Celebrity Route Pays Off for Puma -- WSJ

13 Gennaio 2018 - 9:02AM

Dow Jones News

By Sara Germano

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 13, 2018).

To market women's sportswear, industry executives have long

grappled with a perennial debate: Are celebrities or sports stars

more effective endorsers?

In the case of German brand Puma SE, its 2014 decision to sign

pop star Rihanna as a creative director appears to have paid off.

Annual sales have grown from EUR3 billion ($3.6 billion) to nearly

EUR4 billion, the brand has expanded distribution in major

retailers like Foot Locker Inc., and parent company Kering SA on

Thursday announced a plan to distribute 70% of Puma's shares to

Kering shareholders, praising the business's recent turnaround.

In Puma's most recent annual report, the company credited

Rihanna and "the fantastic development of our women's category" as

contributing to a 7% sales jump in 2016.

Puma Chief Executive Bjorn Gulden said fundamental differences

between how men and women buy sportswear led to the company's

decision to enlist Rihanna, a move that at the time was criticized

by industry analysts as a marketing ploy.

"It's unfortunately very difficult to find a female athlete that

means something in China, in Norway, in the U.S., and in Germany.

If you do, it's coming from someone in entertainment," the Norway

native said. "On the men's side, it's very different. You can

probably name 10 basketball players who mean something all over the

world, same with soccer."

Puma also outfits a range of prominent athletes, including

members of English soccer club Arsenal and Olympic champion

sprinter Usain Bolt, as well as some female athletes, like U.S.

sprinter Jenna Prandini. But it has expanded its roster of female

celebrities since Rihanna to include reality-television star Kylie

Jenner and singer Selena Gomez.

The celebrity marketing playbook hasn't always been effective

for sports brands. In the early 2000s, Reebok signed rappers Jay-Z

and 50 Cent to help expand its appeal at a time when it was known

for outfitting the National Football League and a shoe contract

with basketball star Allen Iverson. Reebok was acquired by rival

Adidas AG in 2006 and struggled to define its identity, eventually

abandoned its team-sports focus.

Yoga gear maker Lululemon Athletica Inc. ushered in the

"athleisure" era over the past decade with its high-price leggings

and strappy bras, all without splashy celebrity marketing. In a

2016 interview, Chief Executive Laurent Potdevin said the company

takes a decidedly different approach to marketing, using

affiliations with community fitness instructors.

"Those are the local superheros that you know in your

communities and you go to their studios," he said. "So we don't do

endorsements the way big athletic brands do."

To be sure, industry titans Nike Inc. and Adidas have done their

share of celebrity marketing, including partnerships with rappers

Kendrick Lamar and Kanye West, respectively. But they have

traditionally focused their marketing dollars on prominent

athletes, including women like sprinter Allyson Felix and tennis

player Caroline Wozniacki. Puma endorsed tennis star Serena

Williams early in her career, but Nike picked up her contract in

2003.

The big brands still have room to grow their women's businesses,

and have faced competition from upstarts. Nike said it would expand

a line of Jordan footwear for women this spring and partner with

online apparel seller Stitch Fix to better reach female consumers.

Meanwhile, Under Armour Inc. lost the head of its women's business

last fall, and said it would focus on performance gear as it

combats a streak of slowing sales.

Each of the major international sports brands -- Nike, Adidas,

Under Armour, Puma, and Lululemon -- were founded by and are helmed

by men.

Mr. Gulden, who has been Puma's CEO since 2013, said women take

their style cues from a range of sources, not just athletes. "Let's

face it, you women like to look good when you do sports," he said,

"and actually spend more money on the clothes than men do."

Industry tracker NPD Group said women accounted for 62% of

retail athletic-apparel sales in the U.S., for the year ended in

November.

(END) Dow Jones Newswires

January 13, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

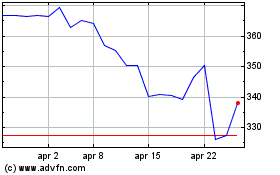

Grafico Azioni Kering (EU:KER)

Storico

Da Mar 2024 a Apr 2024

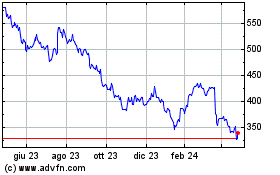

Grafico Azioni Kering (EU:KER)

Storico

Da Apr 2023 a Apr 2024