telecast on

three Chinese television stations and live-streamed on Alibaba's

video service.

When the company reports its final tally at midnight, the U.S.

Securities and Exchange Commission will likely be among those

scrutinizing the numbers.

Alibaba, whose shares trade on the New York Stock Exchange, said

in May 2016 that the SEC was looking into the accounting methods

for its Singles Day figures. The exact nature of the probe isn't

clear, but critics have asserted that merchants selling on Singles

Day have inflated their sales figures.

Alibaba has said it is cooperating with the SEC.

--Xiao Xiao contributed to this article.

Write to Liza Lin at Liza.Lin@wsj.com

(END) Dow Jones Newswires

November 11, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

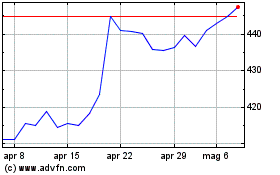

Grafico Azioni LOreal (EU:OR)

Storico

Da Mar 2024 a Apr 2024

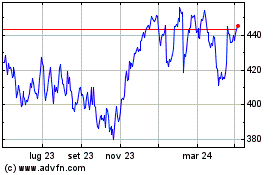

Grafico Azioni LOreal (EU:OR)

Storico

Da Apr 2023 a Apr 2024