EUROPE MARKETS: DAX Drops 1% As European Stock Rally Pauses, But Bank Shares Rise

10 Gennaio 2018 - 1:08PM

Dow Jones News

By Carla Mozee, MarketWatch

European stocks fall to session lows after report that China is

reviewing U.S. bond buying

European stocks fell Wednesday, following a five-day rally that

pushed the market to its highest level in more than two years.

Bucking the trend, shares of banks tracked a rise in U.S. bond

yields.

What are markets doing: The Stoxx Europe 600 index was down 0.5%

at 398.25, with only the financial sector rising, fronted by bank

stocks. The health care and telecom sectors lost the most. On

Tuesday, the benchmark rose 0.4%

(http://www.marketwatch.com/story/european-stocks-rise-for-5th-session-in-a-row-stay-at-highest-since-2015-2018-01-09)

to end at 400.11, a fresh 2 1/2 year high and the first close above

400 since mid-2015.

Germany's DAX 30 index fell 0.7% to 13,287.31, after dropping as

much as 1%. France's CAC 40 turned down by 0.3% to 5,505.83 after

closing on Tuesday at a 10-year high.

The U.K.'s FTSE 100 index little changed at 7,730.27 after

Tuesday's close at an all-time record high.

The euro traded at $1.1997, up from $1.1937 late Tuesday in New

York.

The yield for the 10-year German government bond, or bund, was

up less than 1 basis point to 0.46%, according to Tradeweb. Yields

rise when prices fall.

What's driving the market: Investors took a break from bidding

up European stocks after doing so over the past five sessions, the

market's longest winning streak since early November. Losses for

European benchmarks started to accelerate alongside a drop in U.S.

stock futures following a Bloomberg report that China is

considering halting or slowing purchases of U.S. Treasuries.

(https://www.bloomberg.com/news/articles/2018-01-10/china-officials-are-said-to-view-treasuries-as-less-attractive)

"If the reports turn out to be true and China no longer sees

Treasuries as an attractive option, the repercussions could be

significant as the country is one of the biggest holders of U.S.

debt. A significant change in policy could put considerable upside

pressure on U.S. yields, the result of which would be an effective

tightening for the U.S.," said Craig Erlam, senior market analyst

at Oanda, in a note.

Germany's DAX 30 index fell by more than 1% during Wednesday's

session. Volkswagen AG (VOW.XE) shares were down 1.5% after they've

charged up more than 7% so far this year. Automotive supplier

Continental AG (CON.XE) fell 2.9% in the wake of the company's

evaluation of a possible strategic revamp

(http://www.marketwatch.com/story/continental-weighs-changes-to-be-more-flexible-2018-01-09).

Its shares have jumped more than 8% in 2018.

But bank stocks outperformed other pockets of the broader market

on Wednesday. The move keyed off gains for bank shares on Wall

Street on Tuesday as the U.S. 10-year yield rose above 2.5% for the

first time since March 2017

(http://www.marketwatch.com/story/treasury-yields-rise-as-bank-of-japan-cuts-bond-buying-2018-01-09),

gaining after the Bank of Japan reduced its bond purchases amid

speculation the central bank would signal an end to years of

ultra-accommodative monetary policy.

Higher long-term yields can help lift profit at banks. The Stoxx

Europe 600 Bank Index leapt 1.3%, headed toward its highest since

November 2015, according to FactSet data.

See:European stocks have been a "trendy" trade, but they now

could finally break out

(http://www.marketwatch.com/story/these-stocks-have-been-a-trendy-trade-but-they-now-could-finally-break-out-2018-01-08)

Also check out:These 5 charts are all 'flashing green' for more

U.K. stock records

(http://www.marketwatch.com/story/these-5-charts-are-all-flashing-green-for-more-uk-stock-records-2018-01-08)

Stock movers: Bank stocks were among top gainers on the Stoxx

600, with Commerzbank AG (DBK.XE) up by 3.5%, U.K.'s Metro Bank PLC

(MTRO.LN) rising 3.9% and Spain's Banco Sabadell SA (SAB.MC)

tacking on 2.1%. Deutsche Bank AG (DBK.XE) gained 1.7%.

Tele2 AB shares (TEL2-B.SK) dropped 5.2% after the Swedish

telecom operator said it's buying pay-television company Com Hem

Holding AB

(http://www.marketwatch.com/story/tele2-to-buy-swedish-pay-tv-operator-com-hem-2018-01-10)(COMH.SK)

. Com Hem shares climbed 6.3%.

Taylor Wimpey PLC (TW.LN) said its 2017 results should meet

analyst expectations as home completions increased, but investors

sent shares down 3.6%. The U.K. home builder said it plans on

returning about GBP500 million ($677 million) in dividends

(http://www.marketwatch.com/story/taylor-wimpey-to-return-500-mln-to-shareholders-2018-01-10)

to shareholders in 2018.

Economic data: French industrial production fell 0.5% in

November

(http://www.marketwatch.com/story/french-industrial-production-falls-as-seen-2018-01-10),

as a slowdown in manufacturing output outweighed rising energy

production, national statistics agency Insee.

U.K. manufacturing output rose 0.4% in November

(http://www.marketwatch.com/story/uk-manufacturing-grows-for-7th-month-in-a-row-2018-01-10),

the Office for National Statistics said, a sign that British

producers are benefiting from the pound's weakness and strong

global demand. Separately, the U.K. goods trade deficit with the

rest of the world widened slightly in November to GBP12.2 billion

from the revised October figure of GBP11.7 billion.

(END) Dow Jones Newswires

January 10, 2018 06:53 ET (11:53 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

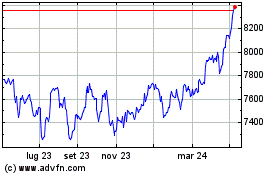

Grafico Indice FTSE 100

Da Mar 2024 a Apr 2024

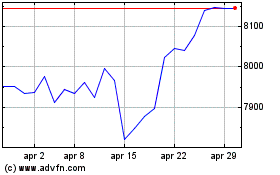

Grafico Indice FTSE 100

Da Apr 2023 a Apr 2024