Glencore Probed for Bribery in Congo

20 Novembre 2017 - 5:05PM

Dow Jones News

By Scott Patterson

LONDON-- Glencore PLC's copper operations in the Democratic

Republic of Congo face scrutiny from Canadian regulators over

financial statements and disclosures related to international

bribery and anticorruption laws, the company said Monday.

Canada's Ontario Securities Commission, or OSC, the country's

biggest regional securities regulator, is also investigating the

governance practices of Glencore copper subsidiary Katanga Mining

and the related conduct of certain directors and officers, the

company said. Katanga is listed in Toronto and owned by Glencore,

the Swiss commodity giant.

Three Katanga directors, including Glencore's billionaire copper

chief, Aristotelis Mistakidis, are stepping down from its board

following an internal review that found "material weaknesses" in

the company's controls over financial reporting, Glencore said.

Glencore nominated three new directors to the board, including

its Chief Financial Officer Steven Kalmin. Katanga's CFO, Jacques

Lubbe, resigned, Katanga said. Glencore, in a separate statement

Monday, said it plans to implement "various structural and control

changes" across its copper department.

Monday's disclosures reveal a chaotic situation at the giant

Congolese copper mine, which Glencore first invested in 2008, as it

ramped up operations. Recurring spills, power outages and plant

modifications from 2010 to 2013 resulted in the inadvertent dumping

of a large amount of copper into a nearby waste dam.

Glencore suspended operations at Katanga in 2015 to revamp its

infrastructure and boost production.

The Wall Street Journal reported in July that Glencore is

subject to an investigation by Canada's OSC regarding more than

$100 million in payments Katanga Mining made to a company owned by

an Israeli businessman. An OSC spokeswoman confirmed that the

agency has an active investigation regarding Katanga Mining.

The OSC investigation stems from payments Katanga was expected

to make to Congo's state-run mining company, Gecamines, that were

instead sent to a Caymans Island company owned by the businessman,

Dan Gertler, the Journal reported. Glencore had acknowledged the

shift in payments and said it was done at the request of

Gecamines.

Mr. Gertler was a central figure in a $412 million settlement in

September between the U.S. Justice Department and the Securities

and Exchange Commission with New York hedge fund Och-Ziff Capital

Management Group LLC. The Justice Department said Och-Ziff went

into business with Mr. Gertler despite a consultant's warnings that

he used political connections in Congo to benefit himself and his

associates.

The Justice Department said a business associate of Och-Ziff's,

who people familiar with the matter said is Mr. Gertler, paid more

than $100 million in bribes to Congolese officials, though he

hasn't been charged.

A spokesman for Mr. Gertler's company, Fleurette, has denied

allegations of bribery. Daniel Och, chairman and chief executive of

Och Ziff, has said the firm's conduct scrutinized by the Justice

Department was "inconsistent with our core values."

Glencore in February purchased Mr. Gertler's stake in Katanga

Mining, as well as his stake in another jointly run Congo copper

mine, for nearly $1 billion including debt.

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

November 20, 2017 10:50 ET (15:50 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

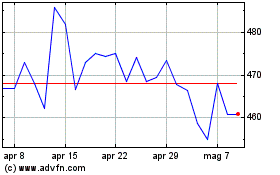

Grafico Azioni Glencore (LSE:GLEN)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Glencore (LSE:GLEN)

Storico

Da Apr 2023 a Apr 2024