By Carla Mozee, MarketWatch

German data beats forecasts, helps maintain positive investing

mood

European stocks climbed for a fifth session on Tuesday, as

upbeat German economic data and a major strategic move by French

telecoms and cable group Altice NV cheered investors. Equities in

the region stayed around their highest levels since 2015.

What are markets doing: The Stoxx Europe 600 index gained 0.3%

to 399.63. All sectors rose, led by gains for the basic materials,

tech and telecom sectors. On Monday, the index rose 0.3%

(http://www.marketwatch.com/story/european-stocks-stick-to-2-year-highs-despite-german-orders-disappointment-2018-01-08)

and closed at its highest since July 2015, according to FactSet

data.

The pan-European benchmark was on track to pierce the 400 level

for the first time since mid-2015, according to FactSet data.

In Frankfurt on Tuesday, the DAX 30 index added 0.2% to reach

13,394.60, wavering around a two-month high. France's CAC 40 was up

0.5% at 5,515.99.

Spain's IBEX 35 turned higher, rising 0.5% to 10,445.80, and the

U.K.'s FTSE 100 index picked up 0.3% at 7,720.96, on course for a

fresh record close.

The euro traded at $1.1941, lower than $1.1968 late Monday in

New York.

See:European stocks have been a "trendy" trade, but they now

could finally break out

(http://www.marketwatch.com/story/these-stocks-have-been-a-trendy-trade-but-they-now-could-finally-break-out-2018-01-08)

Also check out:These 5 charts are all 'flashing green' for more

U.K. stock records

(http://www.marketwatch.com/story/these-5-charts-are-all-flashing-green-for-more-uk-stock-records-2018-01-08)

What's driving the market: The upbeat sentiment that has lifted

global stocks since the start of the new year still has a grip on

the market. Traders are finding little to derail them from riding

last year's rally higher, focusing on the solid economic outlook

instead.

A batch of German economic data out Tuesday added to that

positive backdrop. German industrial output far outstripped

forecasts with growth of 3.4% in November

(http://www.marketwatch.com/story/german-industrial-output-surprises-with-34-rise-2018-01-09),

suggesting Europe's largest economy may have performed better than

anticipated in 2017.

Fresh figures on German trade also came in stronger than

expected. Germany's statistics office also said the country's

adjusted trade balance stood at 22.3 billion euros ($26.7 billion)

in November.

What strategists are saying

"European markets are trading higher as investors have reacted

to positive German industrial data. The number was simply

astonishing, and it printed the reading of 3.4% when the market was

expecting a number of 1.8%," said Naeem Aslam, chief market analyst

at Think Markets UK, in a note.

"However, the euro-dollar pair is still facing it's inevitable

correction, and this is purely because traders are quick on their

feet to take some profit off the table" after the pair recently hit

$1.2083, he said. "The strong rebound in the dollar may keep the

pressure on the euro for a while, but we are not expecting any

major selloff."

Stock movers: Altice shares (ATC.AE) popped up 5.1%, paring an

intraday gain of 10%, after the company late Monday said it plans

to spin off its controlling stake in its U.S. arm

(http://www.marketwatch.com/story/altice-to-spin-off-controlling-stake-in-us-arm-2018-01-09)

as part of a broader reorganization. Altice will split the company

in two: Altice Europe, which would include its international

holdings, and Altice USA Inc.

"At the core of our strategy is the operational and financial

turnaround in France and Portugal," said Altice in a statement.

Wm. Morrison Supermarkets PLC shares (MRW.LN) climbed 3% as the

company said like-for-like sales, excluding fuel, rose 2.8% during

the Christmas period. The company, the first U.K. supermarket

operator to report its trading performance after the Christmas

season, also backed its fiscal 2018 guidance

(http://www.marketwatch.com/story/morrisons-sales-rise-28-at-christmas-2018-01-09).

Among decliners, Steinhoff International Holdings NV fell 6.5%

and French facilities and food services company Sodexo SA (SW.FR)

was down 2.6%.

Salvatore Ferragamo SA shares (SFER.MI) dropped 1.7% after UBS

downgraded the luxury-goods maker to sell from neutral, "on fears

that the pace of like-for-like recovery in 2018 may

disappoint."

Read:Some European banks might suffer as a result of Republican

tax plan

(http://www.marketwatch.com/story/some-european-banks-might-suffer-as-a-result-of-republican-tax-plan-this-expert-says-2018-01-07)

Economic data: France's trade deficit widened to EUR5.7 billion

in November

(http://www.marketwatch.com/story/german-industrial-output-surprises-with-34-rise-2018-01-09)as

exports of energy products and transport equipment fell

sharply.

In November, unemployment in the eurozone was at 8.7%, Eurostat

said Tuesday. The reading met FactSet consensus expectations, and

marked the lowest level since January 2009.

(END) Dow Jones Newswires

January 09, 2018 05:27 ET (10:27 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

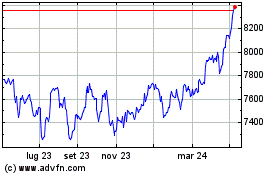

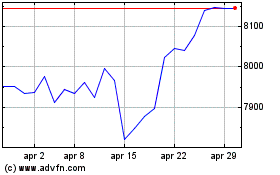

Grafico Indice FTSE 100

Da Mar 2024 a Apr 2024

Grafico Indice FTSE 100

Da Apr 2023 a Apr 2024