TIDMCIA

10 June 2022

Clean Invest Africa plc

("Clean Invest Africa", the "Company" or the "Group")

Notice of AGM

The Company's Annual General Meeting ("AGM") will be held at 10.30am on 4 July

2022 at Peterhouse Capital Limited, 3rd Floor, 80 Cheapside, London, EC2V 6EE.

The Board encourages all shareholders to vote on the resolutions to be proposed

at the AGM. Instructions for voting by proxy are set out in the notes at the

end of the Notice of AGM and on the proxy card sent to shareholders.

Any shareholders who have questions they would like answered in advance of

the meeting can send them to enquiry@coaltechenergy.com and they will be

responded to promptly.

Shareholders can return their proxy forms by post,

or by email to info@nevilleregistrars.co.uk (please include "Clean

Invest Africa" and your full name in the subject line of the email) to arrive

not later than two business days before the time appointed for holding the AGM.

The Notice of AGM is reproduced in full below. It will be dispatched, along

with Forms of Proxy, to shareholders later today and will also be available on

the website at www.cleaninvestafrica.com.

Shareholders should note that the audited accounts to 31 December 2021 have not

yet been finalised and will therefore not be tabled at the AGM. A further AGM

will be notified to shareholders promptly after the finalisation of the audited

accounts. The Company expects to have the audited accounts ready by 30 June

2022, and these will be published accordingly.

The Directors of the Company accept responsibility for the contents of this

announcement.

-S -

Certain information contained in this announcement would have been deemed

inside information for the purposes of Article 7 of Regulation (EU) No 596/2014

until the release of this announcement.

ENQUIRIES :

Clean Invest Africa plc

Filippo Fantechi (Executive Director) +973 3969 6273

Shaikh Mohamed Abdulla Khalifa AlKhalifa (Non-Executive Chairman) +973 3969

2299

Peterhouse Capital Limited

Corporate Adviser +44 20 7469 0930 Guy Miller/Mark Anwyl

References to time in this document and the Notice of Annual General Meeting

are to British Summer Time.

LETTER FROM THE CHAIRMAN OF CLEAN INVEST AFRICA PLC

10 June 2022

To Shareholders and, for information only, to Warrant Holders

Notice of Annual General Meeting

Dear Shareholder,

Introduction

I am pleased to enclose the formal notice ("Notice") of the Annual General

Meeting ('AGM') of the Company. The AGM will be held at the offices of

Peterhouse Capital Limited, 3rd Floor, 80 Cheapside, London, EC2V 6EE at 10:30

a.m. on Monday 4 July 2022.

Voting and asking questions

The Company will include all valid proxy votes (whether submitted

electronically or in hard copy form) in its polls at the AGM and the Chairman

of the meeting will call for a poll on each resolution. Shareholders are

strongly encouraged to appoint the Chairman of the meeting as their proxy. The

Company accordingly requests that shareholders submit their proxy votes in

respect of the resolutions as set out in this Notice as early as possible,

electronically or by post in advance, in accordance with the instructions set

out in this Notice.

However, any shareholders who have questions they would like answered in

advance of the meeting can send them to enquiry@coaltechenergy.com and they

will be responded to promptly.

The resolutions are explained below, and are set out in the Notice of Annual

General Meeting at the end of this document.

Annual General Meeting

Ordinary business at the AGM

Resolution 1: Re-appointment of Director

The Board recommends the re-appointment of Paul Ryan in accordance with the

Company's Articles of Association ("Articles") and, being eligible, he offers

himself for re-appointment as a director.

Resolution 2: Re-appointment of Director

The Board recommends the re-appointment of Noel Lyons in accordance with the

Company's Articles of Association ("Articles") and, being eligible, he offers

himself for re- appointment as a director.

Resolution 3: Re-appointment of Director

The Board recommends the re-appointment of Filippo Fantechi in accordance with

the Company's Articles of Association ("Articles") and, being eligible, he

offers himself for re- appointment as a director.

Resolution 4: Re-appointment of Director

The Board recommends the re-appointment of Shaikh Mohamed Abdulla Khalifa

AlKhalifa in accordance with the Company's Articles of Association ("Articles")

and, being eligible, he offers himself for re- appointment as a director.

Resolution 5: Auditors' reappointment and remuneration

This resolution relating to the auditors' re-appointment and remuneration

constitutes usual business for the AGM.

Special business at the AGM

Resolution 6: 2022/2023 Incentive Scheme

This resolution subject to annual general meeting approval, whereby the Company

proposes a renewed Incentive Scheme for the Company, and in particular through

the potential award of Director and management warrants for 2022/2023 and

beyond to incentivise Directors and management to achieve significant progress

with the business. These management warrants are proposed to be 125m warrants

in total, comprising 25m each for each of the Directors and 25m for management,

and at an exercise price of 0.25p and each with a further 2 follow on warrants

should the warrants be exercised in full, equivalent of two warrants for every

one warrant exercised which will be granted upon such exercise for a further 5

year period and with an exercise price of 0.4 pence per share.

Resolution 7: Section 551 authority

This is an ordinary resolution authorising the Directors to allot relevant

securities (including warrant shares and option shares in addition to those to

be allotted under Resolution 6 above) up to an aggregate nominal amount of £

10,000,000. Such authority, unless previously revoked or varied by the Company

in a General Meeting, will expire at the commencement of the Company's next

Annual General Meeting or 3 July 2023, whichever is the earlier.

Resolution 8: Section 570 authority and dis-application of Section 561(1)

This is a special resolution authorising the Directors to issue equity

securities (including warrant shares and option shares) wholly for cash on a

non-pre-emptive basis pursuant to the authority conferred by resolution number

7 above. This will allow the Board to allot shares without recourse to the

Company's shareholders so that it can move quickly from time to time as it

deems appropriate. Such authority, unless previously revoked or varied by the

Company in a General Meeting, will expire at the commencement of the next

Annual General Meeting or 3 July 2023, whichever is the earlier.

Action to be taken

Shareholders will find a form of proxy enclosed for use at the AGM. To be

valid, forms of proxy must be received by the Company's Registrars, Neville

Registrars Limited, Neville House, Steelpark Road, Halesowen B62 8HD, not later

than two business days before the time appointed for holding the Annual General

Meeting.

Shareholders can return their proxy forms by email to

info@nevilleregistrars.co.uk (please include "Clean Invest Africa" and your

full name in the subject line of the email). You are entitled to appoint a

proxy to vote instead of you. Your attention is drawn to the notes to the forms

of proxy.

Form of Proxy

A Form of Proxy for use at the AGM is enclosed. Please complete and sign the

Form of Proxy and return it to the Company's Registrars at the address set out

above, so as to arrive no later than 48 hours (excluding non-business days)

before the time fixed for the AGM (being 10:30 a.m. on 30 June 2022).

Board Recommendation

The Board considers that each of the Resolutions to be proposed at the AGM are

in the best interests of the Company and its shareholders as a whole and it

unanimously recommends that shareholders vote in favour of each of them as the

Board intend to do so in respect of the Ordinary Shares held by them.

Shareholders should note that the audited accounts to 31 December 2021 have not

yet been finalised and will therefore not be tabled at the AGM. A further AGM

will be notified to shareholders promptly after the finalisation of the audited

accounts. The Company expects to have the audited accounts ready by 30 June

2022, and these will be published accordingly.

Yours faithfully

Shaikh Mohamed Abdulla Khalifa AlKhalifa Non-Executive Chairman

CLEAN INVEST AFRICA PLC

Incorporated in England and Wales as a public limited company under number

10967142

NOTICE OF ANNUAL GENERAL MEETING

NOTICE IS HEREBY GIVEN that the Annual General Meeting (the "AGM") of the

members of Clean Invest Africa plc ("the Company") will be held at the offices

of Peterhouse Capital Limited, 3rd Floor, 80 Cheapside, London, EC2V 6EE at 10:

30 a.m. on 4 July 2022.

The resolutions are set out below:

Ordinary Business

To consider and, if thought fit, to pass the following resolutions which shall

be proposed as ordinary resolutions:

1. To re-appoint Paul Ryan, as a Director of the Company, in accordance with

the Company's Articles of Association ("Articles") and, being eligible, offers

himself for re- appointment as a director.

2. To re-appoint Noel Lyons, as a Director of the Company, in accordance with

the Company's Articles of Association ("Articles") and, being eligible, offers

himself for re- appointment as a director.

3. To re-appoint Filippo Fantechi, as a Director of the Company, in

accordance with the Company's Articles of Association ("Articles") and, being

eligible, offers himself for re- appointment as a director.

4. To re-appoint Shaikh Mohamed Abdulla Khalifa AlKhalifa, as a Director of

the Company, in accordance with the Company's Articles of Association

("Articles") and, being eligible, offers himself for re- appointment as a

director.

5. To re-appoint PKF Littlejohn LLP as auditors of the Company, to hold office

until the commencement of the Company's next Annual General Meeting and to

authorise the Directors to determine their remuneration.

Special business at the AGM

To consider and, if thought fit, to pass the following resolutions, of which

resolution 6 and 7 will be proposed as Ordinary Resolutions and resolution 8

will be proposed as a Special Resolution:

6. To ratify the proposed new 2022/23 Incentive Scheme for the Company, and in

particular the award of 125m management warrants comprising 25m each for each

of the Directors and 25m for management, and at an exercise price of 0.25p and

the granting of the associated warrants.

7. THAT, the Directors be and are hereby generally and unconditionally

authorised for the purposes of Section 551 of the Companies Act 2006 (the "Act

") to exercise all the powers of the Company to allot equity securities (as

defined in Section 560 of the Act) up to an aggregate nominal amount of £

10,000,000 to such persons and at such times and conditions as the Directors

think proper, provided that such authority, unless previously revoked or varied

by the Company in a General Meeting, shall expire at the commencement of the

Annual General Meeting next held after the passing of this resolution or 3 July

2023 (whichever is the earlier to occur) save that the Company may pursuant to

the authority make an offer or agreement or other arrangement before the expiry

of the authority which would or might require relevant securities to be

allotted after such expiry, and the Directors may allot relevant securities in

pursuance of such an offer or agreement or other arrangement as if the power

conferred hereby had not expired. This authority is in substitution for all

previous authorities conferred upon the Directors pursuant to Section 551 of

the Act, but without prejudice to the allotment of any relevant securities

already made or to be made pursuant to such authorities.

8. THAT (subject to and conditional upon the passing of Resolution 7 above),

the Directors be and are hereby empowered pursuant to Section 570 of the Act to

allot equity securities (within the meaning of Section 560 of the Act) wholly

for cash pursuant to the general authority conferred by Resolution 7 as if

Section 561(1) of the Act did not apply to any such allotment, provided that

this power shall be limited to allotments of equity securities:

(i) in connection with or pursuant to an offer by way of rights, open offer or

other pre- emptive offer to the holders of shares in the Company and other

persons entitled to participate therein in proportion (as nearly as

practicable) to their respective holdings, subject to such exclusions or other

arrangements as the Directors may consider necessary or expedient to deal with

fractional entitlements or legal or practical problems under the laws of any

territory or the regulations or requirements of any regulatory authority or any

stock exchange in any territory; and

(ii) otherwise than pursuant to sub-paragraph (i) above, up to an aggregate

nominal amount of £10,000,000;

(iii) and such power, unless previously revoked or varied by the Company at a

General Meeting, shall expire at the commencement of the Annual General Meeting

next held after the passing of this resolution or 3 July 2023 (whichever is the

earlier to occur) but so that the Company may before such expiry make an offer

or agreement or other arrangement which would or might require equity

securities to be allotted or treasury shares to be sold after such expiry, and

the Directors may allot equity securities or sell treasury shares in pursuance

of any such offer or agreement or other arrangement as if the power conferred

by this resolution had not expired. The power hereby conferred shall operate in

substitution for and to the exclusion of any previous power given to the

Directors pursuant to Section 570 of the Act.

BY ORDER OF THE BOARD

MSP Corporate Services Limited

Company Secretary

10 June 2022

Registered Office: 27-28 Eastcastle Street, London, W1W 8DH

NOTES:

1. A member is entitled to attend, speak and vote at the AGM and is entitled

to appoint a proxy to vote on his/her behalf. A proxy need not be a member of

the Company.

2. Forms of proxy, together with any power of attorney or other authority

under which it is executed or a notarially certified copy thereof, must be

completed and, to be valid, must reach the Company's Registrars at Neville

Registrars Limited, Neville House, Steelpark Road, Halesowen B62 8HD not less

than 48 hours (excluding non-business days) before the time appointed for the

holding of the meeting.

3. If the appointer is a corporation, the form of proxy must be under its

common seal or under the hand of an officer or attorney duly authorised.

4. In the case of joint holders, the vote of the senior who tenders a vote,

whether in person or by proxy, will be accepted to the exclusion of the vote of

the other registered holder(s) and for this purpose seniority shall be

determined by the order in which the names stand in the register of members.

5. Pursuant to Regulation 41 of the Uncertificated Securities Regulations 2001

(SI 2001/3755) Reg. 41(1) and (2) and paragraph 18 (c) The Companies Act 2006

(Consequential Amendments) (Uncertificated Securities) Order 2009, only those

shareholders on the Register of Members at 48 hours (excluding non-business

days) before the time appointed for the holding of the meeting shall be

entitled to vote in respect of the number of shares registered in their names

at that time. If the meeting is adjourned by more than 48 hours,

then to be so entitled, a shareholder must be entered on the Company's Register

of Members at the time which is 48 hours (excluding non-business days) before

the time appointed for holding the adjourned meeting or, if the Company gives

notice of the adjourned meeting, at the time specified in that notice.

6. To appoint more than one proxy, you may photocopy the form of proxy. Please

indicate the proxy holder's name and the number of shares in relation to which

they are authorised to act as your proxy (which in aggregate shall not exceed

the number of shares held by you). Please also indicate if the proxy is part of

a multiple set of instructions being given. All forms must be signed and should

be returned together in the same envelope. A failure to specify the number of

shares each proxy appointment relates to or specifying a number in excess of

those held by you, may result in the appointment being invalid. If you do not

have a proxy form and believe that you should have one, or if you require

additional forms, please contact the Company's registrar.

7. As at the close of business on 9 June 2022, the Company's issued share

capital comprised 1,753,103,402 ordinary shares of 0.25p each. Each ordinary

share carries the right to one vote at a general meeting of the Company, and

therefore the total number of voting rights in the Company as at the time and

date given above is 1,753,103,402.

END

(END) Dow Jones Newswires

June 10, 2022 07:43 ET (11:43 GMT)

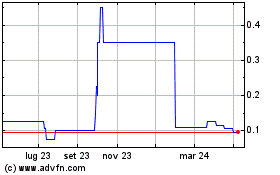

Grafico Azioni Clean Invest Africa (AQSE:CIA)

Storico

Da Mar 2024 a Apr 2024

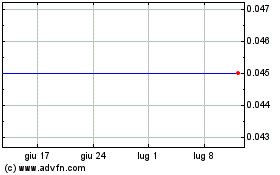

Grafico Azioni Clean Invest Africa (AQSE:CIA)

Storico

Da Apr 2023 a Apr 2024