Excellent results for Alstom in the first half

2017/18

-

Sales up 5% in line with 2020

objective

-

Adjusted EBIT up 16% at 6.2%

margin from 5.6%

-

Net income up 66% at €213

million

-

Sound cash flow generation at

€227 million

-

2020 objectives

confirmed

14 November

2017 - Between 1 April 2017 and 30 September 2017, Alstom

booked €3.2 billion of orders. Sales, at €3.8 billion were up 5%

organically. The adjusted EBIT increased to €231 million, 16% above

last year, leading to an adjusted EBIT margin of 6.2%. Net income

(Group share) reached €213 million. Alstom benefits from a very

strong balance sheet. During the first half of fiscal year 2017/18,

free cash flow amounted to €227 million.

Key figures

| (in € million) |

Half-year ended

30 September 2016 |

Half-year ended

30 September 2017 |

% change

reported |

% change

organic |

| Actual figures |

|

|

|

|

|

| Orders backlog[1] |

33,491 |

32,741 |

(2)% |

0% |

|

| Orders received |

6,212 |

3,170 |

(49)% |

(49)% |

|

| Sales |

3,570 |

3,756 |

5% |

5% |

|

| Adjusted EBIT |

200 |

231 |

16% |

|

|

| Adjusted EBIT margin |

5.6% |

6.2% |

|

|

|

| Net income - Group share |

128 |

213 |

|

|

|

| Free cash flow |

333 |

227 |

|

|

|

"These six first

months were marked by the good execution of our various projects as

shown by solid operational results in line with our 2020

objectives. Systems sales have strongly

increased, supported by the progress of Dubai and Riyadh metros

projects. The construction of South Africa and India factories

continues. Our innovation capacity is highlighted by the first

commercial success for the Coradia iLint, the world's first

hydrogen train. These excellent results

demonstrate the success of Alstom's strategy in a growing market

and represent a significant step towards our 2020 objectives.

Furthermore, the combination of Alstom with

Siemens' railway activities brings together two innovative players

in the mobility market with more unique customer value and

operational potential. At this stage discussions with employee

representative bodies are ongoing and the deal implementation teams

are operational," said Henri

Poupart-Lafarge, Alstom Chairman and Chief Executive Officer.

***

2020 strategy on track

Alstom 2020 strategy is based on

the five following pillars:

-

Customer-focused

organisation

The Group booked €3,170 million

orders in the first half of fiscal year 2017/18. This compares to

€6,212 million over the same period last year which included

several large projects such as the new generation of high-speed

trains with Amtrak in the USA and the extension of Dubai Metro's

Red line with RTA in United Arabic Emirates.

This semester, Alstom signed

contracts in all regions, including two

contracts in Canada for almost 100 light rail vehicles, a first

metro system contract in Vietnam, a metro system contract in Philippines,

contracts for regional trains in Italy,

Senegal and Germany, a maintenance contract in Sweden, as well

as a fleet modernisation project in

the USA.

At €32.7

billion on 30 September 2017, current backlog provides strong

visibility on future sales.

-

Complete range of

solutions

In the first half of fiscal year

2017/18, Alstom's total sales reached €3,756 million, up 5% (5%

organically).

Signalling, systems and services

represented 57% of sales in the first half of 2017/18, in line with

2020 objective of 60%. Systems sales increased by almost 60% with

progress of Riyadh and Dubai metro systems. Signalling and Services

sales slightly decreased due to an adverse forex impact in the

United Kingdom as well as the ramp down of some projects. Rolling

stock sales remained stable at €1.6 billon with deliveries of

regional and high-speed trains in Europe, the beginning of the

Amtrak project in the USA, on-going execution of the PRASA project

in South Africa and tramway deliveries in Algeria.

-

Value creation through

innovation

Alstom sustained its level of

research and development (gross costs) at €101 million, i.e. 2.7%

of sales, in first half of fiscal year 2017/18. Main programmes

included the renewal of rolling stock ranges, signalling, and

predictive maintenance. In April 2017, Alstom launched several

smart mobility technologies to address the evolving needs of both

operators and passengers, such as Mastria, the first multimodal

supervision solution. Alstom and Airbus also signed a strategic

cooperation agreement in the field of cybersecurity. More recently,

Alstom and NTL received the Innovation label at Busworld exhibition

in Belgium for Aptis, their new mobility experience.

-

Operational and environmental

excellence

Alstom delivered an adjusted EBIT

of €231 million in first half of 2017/18, compared to €200 million

the previous year, representing a 16% increase. The adjusted EBIT

margin reached 6.2%, versus 5.6% for last fiscal year. This

continuous improvement was driven by volume increase and on-going

initiatives for operational excellence. Net income (Group share)

reached €213 million.

In September 2017, Alstom improved

its score in the Dow Jones Sustainability World and Europe indices

with an overall score of 80 out of 100 in the DJSI ranking, which

represents a two points improvement compared to previous year.

Finally, in October 2017, Alstom scores B at CDP's climate change

questionnaire.

-

Diverse and entrepreneurial

people

To reflect Alstom's passenger

base, the company has the ambition to increase diversity. Alstom's

employees around the world all share the same culture, underpinned

by strong integrity and ethics values. In June 2017, Alstom

obtained ISO 37001 certification for its anti-bribery management

system, confirming its commitment to fight corruption.

***

Solid balance

sheet

During the first half of fiscal

year 2017/18, the Group free cash flow was positive at €227

million, benefitting from impacts of the Cash Focus programme and

favourable cash profile of several projects.

Alstom invested €80 million in

capital expenditures in first half 2017/18, compared to €43 million

the previous year. As end of September 2017, the cumulated

transformation capex stood at €100 million, out of €300 million,

with notably the progress in sites' construction in South Africa

and in India.

Alstom net debt amounted to €101

million on 30 September 2017, compared to €208 million on 31 March

2017. Last, equity reached €3,787 million at 30 September 2017,

versus €3,713 million at 31 March 2017.

***

Creation of a global

leader in Mobility

On 26 September 2017, Siemens and

Alstom signed a Memorandum of Understanding to combine Siemens'

mobility business including its rail traction drives business with

Alstom. The transaction brings together two innovative players of

the railway market with unique customer value and operational

potential. The two businesses are largely complementary in terms of

activities and geographies.

***

Governance

As per the announcement of 26

September 2017, the French State did not exercise the call options

on Alstom shares held by Bouygues and restituted them on 17 October

2017. According to declaration published by the AMF (the French financial markets authority) on 25

October 2017, Bouygues holds 62,086,226 shares and 65,347,092

voting rights i.e. 28.15% of the capital and 28.95% of the voting

rights of the Company. In this context, Pascal Faure has presented

his resignation from his mandate as Director at Alstom. As a

consequence, the Board of Directors of Alstom is now comprised of

13 Directors of which 6 women (46%) and 7 independent Directors

(54%).

***

Objectives for 2020

confirmed

By 2020 sales should grow

organically by 5% per year.

Adjusted EBIT margin should reach around 7% by 2020 driven by

volume, portfolio mix and results of operational excellence

actions.

By 2020, Alstom expects c. 100% conversion from net income into

free cash flow.

*

The half-year

financial report, as approved by the Board of Directors, in its

meeting held on 13 November 2017, is available on Alstom's website

at www.alstom.com. The accounts have been

reviewed by the auditors.

About

Alstom

As a promoter of sustainable mobility, Alstom

develops and markets systems, equipment and services for the

transport sector. Alstom offers a complete range of solutions (from

high-speed trains to metros, tramways and e-buses), passenger

solutions, customised services (maintenance, modernisation),

infrastructure, signalling and digital mobility solutions. Alstom

is a world leader in integrated transport systems. The company

recorded sales of €7.3 billion and booked €10.0 billion of orders

in the 2016/17 fiscal year. Headquartered in France, Alstom is

present in over 60 countries and employs 32,800

people.

www.alstom.com

Press

contacts

Justine Rohée - Tel. + 33 1 57 06 18 81

justine.rohee@alstomgroup.com

Christopher English - Tel. + 33 1 57

06 36 90

christopher.a.english@alstomgroup.com

Investor

relations

Selma Bekhechi - Tel. + 33 1 57 06 95 39

selma.bekhechi@alstomgroup.com

Julien Minot - Tel. + 33 1 57 06

64 84

julien.minot@alstomgroup.com

This press

release contains forward-looking statements which are based on

current plans and forecasts of Alstom's management. Such

forward-looking statements are relevant to the current scope of

activity and are by their nature subject to a number of important

risks and uncertainty factors (such as those described in the

documents filed by Alstom with the French AMF) that could cause

actual results to differ from the plans, objectives and

expectations expressed in such forward-looking statements. These

such forward-looking statements speak only as of the date on which

they are made, and Alstom undertakes no obligation to update or

revise any of them, whether as a result of new information, future

events or otherwise.

Appendix 1a -

Geographic Breakdown

| Actual figures |

H1 2016/17 |

% |

H1 2017/18 |

% |

| (in € million) |

|

Contrib. |

|

Contrib. |

| Europe |

2,124 |

35% |

1,535 |

48% |

| Americas |

2,570 |

41% |

907 |

29% |

| Asia / Pacific |

267 |

4% |

544 |

17% |

| Middle East / Africa |

1,251 |

20% |

184 |

6% |

| Orders by destination |

6,212 |

100% |

3,170 |

100% |

| Actual figures |

H1 2016/17 |

% |

H1 2017/18 |

% |

| (in € million) |

|

Contrib. |

|

Contrib. |

| Europe |

2,121 |

59% |

1,917 |

51% |

| Americas |

577 |

16% |

727 |

19% |

| Asia / Pacific |

343 |

10% |

429 |

12% |

| Middle East / Africa |

529 |

15% |

683 |

18% |

| Sales by destination |

3,570 |

100% |

3,756 |

100% |

Appendix 1b -

Product Breakdown

| Actual figures |

H1 2016/17 |

% |

H1 2017/18 |

% |

| (in € million) |

|

Contrib. |

|

Contrib. |

| Rolling stock |

2,971 |

48% |

1,330 |

42% |

| Services |

1,596 |

26% |

992 |

31% |

| Systems |

1,268 |

20% |

406 |

13% |

| Signalling |

377 |

6% |

442 |

14% |

| Orders by destination |

6,212 |

100% |

3,170 |

100% |

| Actual figures |

H1 2016/17 |

% |

H1 2017/18 |

% |

| (in € million) |

|

Contrib. |

|

Contrib. |

| Rolling stock |

1,641 |

46% |

1,641 |

43% |

| Services |

742 |

21% |

696 |

19% |

| Systems |

515 |

14% |

819 |

22% |

| Signalling |

672 |

19% |

600 |

16% |

| Sales by destination |

3,570 |

100% |

3,756 |

100% |

Appendix 2 -

Income statement

| Actual figures |

H1 2016/17 |

H1 2017/18 |

| (in € million) |

|

|

| Sales |

3,570 |

3,756 |

| Adjusted Earnings Before Interest and Taxes

(aEBIT) |

200 |

231 |

| Restructuring charges |

- |

(19) |

| Other charges |

(32) |

(18) |

| Earnings Before Interest and Taxes (EBIT) |

168 |

194 |

| Financial

result |

(71) |

(51) |

| Tax

result |

(32) |

(40) |

| Share in

net income of equity investees |

47 |

110 |

| Minority

interests from continued operations |

(8) |

(8) |

| Net income

- Discontinued operations* |

24 |

8 |

| Net income - Group share |

128 |

213 |

*Group share

Appendix 3 - Free

cash flow

| Actual figures |

H1 2016/17 |

H1 2017/18 |

| (in € million) |

|

|

| Adjusted EBIT |

200 |

231 |

| Depreciation and amortisation |

69 |

93 |

| Restructuring cash-out |

(18) |

(18) |

| Capital

expenditure |

(43) |

(80) |

| R&D

capitalisation |

(21) |

(23) |

| Change in

working capital |

188 |

53 |

| Financial

cash-out |

(11) |

(19) |

| Tax

cash-out |

(40) |

(46) |

| Other* |

9 |

36 |

| Free cash flow |

333 |

227 |

*includes free cash flow from

discontinued operations

Appendix 4 -

Non-GAAP financial indicators definitions

This section presents financial indicators used by the Group that

are not defined by accounting standard setters.

Orders received

A new order is recognised as an order received only when the

contract creates enforceable obligations between the Group and its

customer.

When this condition is met, the order is recognised at the contract

value.

If the contract is denominated in a currency other than the

functional currency of the reporting unit, the Group requires the

immediate elimination of currency exposure through the use of

forward currency sales. Orders are then measured using the spot

rate at inception of hedging instruments.

Order backlog

Order backlog represents sales not yet recognised on orders already

received.

Order backlog at the end of a financial year is computed as

follows:

-

order backlog at the beginning of the

year;

-

plus new orders received during the year;

-

less cancellations of orders recorded during the

year;

-

less sales recognised during the year.

The order backlog is also subject

to changes in the scope of consolidation, contract price

adjustments and foreign currency translation effects.

Book-to-Bill

The book-to-bill ratio is the ratio of orders received to the

amount of sales traded for a specific period.

Adjusted EBIT

When Alstom's new organisation was implemented, adjusted EBIT

("aEBIT") became the key performance indicator to present the level

of recurring operational performance. This indicator is also

aligned with market practice and comparable to direct

competitors.

aEBIT corresponds to earning before interests, tax and net result

from equity method investments adjusted with the following

elements:

-

net restructuring expenses (including

rationalisation costs);

-

tangibles and intangibles impairment;

-

capital gains or loss/revaluation on investments

disposals or controls changes of an entity;

-

and any other non-recurring items, such as some

costs incurred to realise business combinations and amortisation of

an asset exclusively valued in the context of business combination

as well as litigation costs that have arisen outside the ordinary

course of business.

A non-recurring item is a

"one-off" exceptional item that is not supposed to be reappearing

in following years and that is significant.

Adjusted EBIT margin corresponds to Adjusted EBIT in percentage of

sales.

The non-GAAP measure adjusted EBIT indicator reconciles with the

GAAP measure EBIT as follows:

| |

Half-year ended |

Half-year ended |

| (in € million) |

30 Sept. 2016 |

30 Sept. 2017 |

| Adjusted Earnings Before Interest and Taxes

(aEBIT) |

200 |

231 |

| Restructuring costs |

- |

(19) |

| Assets impairment |

- |

- |

| PPA amortisation and integration costs |

(24) |

(12) |

| Capital gains/losses on disposal of business |

(1) |

- |

| Others |

(7) |

(6) |

| Earnings Before Interest and Taxes (EBIT) |

168 |

194 |

Free cash flow

Free cash flow is defined as net cash provided by operating

activities less capital expenditures including capitalised

development costs, net of proceeds from disposals of tangible and

intangible assets. In particular, free cash flow does not include

the proceeds from disposals of activity.

The most directly comparable financial measure to free cash flow

calculated and presented in accordance with IFRS is net cash

provided by operating activities.

A reconciliation of free cash flow and net cash provided by

operating activities is presented below:

| |

Half-year ended |

Half-year ended |

| (in € million) |

30 Sept. 2016 |

30 Sept. 2017 |

| Net cash provided by / (used in) operating

activities |

396 |

329 |

| Capital expenditure (including capitalised R&D

costs) |

(64) |

(103) |

| Proceeds from disposals of tangible and intangible

assets |

1 |

1 |

| Free cash flow |

333 |

227 |

Alstom uses the free cash flow

both for internal analysis purposes as well as for external

communication as the Group believes it provides accurate insight

regarding the actual amount of cash generated or used by

operations.

Net cash/(debt)

The net cash/(debt) is defined as cash and cash equivalents, other

current financial assets and non-current financial assets directly

associated to liabilities included in financial debt, less

financial debt.

| |

Year ended |

Half-year ended |

| (in € million) |

31 March 2017 |

30 Sept. 2017 |

| Cash and cash equivalents |

1,563 |

1,643 |

| Other current financial assets |

8 |

15 |

| Financial non-current assets directly associated to

financial debt |

260 |

241 |

| Less: |

|

|

| Current financial debt |

444 |

468 |

| Non-current financial debt |

1,595 |

1,532 |

| Net cash/(debt) at the end of the period |

(208) |

(101) |

Organic basis

Figures given on an organic basis eliminate the impact of changes

in scope of consolidation and changes resulting from the

translation of the accounts into Euro following the variation of

foreign currencies against the Euro. The Group uses figures

prepared on an organic basis both for internal analysis and for

external communication, as it believes they provide means to

analyse and explain variations from one period to another. However

these figures are not measurements of performance under IFRS.

[1] September

16 backlog has been restated from the contribution of staggered

entities

2017-11-14 PR H1

2017-18.pdf

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: ALSTOM SA via Globenewswire

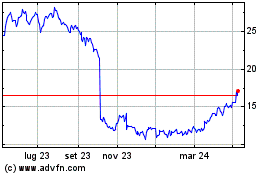

Grafico Azioni Alstom (EU:ALO)

Storico

Da Mar 2024 a Apr 2024

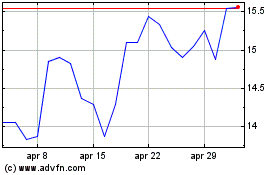

Grafico Azioni Alstom (EU:ALO)

Storico

Da Apr 2023 a Apr 2024