Pound Retreats As UK Construction Activity Growth Eases

03 Gennaio 2018 - 6:44AM

RTTF2

The pound retreated from its early highs against its major

opponents in early European deals on Wednesday, after a data showed

that U.K. construction activity grew at a slower pace in

December.

Survey results from IHS Markit showed that U.K. construction PMI

fell more-than-expected to 52.2 in December from 53.1 in November.

The expected score was 53.0.

Nonetheless, the indicator remained above the 50.0 no change

threshold for the third successive month.

Investors await the latest FOMC meeting minutes due later in the

day for more direction.

The currency was higher against its major rivals in the Asian

session.

The pound retreated to 1.3582 against the greenback, from a

3-1/2-month high of 1.3613 hit at 1:30 am ET. The pound is seen

finding support around the 1.33 level.

Following a 1-week peak of 1.3231 hit versus the franc at 3:00

am ET, the pound reversed direction with the pair trading at

1.3216. If the pound extends decline, 1.31 is likely seen as its

next support level.

Data from the Federal Labor Agency showed that Germany's

unemployment decreased notably in December.

The number of people out of work declined 29,000 in December

from November. Economists had forecast a decrease of 13,000.

The pound reversed from an early near a 4-week high of 152.83

against the Japanese yen, easing back to 152.51. The next possible

support for the pound is seen around the 151.00 area.

The pound, having advanced to near a 2-week peak of 0.8848

against the euro at 3:05 am ET, reversed direction and eased to

0.8865. On the downside, 0.90 is likely seen as the next support

for the pound.

Looking ahead, U.S. construction spending for November, ISM

manufacturing index for December and FOMC minutes of December 12-13

meeting are set for release in the New York session.

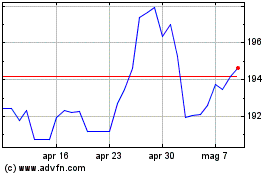

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

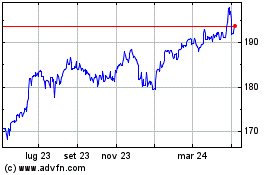

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024