Pound Falls Despite Upbeat U.K. Inflation Data

12 Dicembre 2017 - 7:12AM

RTTF2

The pound dropped against its major rivals in the European

session on Tuesday, even as UK inflation accelerated to a more than

five year high in November.

Data from the Office for National Statistics showed that

inflation rose unexpectedly to 3.1 percent in November from 3

percent in October. Inflation was last higher in March 2012. The

rate was expected to remain at 3 percent.

On a monthly basis, consumer prices rose 0.3 percent, slightly

faster than the expected 0.2 percent increase.

Inflation, based on the consumer prices index including owner

occupiers' housing costs, held steady at 2.8 percent in

November.

Likewise, core inflation that excludes volatile energy, food,

alcoholic beverages and tobacco, remained unchanged at 2.7

percent.

Another report from ONS showed that output price inflation

climbed to 3 percent in November from 2.8 percent in October.

Similarly, monthly increase moved up to 0.3 percent from 0.2

percent.

At the same time, input price inflation surged to 7.3 percent on

a yearly basis from 4.8 percent a month ago. Month-on-month, input

prices gained 1.8 percent following October's 1 percent rise

Meanwhile, European stocks rose as a two-day meeting of the U.S.

Federal Reserve gets underway later today, with investors expecting

the U.S. central bank to hike rates by 25 basis points and maintain

expectations of three hikes in 2018.

Other major central banks, including the European Central Bank,

Bank of England and the Swiss National Bank will announce their

policy decisions on Thursday.

The currency showed mixed trading in the Asian session. While it

held steady against the greenback and the euro, it rose against the

franc. Against the yen, the currency fell.

The pound dropped to an 8-day low of 1.3178 against the franc,

from a high of 1.3253 hit at 3:15 am ET. The next possible support

for the pound is seen around the 1.30 level.

The pound weakened to a 5-day low of 0.8846 against the euro,

after having advanced to 0.8806 soon after the release of the data.

The pound is seen finding support around the 0.90 region.

Survey data from the Mannheim-based think tank ZEW showed that

Germany's economic sentiment weakened in December.

The ZEW Indicator of Economic Sentiment fell 1.3 points to 17.4

in December. The indicator remained below its long-term average of

23.7 and the expected level of 17.6.

The pound slid to a 2-week low of 1.3311 against the greenback,

following an advance to 1.3380 in the immediate aftermath of the

data. Continuation of the pound's downtrend may see it challenging

support around the 1.31 area.

The U.K. currency declined to a 5-day low of 151.03 versus the

Japanese yen, from a high of 151.76 hit quickly upon the release of

the data. Further downtrend may take the pound to a support around

the 153.00 level.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's tertiary activity index increased at a

faster-than-expected pace in October, after falling in the previous

two months.

The tertiary activity index climbed 0.3 percent month-over-month

in October, reversing a 0.2 percent decrease in September.

Economists had expected a 0.2 percent rise for the month.

Looking ahead, U.S. producer prices and monthly budget statement

for November are due in the New York session.

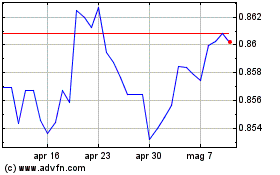

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Mar 2024 a Apr 2024

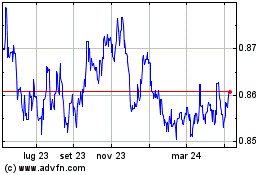

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Apr 2023 a Apr 2024