Form S-1 - General form for registration of securities under the Securities Act of 1933

06 Settembre 2024 - 10:16PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on September 6, 2024

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

WESTWATER RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| |

Delaware

|

|

|

1000

|

|

|

75-2212772

|

|

| |

(State or other jurisdiction

of incorporation or

organization)

|

|

|

(Primary Standard Industrial

Classification Code

Number)

|

|

|

(I.R.S. Employer

Identification Number)

|

|

6950 South Potomac Street, Suite 300

Centennial, Colorado 80112

(303) 531-0516

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Steven M. Cates

Senior Vice President and Chief Financial Officer

Westwater Resources, Inc.

6950 South Potomac Street, Suite 300

Centennial, Colorado 80112

(303) 531-0516

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| |

Amy Bowler, Esq.

Leah Neumann, Esq.

Holland & Hart LLP

555 17th Street, Suite 3200

Denver, Colorado 80202

Telephone: (303) 295-8000

|

|

|

Anthony J. Marsico, Esq.

Reed Smith LLP

599 Lexington Avenue

New York, New York 10022

Telephone: (212) 521-5400

Facsimile: (212) 521-5450

|

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☐

|

|

|

Accelerated filer ☐

|

|

|

Non-accelerated filer ☒

|

|

|

Smaller reporting company ☒

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and the selling stockholder is not soliciting offers to buy these securities in any state or jurisdiction where the offer or sale of these securities is not permitted.

Subject to Completion, Dated September 6, 2024

PRELIMINARY PROSPECTUS

Up to 11,668,189 Shares

Common Stock

This prospectus relates to the sale of 11,668,189 shares of our common stock by Lincoln Park Capital Fund, LLC (“Lincoln Park” or the “selling stockholder”).

The shares of common stock being offered by the selling stockholder have been or may be purchased pursuant to the purchase agreement, dated August 30, 2024, that we entered into with Lincoln Park (the “Purchase Agreement”). See “The Lincoln Park Transaction” for a description of the Purchase Agreement and “Selling Stockholder” for additional information regarding Lincoln Park. The prices at which Lincoln Park may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of shares of common stock by the selling stockholder. We have not yet sold any shares of common stock to Lincoln Park under the Purchase Agreement. Subject to the Exchange Cap (as defined herein), we may receive up to $30.0 million aggregate gross proceeds (subject to certain limitations) under the Purchase Agreement from any sales we make to Lincoln Park pursuant to the Purchase Agreement after the date of this prospectus.

The selling stockholder may sell or otherwise dispose of the shares of common stock described in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution” for more information about how the selling stockholder may sell or otherwise dispose of the shares of common stock being registered pursuant to this prospectus. The selling stockholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended.

The selling stockholder will pay all brokerage fees and commissions and similar expenses. We will pay the expenses (except brokerage fees and commissions and similar expenses) incurred in registering the shares, including legal and accounting fees. See “Plan of Distribution.”

We are a “smaller reporting company” under the federal securities laws and, as such, are subject to reduced public company reporting requirements. See “Implications of Being a Smaller Reporting Company.”

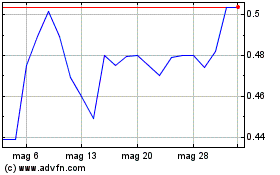

Our common stock is listed on the NYSE American LLC (“NYSE American”) under the symbol “WWR.” On September 5, 2024, the last reported sale price of our common stock on NYSE American was $0.52 per share.

Investing in our securities involves a high degree of risk. You should read “Risk Factors” beginning on page 10 of this prospectus and the reports we file with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, incorporated by reference in this prospectus, to read about factors to consider before purchasing our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

|

Prospectus

|

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

27

|

|

|

ABOUT THIS PROSPECTUS

We have not, and the selling stockholder has not, authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus or any accompanying prospectus supplement or free writing prospectus, and neither we nor the selling stockholder take any responsibility for any other information that others may give you. We and the selling stockholder are offering to sell these securities and seeking offers to buy these securities only in jurisdictions where offers and sales are permitted. This prospectus and any accompanying supplement to this prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate.

You should not assume that the information contained in this prospectus or any prospectus supplement or free writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus relates to the offering of our common stock. Before buying any of our common stock, you should carefully read this prospectus, any supplement to this prospectus, the information and documents incorporated herein by reference and the additional information under the heading “Where You Can Find More Information” and “Information Incorporated by Reference.” These documents contain important information that you should consider when making your investment decision.

References to the “Company,” “Westwater,” “WWR,” “we,” “our” and “us” in this prospectus are to Westwater Resources, Inc. and its consolidated subsidiaries, unless the context otherwise requires. This document includes trade names and trademarks of other companies. All such trade names and trademarks appearing in this document are the property of their respective holders.

DEFINITIONS

When used in this prospectus, the following terms have the meaning indicated unless noted otherwise.

|

Term

|

|

|

Meaning

|

|

|

Annual Report

|

|

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 19, 2024

|

|

|

Board

|

|

|

The Board of Directors of Westwater Resources, Inc.

|

|

|

Coosa Graphite Deposit

|

|

|

The Company’s graphite mineral deposit located near Rockford, Alabama.

|

|

|

CSPG

|

|

|

Coated spherical purified graphite.

|

|

|

Exchange Act

|

|

|

The Securities Exchange Act of 1934, as amended.

|

|

|

graphite

|

|

|

A naturally occurring carbon material with electrical properties that enhance the performance of electrical storage batteries, listed on the U.S. Critical Minerals List and the EU Critical Raw Materials List.

|

|

|

Kellyton Graphite Plant

|

|

|

The Company’s planned battery-grade graphite processing facility near Kellyton, Alabama.

|

|

|

SEC

|

|

|

Securities and Exchange Commission.

|

|

|

Securities Act

|

|

|

The Securities Act of 1933, as amended.

|

|

|

spot price

|

|

|

The price at which a mineral commodity may be purchased for delivery within one year.

|

|

|

vanadium

|

|

|

A rare-earth metal used as a strengthening alloy in steelmaking, and in certain types of batteries, listed on the U.S. Critical Minerals List.

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents we have incorporated by reference contain forward-looking statements.

With the exception of historical matters, the matters discussed in this prospectus are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projections or estimates contained herein. Forward-looking statements convey our current expectations or forecasts of future events. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements include, without limitation, statements regarding the adequacy of funding, liquidity, access to capital, financing activities, the timing or occurrence of any future drilling or production from the Company’s properties, economic conditions, the strategic goals of the business, costs of any phase of development or operational line at the Kellyton Graphite Plant and estimated construction and commissioning timelines and completion dates, the start date for the mining of the Coosa Graphite Deposit, and the Company’s anticipated cash burn rate and capital requirements. Words such as “may,” “could,” “should,” “would,” “believe,” “estimate,” “expect,” “anticipate,” “plan,” “forecast,” “potential,” “intend,” “continue,” “project,” “target” and variations of these words, comparable words and similar expressions generally indicate forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied by these forward-looking statements.

Factors that could cause actual results to differ materially from these forward-looking statements include, among others:

•

the spot price and long-term contract price of graphite (both flake graphite feedstock and purified graphite products) and vanadium, and the world-wide supply and demand of graphite and vanadium;

•

the effects, extent and timing of the entry of additional competition in the markets in which we operate;

•

our ability to obtain and maintain contracts or other agreements with customers;

•

available sources and transportation of graphite feedstock;

•

the ability to control costs and avoid cost and schedule overruns during the development, construction and operation of the Kellyton Graphite Plant;

•

the ability to construct and operate the Kellyton Graphite Plant in accordance with the requirements of permits and licenses and the requirements of tax credits and other incentives;

•

the effects of inflation, including labor shortages and supply chain disruptions;

•

rising interest rates and the associated impact on the availability and cost of financing sources;

•

the availability and supply of equipment and materials needed to construct the Kellyton Graphite Plant;

•

stock price volatility;

•

government regulation of the mining and manufacturing industries in the United States;

•

unanticipated geopolitical, geological, processing, regulatory and legal or other problems we may encounter;

•

the results of our exploration activities, and the possibility that future exploration results may be materially less promising than initial exploration results;

•

any graphite or vanadium discoveries not being in high enough concentration to make it economic to extract the minerals;

•

our ability to finance growth plans;

•

our ability to obtain and maintain rights of ownership or access to our mining properties;

•

currently pending or new litigation or arbitration; and

•

our ability to maintain and timely receive mining, manufacturing, and other permits from regulatory agencies.

In addition, other factors are described in our Annual Report, and the other reports we file with the SEC. You should consider the risks described in the “Risk Factors” section of our most recent Annual Report and, to the extent applicable, our Quarterly Reports on Form 10-Q, in evaluating any forward-looking statements included or incorporated by reference in this prospectus.

Most of these factors are beyond our ability to predict or control. Future events and actual results could differ materially from those set forth herein, contemplated by or underlying the forward-looking statements. Forward-looking statements speak only as of the date on which they are made. We disclaim any obligation to update any forward-looking statements made herein, except as required by law.

In light of these risks, uncertainties and assumptions, you are cautioned not to place undue reliance on forward-looking statements, which are inherently unreliable and speak only as of the date of this prospectus or any document incorporated by reference in this prospectus. When considering forward-looking statements, you should keep in mind the cautionary statements in this prospectus and the documents incorporated by reference in this prospectus. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in or incorporated by reference in this prospectus might not occur.

PROSPECTUS SUMMARY

This summary highlights selected information about Westwater Resources, Inc. and this offering of common stock. This summary does not contain all of the information that may be important to you in making an investment decision. For a more complete understanding of Westwater Resources, Inc. you should read carefully this entire prospectus, including the “Risk Factors” section and the other documents we refer to and incorporate by reference. Unless otherwise indicated, “common stock” means our common stock, par value $0.001 per share.

About Westwater Resources, Inc.

Westwater Resources, Inc., originally incorporated in 1977, is an energy technology company focused on developing battery-grade natural graphite materials through its two primary projects, the Kellyton Graphite Plant and the Coosa Graphite Deposit, both located in Coosa County, Alabama. Westwater expects the Kellyton Graphite Plant to process natural flake graphite and, based on current studies and estimates, produce 12,500 metric tons (“mt”) per year of CSPG in Phase I of the Kellyton Graphite Plant, primarily for use in lithium-ion batteries. Westwater also holds mineral rights to explore and potentially mine the Coosa Graphite Deposit, which Westwater anticipates will eventually provide natural graphite flake concentrate to the Kellyton Graphite Plant.

Our principal executive offices are located at 6950 South Potomac Street, Suite 300, Centennial, Colorado 80112, and our telephone number is (303) 531-0516. Our website is located at www.westwaterresources.net. Information contained on our website or that can be accessed through our website is not incorporated by reference into this prospectus.

For additional information regarding our business, properties and financial condition, please refer to the documents cited in “Where You Can Find More Information.”

The Purchase Agreement with Lincoln Park

On August 30, 2024, we entered into a purchase agreement with Lincoln Park, which we refer to in this prospectus as the Purchase Agreement, pursuant to which Lincoln Park has agreed to purchase from us up to an aggregate of $30,000,000 of our common stock (subject to certain limitations) from time to time over the term of the Purchase Agreement. Also on August 30, 2024, we entered into a registration rights agreement with Lincoln Park, which we refer to in this prospectus as the Registration Rights Agreement. Pursuant to our obligations under the Registration Rights Agreement, we have filed with the Securities and Exchange Commission (the “SEC”) the registration statement that includes this prospectus to register for resale under the Securities Act of 1933, as amended, or the Securities Act, the shares of common stock that have been or may be issued to Lincoln Park under the Purchase Agreement.

This prospectus covers the resale by the selling stockholder of 11,668,189 shares of our common stock, comprised of: (i) 600,000 shares that we issued to Lincoln Park (the “Initial Commitment Shares”); (ii) up to 600,000 shares that we may issue to Lincoln Park from time to time in connection with each purchase of common stock by Lincoln Park (the “Additional Commitment Shares” and together with the Initial Commitment Shares, the “Commitment Shares”), in each case, as consideration for Lincoln Park’s commitment to purchase shares of common stock under the Purchase Agreement, and (iii) 10,468,189 shares we have reserved for issuance and sale and may issue and sell to Lincoln Park in the future under the Purchase Agreement, if and when we sell shares to Lincoln Park under the Purchase Agreement.

We do not have the right to commence any sales of our common stock to Lincoln Park under the Purchase Agreement until all of the conditions set forth in the Purchase Agreement have been satisfied, including that the SEC has declared effective the registration statement that includes this prospectus registering the shares issued and being issued and sold to Lincoln Park, which we refer to in this prospectus as the Commencement. Thereafter, we may, from time to time and at our sole discretion for a period of 24-months, on any business day that we select, direct Lincoln Park to purchase up to 150,000 shares of common stock, which amounts may be increased depending on the market price of our common stock at the time of sale, which we refer to in this prospectus as “regular purchases.” In addition, at our discretion, Lincoln Park

has committed to purchase other “accelerated amounts” and/or “additional accelerated amounts” under certain circumstances.

We will control the timing and amount of any sales of our common stock to Lincoln Park. The purchase price of the shares that may be sold to Lincoln Park in regular purchases under the Purchase Agreement will be based on an agreed upon fixed discount to the market price of our common stock immediately preceding the time of sale as computed under the Purchase Agreement. The purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split or other similar transaction occurring during the business days used to compute such price.

We may at any time in our sole discretion terminate the Purchase Agreement without fee, penalty or cost upon one business day notice. There are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights Agreement, other than a prohibition on us effecting or entering into an agreement to effect an “equity line of credit” or other continuous offering or similar offering in which we or our subsidiaries may offer, issue or sell common stock or any securities exercisable, exchangeable or convertible into common stock at a future determined price, subject to certain exemptions, for a period defined in the Purchase Agreement. Lincoln Park may not assign or transfer its rights and obligations under the Purchase Agreement.

As of September 5, 2024, there were 58,970,133 shares of our common stock outstanding, of which 57,946,110 shares were held by non-affiliates, including the 600,000 Initial Commitment Shares that we have issued to Lincoln Park as the Initial Commitment Shares under the Purchase Agreement. Although the Purchase Agreement provides that we may sell up to an aggregate of $30,000,000 of our common stock to Lincoln Park, only 11,668,189 shares of our common stock are being offered under this prospectus, which represents the 600,000 shares that we have already issued to Lincoln Park as the Initial Commitment Shares under the Purchase Agreement, up to 600,000 shares that we may issue to Lincoln Park as the Additional Commitment Shares under the Purchase Agreement, and the 10,468,189 shares that may be issued and sold to Lincoln Park in the future under the Purchase Agreement, if and when we sell shares to Lincoln Park under the Purchase Agreement. Depending on the market prices of our common stock at the time we elect to issue and sell shares to Lincoln Park under the Purchase Agreement, we may need to register for resale under the Securities Act additional shares of our common stock in order to receive aggregate gross proceeds equal to the $30,000,000 total commitment available to us under the Purchase Agreement. If all of the 11,668,189 shares of our common stock shares offered by Lincoln Park under this prospectus were issued and outstanding as of the date hereof, such shares would represent approximately 16.7% of the total number of shares of our common stock outstanding and approximately 16.9% of the total number of outstanding shares held by non-affiliates, in each case as of the date hereof. If we elect to issue and sell more than the 11,668,189 shares offered under this prospectus to Lincoln Park, which we have the right, but not the obligation, to do, we must first (i) register for resale under the Securities Act any such additional shares, which could cause additional substantial dilution to our stockholders, and (ii) obtain stockholder approval to issue shares of common stock in excess of the Exchange Cap under the Purchase Agreement in accordance with NYSE American rules. The number of shares ultimately offered for resale by Lincoln Park is dependent upon the number of shares we sell to Lincoln Park under the Purchase Agreement.

Under applicable rules of NYSE American, in no event may the Company issue or sell to Lincoln Park under the Purchase Agreement any shares of its common stock to the extent the issuance of such shares of Common Stock, when aggregated with all other shares of common stock issued pursuant to the Purchase Agreement (including the Commitment Shares), would cause the aggregate number of shares of common stock issued pursuant to the Purchase Agreement to exceed 19.99% of the shares of common stock outstanding immediately prior to the execution of this Agreement, or 11,668,189 shares of common stock (the “Exchange Cap”), unless and until the Company obtains stockholder approval to issue shares of common stock in excess of the Exchange Cap or otherwise, and in accordance with applicable NYSE American listing rules. In any event. the Purchase Agreement specifically provides that the Company may not issue or sell any shares of its common stock under the Purchase Agreement if such issuance or sale would breach any applicable NYSE American rules.

The Purchase Agreement also prohibits us from directing Lincoln Park to purchase any shares of common stock if those shares, when aggregated with all other shares of our common stock then beneficially

owned by Lincoln Park and its affiliates, would result in Lincoln Park and its affiliates having beneficial ownership, at any single point in time, of more than 9.99% of the then total outstanding shares of our common stock, as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Rule 13d-3 thereunder, which limitation we refer to as the Beneficial Ownership Cap.

Issuances of our common stock in this offering will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares of common stock that our existing stockholders own will not decrease, the shares owned by our existing stockholders will represent a smaller percentage of our total outstanding shares after any such issuance to Lincoln Park.

Summary of the Offering

The following summary is provided solely for your convenience and is not intended to be complete. It does not contain all the information that is important to you. You should read the full text and more specific details contained elsewhere in this prospectus. For a more complete understanding of the securities being offered by the selling stockholder, please refer to the section of this prospectus titled “Description of Securities.”

Common stock offered by the selling stockholder pursuant to this prospectus

11,668,189 shares consisting of:

•

600,000 Initial Commitment Shares issued to Lincoln Park upon the execution of the Purchase Agreement;

•

up to 600,000 Additional Commitment Shares that may be issued to Lincoln Park; and

•

10,468,189 additional shares that we may sell and issue to Lincoln Park under the Purchase Agreement.

Common stock outstanding(1)

58,970,133 shares of common stock

We will receive no proceeds from the sale of shares of our common stock by Lincoln Park pursuant to this prospectus. We may receive up to $30,000,000 in aggregate gross proceeds under the Purchase Agreement from any sales of shares of our common stock we make to Lincoln Park pursuant to the Purchase Agreement after the Commencement Date. We intend to use any net proceeds that we received under the Purchase Agreement for general corporate purposes, which may include advancing the development of Phase I of the Kellyton Graphite Plant and our graphite business, developing the Coosa Graphite Deposit, and making additions to our working capital. It is possible that no shares will be issued under the Purchase Agreement. See “Use of Proceeds” on page 19 of this prospectus for more information.

Our common stock is listed on NYSE American under the symbol “WWR.”

An investment in our common stock involves risks, and prospective investors should carefully consider the matters discussed under “Risk Factors” beginning on page 10 of this supplement and the reports we file with the SEC pursuant to the Exchange Act, incorporated by reference in this prospectus before making an investment in our common stock.

(1)

The number of shares of common stock is based on 58,970,133 shares outstanding as of September 5, 2024, and excludes, as of September 5, 2024:

•

649,345 shares of common stock issuable upon the exercise of outstanding options;

•

4,117,189 shares of common stock issuable upon the vesting of outstanding restricted stock units;

•

100,003 additional shares of common stock reserved for future issuance under our 2013 Omnibus Incentive Plan, as amended; and

•

114,429 additional shares of common stock reserved for future issuance under our Employment Inducement Incentive Award Plan.

IMPLICATIONS OF BEING A SMALLER-REPORTING COMPANY

We are a smaller reporting company as defined in the Exchange Act. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for so long as (i) the market value of our voting and non-voting common stock held by non-affiliates is less than $250 million measured on the last business day of our second fiscal quarter or (ii) our annual revenue is less than $100 million during the most recently completed fiscal year and the market value of our voting and non-voting common stock held by non-affiliates is less than $700 million measured on the last business day of our second fiscal quarter. Specifically, as a smaller reporting company, we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report and have reduced disclosure obligations regarding executive compensation, and if we are a smaller reporting company with less than $100 million in annual revenue, we would not be required to obtain an attestation report on internal control over financial reporting issued by our independent registered public accounting firm.

RISK FACTORS

An investment in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below, as well as the risks described under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 and in the other filings we make with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we have incorporated herein by reference. The impacts of the contingencies contemplated by these risks could materially adversely affect our business, financial condition or results of operations. The risks described in these documents are not the only ones we face, but those that we consider to be material. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations and financial condition. Please also read carefully the section titled “Cautionary Note Regarding Forward-Looking Statements,” where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this prospectus.

Risks Related to this Offering and Ownership of Our Common Stock

The sale or issuance of our common stock to Lincoln Park may cause dilution and the sale of the shares of common stock acquired by Lincoln Park, or the perception that such sales may occur, could cause the price of our common stock to decrease.

On August 30, 2024, we entered into the Purchase Agreement with Lincoln Park, pursuant to which (i) we issued 600,000 shares to Lincoln Park as the Initial Commitment Shares, (ii) we have reserved and may issue 600,000 additional shares to Lincoln Park as the Additional Commitment Shares, in each case, as consideration for Lincoln Park’s commitment to purchase shares of common stock under the Purchase Agreement, and (iii) Lincoln Park has committed to purchase up to $30,000,000 of our common stock.

The shares of our common stock that may be issued under the Purchase Agreement may be sold by us to Lincoln Park at our discretion from time to time over a 24-month period commencing after the satisfaction of certain conditions set forth in the Purchase Agreement, including that the SEC has declared effective the registration statement that includes this prospectus (such date on which all of such conditions are satisfied, the “Commencement Date”). The purchase price for the shares that we may sell to Lincoln Park under the Purchase Agreement will fluctuate based on the price of our common stock. Depending on market liquidity at the time, sales of such shares may cause the trading price of our common stock to decrease.

We generally have the right to control the timing and amount of any future sales of our shares to Lincoln Park. Additional sales of our common stock, if any, to Lincoln Park will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to Lincoln Park all, some or none of the additional shares of our common stock that may be available for us to sell pursuant to the Purchase Agreement. If and when we do sell additional shares to Lincoln Park, after Lincoln Park has acquired the shares, Lincoln Park may resell all, some or none of those shares at any time or from time to time in its discretion. Therefore, sales to Lincoln Park by us could result in substantial dilution to the interests of other holders of our common stock. Additionally, the sale of a substantial number of shares of our common stock to Lincoln Park, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales.

Further, we are not restricted from issuing additional securities in the future, including our common stock, securities that are convertible into or exchangeable for, or that represent the right to receive, our common stock or substantially similar securities. To the extent that we raise additional funds through the sale of equity or convertible debt securities, the issuance of such securities will result in dilution to our stockholders.

We may require additional financing to sustain our operations, without which we may not be able to continue operations, and the terms of subsequent financings may adversely impact our stockholders.

We may direct Lincoln Park to purchase up to $30,000,000 worth of shares of our common stock under our agreement over a 24-month period in amounts up to 150,000 shares of our common stock, which may be increased depending on the market price of our common stock at the time of sale, and, in each

case, subject to a maximum limit of $1,000,000 per purchase, on any single business day (such share amounts being subject to adjustment for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction as provided in the Purchase Agreement). Assuming a purchase price of $0.52 per share (the closing sale price of the common stock on September 5, 2024) and the purchase by Lincoln Park of 10,468,189 purchase shares, gross proceeds to us would only be $5.4 million.

The extent we rely on Lincoln Park as a source of funding will depend on a number of factors including the prevailing market price of our common stock and the extent to which we are able to secure financing from other sources. If obtaining sufficient financing from Lincoln Park were to prove unavailable or prohibitively dilutive, we may need to secure another source of funding in order to satisfy our financing needs. Even if we sell all $30,000,000 under the Purchase Agreement to Lincoln Park, we may still need additional capital to finance our future working capital needs, and we may have to raise funds through the issuance of equity or debt securities. Depending on the type and the terms of any financing we pursue, stockholders’ rights and the value of their investment in our common stock could be reduced. A financing could involve one or more types of securities including common stock, convertible debt or warrants to acquire common stock. These securities could be issued at or below the then prevailing market price for our common stock. We currently have no authorized preferred stock. In addition, if we issue secured debt securities, the holders of the debt would have a claim to our assets that would be prior to the rights of stockholders until the debt is paid. Interest on these debt securities would increase costs and negatively impact operating results. If the issuance of new securities results in diminished rights to holders of our common stock, the market price of our common stock could be negatively impacted.

Should the financing we require to sustain our financing needs be unavailable or prohibitively expensive when we require it, the consequences could be a material adverse effect on our business, operating results, financial condition and prospects.

Our management will have broad discretion over the use of the net proceeds from our sale of shares of common stock to Lincoln Park, you may not agree with how we use the proceeds and the proceeds may not be invested successfully.

Our management will have broad discretion as to the use of the net proceeds from our sale of shares of common stock to Lincoln Park, and we could use them for purposes other than those contemplated at the time of commencement of this offering. Accordingly, you will be relying on the judgment of our management with regard to the use of those net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used as you may deem to be appropriate. It is possible that, pending their use, we may invest those net proceeds in a manner that may not yield a favorable, or any, return for us. The manner in which our management uses such funds could have a material adverse effect on our business, financial condition, operating results and cash flows.

Our stock price has been and may continue to be volatile and may fluctuate significantly, which may adversely impact investor confidence and results and increase the likelihood of securities class action litigation.

Our common stock price has experienced volatility in the past and may remain volatile in the future. For example, during 2023, the sale price of our common stock ranged from a high of $1.31 per share to a low of $0.49 per share. Volatility in our stock price can be driven by many factors including, but not limited to, general market conditions, market conditions in the energy materials industry, announcements that we may make regarding our business plans or strategy, including announcements concerning our anticipated battery-graphite business, the increase in the sale and issuance of shares of our common stock to finance our operations, and the accuracy of expectations and predictions of financial analysts and the market as they pertain to our future business prospects. In addition, the price of our common stock may increase or decrease substantially for reasons unrelated to our operating performance or prospects. If our common stock continues to experience price volatility, any shares investors purchase may rapidly lose some or substantially all of their value.

Stockholders of a public company sometimes bring securities class action suits against the company following periods of instability in the market price of that company’s securities. If we were involved in a class action suit, it could divert a significant amount of our management’s attention and other resources from our business and operations, which could harm our results of operations and require us to incur significant

expenses to defend the suit. Any such class action suit, whether or not successful, could harm our reputation and restrict our ability to raise capital in the future. In addition, if a claim is successfully made against us, we may be required to pay damages, which could have a material adverse effect on our results of operations and financial condition.

Furthermore, our ability to raise funds through the issuance of equity or otherwise use our common stock as consideration is impacted by the price of our common stock. A low stock price may adversely impact our ability to fund our operating and growth plans, including Phase I of the Kellyton Graphite Plant, which would harm our business and prospects.

The Company has no history of paying dividends on its common stock, and we do not anticipate paying dividends in the foreseeable future.

The Company has not previously paid dividends on its common stock. We currently anticipate that we will retain all of our available cash, if any, for use as working capital and for other general corporate purposes. Any payment of future dividends will be at the discretion of our Board of Directors and will depend upon, among other things, our earnings, financial condition, capital requirements, level of indebtedness, statutory and contractual restrictions applicable to the payment of dividends and other considerations that our Board of Directors deems relevant. Investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize a return on their investment.

Terms of subsequent financings may adversely impact holders of our securities.

In order to finance our future production plans and working capital needs, we may have to raise funds through the issuance of equity or debt securities. Depending on the type and the terms of any financing we pursue, holders of our securities’ rights and the value of their investment in our common stock could be reduced. A financing could involve one or more types of securities including common stock, convertible debt or warrants to acquire common stock. These securities could be issued at or below the then prevailing market price for our common stock. We currently have no authorized preferred stock. In addition, if we issue secured debt securities, the holders of the debt would have a claim to our assets that would be senior to the rights of holders of our other securities until the debt is paid. Interest on these debt securities would increase financing and interest costs and could negatively our impact our operating results. If the issuance of new securities results in diminished rights to holders of our common stock, the market price of our common stock could be negatively impacted.

Stockholders would be diluted if we use common stock to raise capital, and the perception that such sales may occur, could cause the price of our common stock to decrease.

We plan to seek additional capital to carry out our business plan. This financing could involve one or more types of securities including common stock, convertible debt or warrants to acquire common stock. These securities could be issued at or below the then prevailing market price for our common stock. Any issuance of additional shares of our common stock could be dilutive to existing holders of our securities and could adversely affect the market price of our common stock.

THE LINCOLN PARK TRANSACTION

General

On August 30, 2024, we entered into a purchase agreement with Lincoln Park, pursuant to which Lincoln Park has agreed to purchase from us up to an aggregate of $30,000,000 of our common stock (subject to certain limitations) from time to time over the term of the Purchase Agreement. Also on August 30, 2024, we entered into a registration rights agreement with Lincoln Park, which we refer to in this prospectus as the Registration Rights Agreement. Pursuant to our obligations under the Registration Rights Agreement, we have filed with the SEC the registration statement that includes this prospectus to register for resale under the Securities Act the shares of common stock that have been or may be issued to Lincoln Park under the Purchase Agreement. Terms used but not defined herein shall have the respective meaning ascribed to each such term in the Purchase Agreement.

This prospectus covers the resale by the selling stockholder of 11,668,189 shares of our common stock, comprised of: (i) 600,000 Initial Commitment Shares that we issued to Lincoln Park; (ii) 600,000 Additional Commitment Shares that we may issue to Lincoln Park from time to time in connection with each purchase of common stock by Lincoln Park, in each case, as consideration for Lincoln Park’s commitment to purchase shares of common stock under the Purchase Agreement; and (iii) 10,468,189 shares we have reserved for issuance and sale and may issue and sell to Lincoln Park in the future under the Purchase Agreement, if and when we sell shares to Lincoln Park under the Purchase Agreement.

We do not have the right to commence any sales of our common stock to Lincoln Park under the Purchase Agreement until all of the conditions set forth in the Purchase Agreement have been satisfied, including that the SEC has declared effective the registration statement that includes this prospectus registering the shares that will be issued and sold to Lincoln Park, which we refer to in this prospectus as the Commencement. Thereafter, we may, from time to time and at our sole discretion for a period of 24-months, on any business day that we select, direct Lincoln Park to purchase up to 150,000 shares of common stock, which amounts may be increased depending on the market price of our common stock at the time of sale, which we refer to in this prospectus as “regular purchases.” In addition, at our discretion, Lincoln Park has committed to purchase other “accelerated amounts” and/or “additional accelerated amounts” under certain circumstances.

We will control the timing and amount of any sales of our common stock to Lincoln Park. The purchase price of the shares that may be sold to Lincoln Park in regular purchases under the Purchase Agreement will be based on an agreed upon fixed discount to the market price of our common stock immediately preceding the time of sale as computed under the Purchase Agreement. The purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction occurring during the business days used to compute such price.

We may at any time in our sole discretion terminate the Purchase Agreement without fee, penalty or cost upon one business day notice. There are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights Agreement, other than a prohibition on us effecting or entering into an agreement to effect an “equity line of credit” or other continuous offering or similar offering in which we or our subsidiaries may offer, issue or sell common stock or any securities exercisable, exchangeable or convertible into common stock at a future determined price, subject to certain exemptions, for a period continuing until the earlier of: (A) the 90-day anniversary of the effective date of the termination of the Purchase Agreement, or (B) the later of (i) the 24-month anniversary of the date of the Purchase Agreement, or (ii) the 24-month anniversary of the Commencement Date. Lincoln Park may not assign or transfer its rights and obligations under the Purchase Agreement.

As of September 5, 2024, there were 58,970,133 shares of our common stock outstanding, of which 57,946,110 shares were held by non-affiliates, including the 600,000 Initial Commitment Shares that we have issued to Lincoln Park under the Purchase Agreement. Although the Purchase Agreement provides that we may sell up to an aggregate of $30,000,000 of our common stock to Lincoln Park, only 11,668,189 shares of our common stock are being offered under this prospectus, which represents the 600,000 Initial Commitment Shares that we issued to Lincoln Park under the Purchase Agreement, up to 600,000 Additional

Commitment Shares that we may issue to Lincoln Park from time to time under the Purchase Agreement, and the 10,468,189 shares which may be issued and sold to Lincoln Park in the future under the Purchase Agreement, if and when we sell shares to Lincoln Park under the Purchase Agreement. Depending on the market prices of our common stock at the time we elect to issue and sell shares to Lincoln Park under the Purchase Agreement, we may need to register for resale under the Securities Act additional shares of our common stock in order to receive aggregate gross proceeds equal to the $30,000,000 total commitment available to us under the Purchase Agreement. If all of the 11,668,189 shares offered by Lincoln Park under this prospectus were issued and outstanding as of the date hereof, such shares would represent approximately 16.7% of the total number of shares of our common stock outstanding and approximately 16.9% of the total number of outstanding shares held by non-affiliates, in each case as of the date hereof. If we elect to issue and sell more than the 11,668,189 shares offered under this prospectus to Lincoln Park, which we have the right, but not the obligation, to do, we must first (i) register for resale under the Securities Act any such additional shares, which could cause additional substantial dilution to our stockholders, and (ii) obtain stockholder approval to issue shares of common stock in excess of the Exchange Cap under the Purchase Agreement in accordance with NYSE American rules. The number of shares ultimately offered for resale by Lincoln Park is dependent upon the number of shares we sell to Lincoln Park under the Purchase Agreement.

Under applicable rules of NYSE American, in no event may the Company issue or sell to Lincoln Park under the Purchase Agreement any shares of its common stock to the extent the issuance of such shares of Common Stock, when aggregated with all other shares of common stock issued pursuant to the Purchase Agreement (including the Commitment Shares), would cause the aggregate number of shares of common stock issued pursuant to the Purchase Agreement to exceed the Exchange Cap, or 11,668,189 shares of common stock, unless and until the Company obtains stockholder approval to issue shares of common stock in excess of the Exchange Cap or otherwise, and in accordance with applicable NYSE American listing rules. The Purchase Agreement specifically provides that the Company may not issue or sell any shares of its common stock under the Purchase Agreement if such issuance or sale would breach any applicable NYSE American rules.

The Purchase Agreement also prohibits us from directing Lincoln Park to purchase any shares of common stock if those shares, when aggregated with all other shares of our common stock then beneficially owned by Lincoln Park and its affiliates, would result in Lincoln Park and its affiliates having beneficial ownership, at any single point in time, of more than 9.99% of the then total outstanding shares of our common stock, as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Rule 13d-3 thereunder, which limitation we refer to as the Beneficial Ownership Cap.

Issuances of our common stock in this offering will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares of common stock that our existing stockholders own will not decrease, the shares owned by our existing stockholders will represent a smaller percentage of our total outstanding shares after any such issuance to Lincoln Park.

Purchase of Shares Under the Purchase Agreement

Under the Purchase Agreement, upon Commencement, on any business day that we select (the “Purchase Date”) (and provided (A) the closing sale price of our common stock on the Purchase Date is not less than $0.10 (as adjusted pursuant to the Purchase Agreement) and (B) all shares of common stock subject to all prior Regular Purchases and all Additional Commitment Shares required to be issued to Lincoln Park have been properly delivered to Lincoln Park in accordance with the Purchase Agreement), we may direct Lincoln Park to purchase up to 150,000 shares of our common stock in a regular purchase on such business day, which is referred to as a “Regular Purchase” in this prospectus, provided, however, that (i) the Regular Purchase may be increased to up to 200,000 shares, provided that the closing sale price of our common stock is not below $0.50 on the Purchase Date, (ii) the Regular Purchase may be increased to up to 250,000 shares, provided that the closing sale price of our common stock is not below $0.75 on the Purchase Date, and (iii) the Regular Purchase may be increased to up to 300,000 shares, provided that the closing sale price of the common stock is not below $1.00 on the Purchase Date (such share amount limitation, the

“Regular Purchase Share Limit”). In each case, Lincoln Park’s maximum commitment in any single Regular Purchase may not exceed $1,000,000. The Regular Purchase Share Limit is subject to proportionate adjustment in the event of a reorganization, recapitalization, non-cash dividend, stock split or other similar transaction; provided, that if after giving effect to such full proportionate adjustment, the adjusted Regular Purchase Share Limit would preclude us from requiring Lincoln Park to purchase common stock at an aggregate purchase price equal to or greater than $100,000 in any single Regular Purchase, then the Regular Purchase Share Limit will not be fully adjusted, but rather the Regular Purchase Share Limit for such Regular Purchase shall be adjusted as specified in the Purchase Agreement, such that, after giving effect to such adjustment, the Regular Purchase Share Limit will be equal to (or as close as can be derived from such adjustment without exceeding) $100,000.

The purchase price per share for each such Regular Purchase will be equal to 97% of the lower of:

•

the lowest sale price for our common stock on the purchase date of such shares; and

•

the arithmetic average of the three lowest closing sale prices for our common stock during the 10 consecutive business days ending on the business day immediately preceding the purchase date of such shares.

In addition to Regular Purchases described above, we may also direct Lincoln Park, on the Purchase Date on which we have properly submitted a Regular Purchase notice directing Lincoln Park to purchase the maximum number of shares of our common stock that we are then permitted to include in a single Regular Purchase notice (and provided all shares of common stock subject to all prior Regular Purchases, Accelerated Purchases and Additional Accelerated Purchases effected prior to such Purchase Date and all Additional Commitment Shares required to be issued to Lincoln Park have been properly delivered to Lincoln Park in accordance with the Purchase Agreement), to purchase an additional amount of our common stock, which we refer to as an “Accelerated Purchase,” on the next business day following such Purchase Date for such corresponding Regular Purchase, which we refer to as the “Accelerated Purchase Date,” not to exceed the lesser of:

•

three times the number of shares of common stock purchased pursuant to the corresponding Regular Purchase; and

•

30% of the total number of shares of our common stock traded on NYSE American during the period on the applicable Accelerated Purchase Date beginning at the Accelerated Purchase Commencement Time (as defined in the Purchase Agreement) for such Accelerated Purchase and ending at the Accelerated Purchase Termination Time (as defined in the Purchase Agreement) for such Accelerated Purchase, which we refer to as the “Accelerated Purchase Measurement Period.”

The purchase price per share for each such Accelerated Purchase will be equal to 97% of the lower of:

•

the volume weighted average price of our common stock during the Accelerated Purchase Measurement Period on the applicable Accelerated Purchase Date; and

•

the closing sale price of our common stock on the applicable Accelerated Purchase Date.

We may also direct Lincoln Park, not later than 1:00 p.m., Eastern Time, on a business day on which an Accelerated Purchase has been completed (the “Additional Accelerated Purchase Date”), to purchase an additional amount of our common stock, which we refer to as an “Additional Accelerated Purchase,” not to exceed the lesser of:

•

three times the number of shares of common stock purchased pursuant to the Regular Purchase corresponding to the Accelerated Purchase that was completed on such Accelerated Purchase date on which an Additional Accelerated Purchase notice was properly received; and

•

30% of the total number of shares of our common stock traded on NYSE American during the period on the applicable Additional Accelerated Purchase Date beginning at the Additional Accelerated Purchase Commencement Time (as defined in the Purchase Agreement) for such Additional Accelerated Purchase and ending at the Additional Accelerated Purchase Termination Time (as defined in the Purchase Agreement) for such Additional Accelerated Purchase, which we refer to as the “Additional Accelerated Purchase Measurement Period.”

We may, in our sole discretion, submit multiple Additional Accelerated Purchase notices to Lincoln Park prior to 1:00 p.m., Eastern Time, on a single Additional Accelerated Purchase Date, provided that (A) all prior Accelerated Purchases and Additional Accelerated Purchases (including those that have occurred earlier on the same day) have been completed and (B) all of the shares to be purchased thereunder (and under the corresponding Regular Purchase) and all Additional Commitment Shares required to be issued to Lincoln Park have been properly delivered to Lincoln Park in accordance with the Purchase Agreement.

The purchase price per share for each such Additional Accelerated Purchase will be equal to 97% of the lower of:

•

the volume weighted average price of our common stock during the Additional Accelerated Purchase Measurement Period on the applicable Additional Accelerated Purchase Date; and

•

the closing sale price of our common stock on the applicable Additional Accelerated Purchase Date.

In the case of the Regular Purchases, Accelerated Purchases and Additional Accelerated Purchases, the purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction occurring during the business days used to compute the purchase price.

Other than as described above, there are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Lincoln Park.

Suspension Events

Suspension events under the Purchase Agreement include the following:

•

the effectiveness of the registration statement of which this prospectus forms a part lapses for any reason (including, without limitation, the issuance of a stop order), or such registration statement (or the prospectus forming a part thereof) are unavailable for the resale by Lincoln Park of our common stock offered hereby, and such lapse or unavailability continues for a period of 10 consecutive business days or for more than an aggregate of 30 business days in any 365-day period;

•

suspension by our principal market of our common stock from trading for a period of one business day;

•

the de-listing of our common stock from NYSE American, our principal market, provided our common stock is not immediately thereafter trading on The Nasdaq Capital Market, The Nasdaq Global Market, The Nasdaq Global Select Market, the New York Stock Exchange, the NYSE Arca, or the OTCQX or OTCQB operated by the OTC Markets Group Inc. (or any nationally recognized successors thereto);

•

the failure of our transfer agent to issue to Lincoln Park shares of our common stock within two business days after the applicable date on which Lincoln Park is entitled to receive such shares;

•

any breach of the representations or warranties or covenants contained in the Purchase Agreement or Registration Rights Agreement that has or could have a material adverse effect on us and, in the case of a breach of a covenant that is reasonably curable, that is not cured within five business days;

•

any voluntary or involuntary participation or threatened participation in insolvency or bankruptcy proceedings by or against us;

•

if at any time we are not eligible to transfer our common stock electronically; or

•

if at any time the Exchange Cap is reached, to the extent applicable.

Lincoln Park does not have the right to terminate the Purchase Agreement upon any of the suspension events set forth above. During a suspension event, all of which are outside of Lincoln Park’s control, we may not direct Lincoln Park to purchase any shares of our common stock under the Purchase Agreement.

Our Termination Rights

We have the unconditional right, at any time, for any reason and without any payment or liability to us, to give notice to Lincoln Park to terminate the Purchase Agreement. In the event of bankruptcy proceedings by or against us, the Purchase Agreement will automatically terminate without action of any party.

No Short-Selling or Hedging by Lincoln Park

Lincoln Park has agreed that neither it nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time prior to the termination of the Purchase Agreement.

Prohibitions on Variable Rate Transactions

There are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights Agreement other than a prohibition on us effecting or entering into an agreement to effect an “equity line of credit” or other continuous offering or similar offering in which we or our subsidiaries may offer, issue or sell common stock or any securities exercisable, exchangeable or convertible into common stock at a future determined price, subject to certain exemptions, for a period continuing until the earlier of: (A) the 90-day anniversary of the effective date of the termination of the Purchase Agreement, or (B) the later of (i) the 24-month anniversary of the date of the Purchase Agreement, or (ii) the 24-month anniversary of the Commencement Date.

Effect of Performance of the Purchase Agreement on Our Stockholders

All 11,668,189 shares registered in this offering that have been and may be issued as Commitment Shares and may be issued or sold by us to Lincoln Park under the Purchase Agreement are expected to be freely tradable. It is anticipated that shares registered in this offering, excluding the Commitment Shares, will be sold to Lincoln Park over a period of up to 24-months commencing on the Commencement Date. The resale by Lincoln Park of a significant amount of shares registered in this offering, at any given time during the pendency of this offering, could cause the market price of our common stock to decline and to be volatile. Resales of our common stock to Lincoln Park, if any, will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to Lincoln Park all, some or none of the shares of our common stock that may be available for us to sell pursuant to the Purchase Agreement. If and when we do sell shares to Lincoln Park, after Lincoln Park has acquired the shares, Lincoln Park may resell all, some or none of those shares at any time or from time to time in its discretion. Therefore, sales to Lincoln Park by us under the Purchase Agreement may result in substantial dilution to the interests of other holders of our common stock. In addition, if we sell a substantial number of shares to Lincoln Park under the Purchase Agreement, or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement with Lincoln Park may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect such sales. However, we have the right to control the timing and amount of any additional sales of our shares to Lincoln Park and the Purchase Agreement may be terminated by us at any time at our discretion without any cost to us.

Pursuant to the terms of the Purchase Agreement, we have the right, but not the obligation, to direct Lincoln Park to purchase up to $30,000,000 of our common stock. Depending on the price per share at which we sell our common stock to Lincoln Park pursuant to the Purchase Agreement, we may need to sell to Lincoln Park under the Purchase Agreement more shares of our common stock than are offered under this prospectus in order to receive aggregate gross proceeds equal to the $30,000,000 total commitment available to us under the Purchase Agreement. If we choose to do so, in addition to obtaining stockholder approval to issue shares of common stock in excess of the Exchange Cap under the Purchase Agreement in accordance with NYSE American rules, we must first register for resale under the Securities Act such additional shares of our common stock, which could cause additional substantial dilution to our stockholders. The number of shares ultimately offered for resale by Lincoln Park under this prospectus is dependent upon the number of shares we direct Lincoln Park to purchase under the Purchase Agreement.

The Purchase Agreement prohibits us from issuing or selling to Lincoln Park under the Purchase Agreement (i) shares of our common stock in excess of the Exchange Cap, unless we obtain stockholder

approval to issue shares in excess of the Exchange Cap, and (ii) any shares of our common stock if those shares, when aggregated with all other shares of our common stock then beneficially owned by Lincoln Park and its affiliates, would exceed the Beneficial Ownership Cap. We would seek stockholder approval before issuing shares in excess of the Exchange Cap.

The following table sets forth the amount of gross proceeds we would receive from Lincoln Park from our sale of shares to Lincoln Park under the Purchase Agreement at varying purchase prices:

|

Assumed Average Purchase Price Per Share

|

|

|

Number of

Registered

Shares to be

Issued if

Full Purchase(1)

|

|

|

Percentage of

Outstanding

Shares

After Giving

Effect to

the Issuance

to Lincoln

Park(2)

|

|

|

Proceeds

from

the Sale of

Shares to

Lincoln

Park

Under the

Purchase

Agreement(1)

|

|

|

$0.25

|

|

|

|

|

11,668,189 |

|

|

|

|

|

16.7% |

|

|

|

|

$ |

2,917,047 |

|

|

|

$0.50

|

|

|

|

|

11,668,189 |

|

|

|

|

|

16.7% |

|

|

|

|

$ |

5,834,095 |

|

|

|

$0.52(3)

|

|

|

|

|

11,668,189 |

|

|

|

|

|

16.7% |

|

|

|

|

$ |

6,067,458 |

|

|

|

$0.75

|

|

|

|

|

11,668,189 |

|

|

|

|

|

16.7% |

|

|

|

|

$ |

8,751,142 |

|

|

|

$1.00

|

|

|

|

|

11,668,189 |

|

|

|

|

|

16.7% |

|

|

|

|

$ |

11,668,189 |

|

|

|

$2.57

|

|

|

|

|

11,668,189 |

|

|

|

|

|

16.7% |

|

|

|

|

$ |

29,987,246 |

|

|

(1)

Although the Purchase Agreement provides that we may sell up to $30,000,000 of our common stock to Lincoln Park, we are only registering 11,668,189 shares under this prospectus, which are equal to the Exchange Cap and include 600,000 shares issued to Lincoln Park as the Initial Commitment Shares and up to 600,000 additional shares that may be issued to Lincoln Park as the Additional Commitment Shares, in each case, as consideration for Lincoln Park’s commitment to purchase shares of common stock under the Purchase Agreement, which may or may not cover all the shares we ultimately sell to Lincoln Park under the Purchase Agreement, depending on the purchase price per share. We would seek stockholder approval before issuing more than 11,668,189 shares to Lincoln Park. The number of shares to be issued as set forth in this column (i) gives effect to the Exchange Cap and (ii) is without regard for the Beneficial Ownership Cap.

(2)

The denominator is based on 58,970,133 shares outstanding as of September 5, 2024 (which number includes the 600,000 Initial Commitment Shares), adjusted to include the number of shares set forth in the column titled “Number of Registered Shares to be Issued if Full Purchase,” which we would have sold to Lincoln Park, assuming the purchase price in the adjacent column. The numerator is based on the number of shares issuable under the Purchase Agreement, set forth in the column titled “Number of Registered Shares to be Issued if Full Purchase,” at the corresponding assumed purchase price set forth in the adjacent column. The table does not give effect to the prohibition contained in the Purchase Agreement that prevents us from selling and issuing to Lincoln Park shares such that, after giving effect to such sale and issuance, Lincoln Park and its affiliates would beneficially own more than 9.99% of the then outstanding shares of our common stock.

(3)

The closing sale price of our shares on September 5, 2024.

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by Lincoln Park. We will receive no proceeds from the sale of shares of common stock by Lincoln Park in this offering. We may receive up to $30 million aggregate gross proceeds (subject to certain limitations) under the Purchase Agreement from any sales we make to Lincoln Park pursuant to the Purchase Agreement after the date of this prospectus. We estimate that the net proceeds to us from the sale of our common stock to Lincoln Park pursuant to the Purchase Agreement would be up to $28.5 million over an approximately 24-month period, assuming that we sell the full amount of our common stock that we have the right, but not the obligation, to sell to Lincoln Park under the Purchase Agreement, and after other estimated fees and expenses. See “Plan of Distribution” elsewhere in this prospectus for more information.

We intend to use any net proceeds that we received under the Purchase Agreement for general corporate purposes, which may include advancing the development of Phase I of the Kellyton Graphite Plant and our graphite business, developing the Coosa Graphite Deposit, and making additions to our working capital. It is possible that no shares will be issued under the Purchase Agreement.

MARKET FOR COMMON STOCK AND DIVIDEND POLICY

Our common stock is traded on NYSE American under the symbol “WWR.” The last reported sale price of our common stock on September 5, 2024 on NYSE American was $0.52 per share. As of March 15, 2024, there were 69 holders of record of our common stock.

We have never paid any cash or other dividends on our common stock, and we do not anticipate paying dividends for the foreseeable future. We expect to retain our earnings, if any, for the growth and development of our business. Any future determination to declare dividends will be made at the discretion of our Board and will depend on our financial condition, results of operations, capital requirements, general business conditions and other factors that our Board may consider relevant.

SELLING STOCKHOLDER

This prospectus relates to the possible resale by the selling stockholder, Lincoln Park, of shares of our common stock that have been or may be issued to Lincoln Park pursuant to the Purchase Agreement. We are filing the registration statement of which this prospectus forms a part pursuant to the provisions of the Registration Rights Agreement, which we entered into with Lincoln Park on August 30, 2024, concurrently with our execution of the Purchase Agreement, in which we agreed to provide certain registration rights with respect to sales by Lincoln Park of the shares of our common stock that have been or may be issued to Lincoln Park under the Purchase Agreement.

Lincoln Park, as the selling stockholder, may, from time to time, offer and sell pursuant to this prospectus any or all of the shares that we may issue to Lincoln Park from time to time at our discretion under the Purchase Agreement. The “selling stockholder” may sell some, all or none of its shares. We do not know how long the selling stockholder will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling stockholder regarding the sale of any of the shares.

The following table presents information regarding the selling stockholder and the shares that it may offer and sell from time to time under this prospectus. The table is prepared based on information supplied to us by the selling stockholder, and reflects its holdings as of September 5, 2024. Neither Lincoln Park nor any of its affiliates has held a position or office, or had any other material relationship, with us or any of our predecessors or affiliates. Beneficial ownership is determined in accordance with Section 13(d) of the Exchange Act and Rule 13d-3 thereunder. The percentage of shares beneficially owned prior to the offering is based on 58,970,133 shares of our common stock outstanding as of September 5, 2024.

| |

|

|

Shares Beneficially

Owned Prior to Offering

|

|

|

Number of Shares

Being Offered

|

|

|

Shares Beneficially

Owned After Offering(1)

|

|

|

Name

|

|

|

Number

|

|

|

%

|

|

|

Number

|

|

|

%

|

|

|

Lincoln Park Capital Fund, LLC(2)

|

|

|

|

|

600,000(3) |

|

|

|

|

|

1.02%(4) |

|

|

|

|

|

11,668,189 |

|

|

|

|

|

0(3) |

|

|

|

|

|

0.0% |

|

|

(1)

Assumes the sale of all shares of common stock registered pursuant to this prospectus, although the selling stockholder is under no obligation known to us to sell any shares of common stock at this time.

(2)