TIDMINC

RNS Number : 9158Y

Incanthera PLC

18 May 2021

18 May 2021

Incanthera plc

("Incanthera" the "Company")

RESULTS FOR THE YEARED 31 MARCH 2021

Incanthera plc (AQSE: INC), the specialist oncology company

focused on innovative technologies in oncology and dermatology is

pleased to announce results for the year ended 31 March 2021.

Incanthera is dedicated to improving treatment options with

therapeutics combined with targeted delivery technologies to

transform the future of healthcare.

The year end results mark the first full anniversary of trading

following the successful flotation of the Company to the AQSE

Growth Market in February 2020.

Highlights:

-- Commercial discussions with two global cosmetic companies for

Sol skin cancer technology continue to progress

-- Promotion to top Apex sector of AQSE awarded having met qualifying criteria

-- Technology portfolio fully patent protected and strengthened

through the filing of a new patent which gives extended patent

protection to Sol to 2040

-- GBP1.14 million further funding through recently

oversubscribed placing with existing and new investors

-- Directors' and management's further investment

-- Financial performance for the year in line with the Board's expectations

Financial Highlights:

-- Total group loss for the year: GBP905,000, 2020: GBP1,128,000

-- Operating expenses increased in line with Sol progression: GBP979,000, 2020: GBP933,000

-- Year end cash position strengthened following the successful

fundraise, 2021: GBP957k, 2020: GBP392k

Simon Ward, Chief Executive Officer, commented:

"This has been a very important first year on the public markets

for Incanthera.

The public stage has provided a great opportunity for us and we

have concentrated on delivering operational successes through our

evolutionary technology Sol, now the subject of discussion with two

global cosmetics companies. These discussions continue to progress

and we look forward to making further updates when we are able.

We are also delighted at the result of our recent placing,

securing further funding from existing shareholders and welcoming

new investors, which puts us in an excellent position to conclude

the Sol discussions and to continue to look at the promise of new

opportunities to deliver returns to Shareholders.

We are immensely proud and grateful to have marked our first

public year with these operational and financial achievements and

we look forward to the year ahead with all the opportunity and

promise that we can see."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (which

forms part of domestic UK law pursuant to the European Union (Withdrawal) Act 2018).

The directors of the Company take responsibility for this

announcement.

For further enquiries:

Incanthera plc:

www.incanthera.com

Tim McCarthy, Chairman

tim.mccarthy@incanthera.com +44 (0) 7831 675747

Simon Ward, Chief Executive Officer

simon.ward@incanthera.com +44 (0) 7747 625506

Suzanne Brocks, Head of Communications

suzanne.brocks@incanthera.com +44 (0) 7776 234600

Aquis Exchange Corporate Adviser:

Cairn Financial Advisers LLP

Jo Turner/James Lewis/Mark Rogers +44 (0) 20 7213 0880

Broker:

Stanford Capital Partners Ltd

Patrick Claridge/Tom Price/John Howes/Bob

Pountney +44 (0) 20 3815 8880

Notes to Editors

Incanthera is a specialist oncology company focused on

transforming cancer treatment by creating environments in which

cancer cannot survive. It seeks to identify and develop innovative

solutions to current clinical, commercially relevant unmet needs,

utilising new technology from leading academic institutions.

The Company's current lead product and focus is Sol, a

potentially innovative topical product for the treatment of solar

keratosis and the prevention of skin cancers. This has achieved

proof of concept and the Company is now focussed upon delivering

Sol to a commercial partner.

The Company originated from the Institute of Cancer Therapeutics

("ICT") at the University of Bradford and has acquired and

developed a portfolio of specific cancer-targeting therapeutics

through a Pipeline Agreement with the ICT and other corporate

acquisitions.

Incanthera's strategy is to develop each candidate in the

portfolio from initial acquisition or discovery to securing its

future through commercially valuable partnerships at the earliest

opportunity in its development pathway.

For more information on the Company please visit:

www.incanthera.com

@incantheraplc

Incanthera plc

RESULTS FOR THE YEARED 31 MARCH 2021

Chairman's Statement

Our Business

Health is our focus. It is also Incanthera's mission and

purpose, to find innovative treatments and technologies to provide

ever better options for more targeted, holistic healthcare.

Incanthera's portfolio of novel cancer medicines utilises

targeted technology and delivery systems, addressing the oncology

spectrum.

These technologies now show the opportunity to transcend across

other treatment areas and the success of this year, under review,

is owed to the successful progression of our skin cancer

technology, Sol, which combines the spheres of oncology and

dermatology.

Introduced to our portfolio in 2018, we quickly realised its

potential to address an area of unmet medical need in the oncology

and dermatology field.

Progression and Evolution

Sol formed the focus for our flotation on the AQSE Growth Market

in 2020 and the enthusiasm and potential we saw in the technology,

was matched by the support of the investment community, resulting

in our successful admission in February 2020.

Despite the immediate global shutdown following our flotation,

our team immediately went to work to further develop and refine the

Sol formulation which resulted in the very successful study results

we reported in September last year.

The study data on Sol's successful permeation across the skin

barrier and excellent safety profile on human skin surpassed our

expectations, strengthening the technology's commercial potential

and valuation, which was further enhanced through the filing of a

new patent which will give extended patent protection to Sol to

2040.

With such strong data and enhanced awareness, we have begun to

introduce Sol to a number of potential commercial partners and, as

advised in a commercial update in February 2021, we have

prioritised discussions with two Global cosmetic companies. These

discussions continue to progress and we look forward to providing

further updates when we are able.

It is a reflection of the Global situation in the past 12-18

months that whilst we were fortunate to progress our technologies

towards commercial negotiations, many companies were faced with

wide ranging efforts to manage their own businesses and, for that

reason, discussions understandably have taken longer than

originally anticipated.

In order to continue negotiations confidently and to ensure we

fulfilled our responsibilities to secure ongoing financial security

for the business, we undertook a fundraising in March.

We were delighted that this resulted in an oversubscribed

Placing, raising GBP1.14m for the company, which we announced on 23

March 2021.

These funds provide the security from which to conclude

negotiations on Sol in a confident manner and also provide a cash

runway into the second half of 2022.

In addition, the Directors and management team demonstrated

their ongoing confidence with further share purchases announced on

19 April 2021.

Whilst the focus this year has been on Sol, we continue our work

with the ICT at Bradford University to look at exciting and new

developments there, and to consistently review and evaluate our

portfolio for commercial opportunity and partnerships.

Ou t l o o k

It has been an exceptional year for Incanthera, one that was

always going to be important in our first full year as a public

company.

I would like to pay tribute to the team at Incanthera who have

worked harder and more determinedly than ever, in spite of often

challenging circumstances in the past year, as they have all

juggled working from home, home schooling and wider family

commitments and challenges.

I thank them all for their dedication to bring this year to the

conclusion we have, and I also extend thanks to our advisers, for

their guidance and support.

In concluding I thank you, our Shareholders, existing and new,

for your continued belief, ongoing encouragement and investment and

support of Incanthera. We are delighted to have delivered solid

progress in our first year as a public company and we look forward

to the future with anticipation.

Tim Mc C a rthy

Cha ir m an

18 May 2021

Chief Executive's Review

Incanthera has marked its first year as a public company with

the emphasis on operational success.

Our evolutionary technology, Sol, is the subject of ongoing

commercial discussions with two Global cosmetic companies.

The Company was founded in 2010, with the aim of bringing

innovative novel technologies to patients. It is very pleasing to

be in the position of reporting on a year which has seen that

vision come closer to fulfilment.

S tr a t e g i c pr o gr ess

Incanthera came to the public stage through the flotation on

AQSE in February 2020, on the basis of developing the technology

behind Sol towards a commercial partnership agreement.

The investment received at the IPO has allowed us to progress

the refinement of our Sol formulation to deliver the exceptional

permeation and sensitisation study results reported in September

2020.

The strength of the data surpassed our expectations,

considerably strengthening Sol's commercial value and potential for

licensing.

The study results proved beyond doubt that Sol has a unique

capability to permeate the skin barrier and deliver effective

treatment at the site of pre-cancerous and cancerous conditions in

a formulation that is as "non-irritant" as some currently marketed

baby sun protection products.

This is breakthrough news for skin cancer patients, offering a

targeted and safe approach and an opportunity to prevent

development of skin cancer.

The combined package of proven efficacy and safety delivers an

even stronger commercial profile, which has concentrated

discussions towards a potential licensing partnership. This is

further enhanced by the filing in July 2020 which will protect our

Sol technology until 2040.

Commercial discussions with a number of interested potential

partners are now active with concentration on two Global cosmetics

companies, as announced in March 2021. These discussions continue

to progress and the management is pleased with the feedback from

both groups. We will look to update the market further as and when

we are able.

In Summary

The public listing on AQSE last year provided a platform to

engage our long-term shareholders in opportunities for the future,

but also to bring in new investment and new investors.

We are delighted to have delivered the operational successes and

to have secured further funding recently which puts us in an

excellent position to conclude the Sol discussions and to continue

to look at the promise our technologies and delivery mechanisms can

bring to our future commercial success.

Our heritage from the Institute of Cancer Therapeutics (ICT) at

the University of Bradford, is something we are proud of. We

continue to work with the team there, who produce ground-breaking

technologies in oncology.

Outlook

Against the backdrop of such an extraordinary time in all of our

lives, I am very aware that to progress, and to be in a position to

look to the future is one that is not afforded to every Company

this year.

I am immensely grateful and proud that our team has shown the

talents to produce such successful results whilst protecting our

assets and financially securing our immediate future.

The continued support of our Shareholders and the new investment

in our company is testament to the achievements and enormous

potential we have in our existing portfolio and opportunities for

the future. We look forward to continuing to enhance and build our

commercial and professional relationships, expertise and ability to

bring novel medicines to patients.

Simon Ward

Chief Executive Officer

18 May 2021

Financial Review

The financial performance for the year ended 31 March 2021 was

in line with expectations.

Lo sses

The total group loss for the year was GBP905k (31 March 2020:

GBP1,128k) including a charge for share-based compensation of

GBP37k (2020: GBP293k). Operating expenses excluding share-based

compensation have increased in line with our ambitions for

progression of Sol, to GBP979k (2020: GBP933k).

Sh ar e -b a sed c om pe n sa ti o n

Acc o u n ti n g s t a n d a r ds r e q ui re a ch ar ge to be m

a de a g ain st t he gr a nt of s h a re o pt io ns a nd r e co g

nis ed in the C o n so l i d a t ed S t a t eme nt of C omp r e h e

ns i ve In c om e. T his amo u n t ed to GBP 37k ( 2 0 20: GBP 2 93

k) a nd has no i m p a ct on c a sh fl o w s.

Hea dc o u nt

Average headcount of the Group for the year was 6 (2020: 5).

T a x a t i o n

The Group has elected to claim research and development tax

credits under the small or medium enterprise research and

development scheme of GBP111k (2020: GBP98k).

Sh ar e c ap it al

The balance of funds from the subscription agreements, entered

into at the time of last year's IPO, were received on the 28(th)

September 2020, realising the final GBP350k of investment. The

subscription comprised of the issue of 3,684,211 ordinary shares of

2p issued at the IPO price of 9.5p.

Whilst the global pandemic has had implications for us all, the

impact on the Group and the continued development of Sol has been

minimal. However, in one key area the situation has held us back,

and that is in the progression towards a license deal. In turn,

this delay has led us to raise additional funds in order to provide

financial security . The placing was a resounding success, raising

GBP1.145m and comprising the issue of 9,538,750 ordinary shares of

2p at an issue price of 12p per share. I n conjunction with this

placing, on the 4th April 2021, 8,500,000 warrants were issued to

participating investors. These warrants were issued at an exercise

price of 20p and have an expiry date of 10 years from placing.

Cas h fl o ws and fi n ancial po si ti on

The cash position at 31 March 2021 increased to GBP957k (31

March 2020: GBP392k). Expenditure on development of the Sol

programme, and recurring general and administrative costs were

offset by the placing of the 28th March (GBP1,145k before expenses)

and receipt of the 2020 tax credit (GBP98k).

Div i d e n d s

N o dividend is recommended (2020: nil) due to the early stage

of the development of the Group.

Lo ss P er Sh ar e

The basic and diluted loss per share was 1.44p (2020:

2.27p).

Y ea r - e n d c ash and s ho r t -t e rm i n v est m e nts, and

c ash on d e po sit h el d:

The increase in year-end cash arises from our fundraise in March

2021 which raised GBP1,145k before expenses.

Highlighted Principal Risks and Uncertainties

C o v i d - 1 9

The Global Pandemic continues, and whilst vaccination roll-out

programmes escalate worldwide, the risk of variants and future

restrictions may continue to pose a threat to the continuation of

business operations, until the wider picture is more secure.

Continuation of the pandemic for a sustained period of months

may affect:

-- O u r ability to raise further finance as a consequence of a

depressed funding environment

-- Our ability to conduct and conclude partnering

discussions

Mitigating Factors:

All government guidance is monitored closely and followed

immediately by advisory notices to all employees, and provision of

the appropriate guidance to advisors and investors, where

necessary, via Regulatory announcement.

Laura Brogden

Chief Financial Officer

18 May 2021

C o n s o l i d a t e d S ta t e m e n t o f Comprehensive Income

For the Year ended 3 1 M a rch 2021

As a t As a t

--------------------------------------------------

3 1 March 3 1 March

--------------------------------------------------

2021 2021

GBP ' 000 GBP ' 000

-------------------------------------------------- ----------------- -----------------

Direct Costs

Operating Expenses

Operating expenses (979) (933)

Share based compensation (37) (293)

-------------------------------------------------- ----------------- -----------------

Total operating expenses (1,016) (1,226)

-------------------------------------------------- ----------------- -----------------

Operating Loss (1,016) (1,226)

-------------------------------------------------- ----------------- -----------------

Loss on ordinary activities before taxation (1,016) (1,226)

Taxation 111 98

-------------------------------------------------- ----------------- -----------------

Loss and total comprehensive expense attributable

to equity holders of the parent for the year (905) (1,128)

-------------------------------------------------- ----------------- -----------------

Loss per share attributable to equity holders of

the parent (pence)

Basic loss per share (pence) (1.44) (2.27)

Diluted loss per share (pence) (1.44) (2.27)

-------------------------------------------------- ----------------- -----------------

C o n s o l i d a t e d a n d C o mpa ny S ta t e m e n ts of F

i n a ncial P o si t i on

A s at 31 M a rch 2021

Group Company

--------------------------------------

As a t As at As a t As at

--------------------------------------

3 1 March 31 March 3 1 March 31 March

2021 2020 2021 2020

GBP ' GBP '

000 GBP'000 000 GBP'000

-------------------------------------- -------------- --------------- -------------- -------------

Assets

Non-current assets

Property, plant and equipment - 3 - -

Intangible assets 655 787 - -

Intercompany Loan 1,156 685

Investments in subsidiary undertaking - - 4,614 4,614

-------------------------------------- -------------- --------------- -------------- -------------

Total non-current assets 655 790 5,770 5,299

Current assets

Trade and other receivables 136 114 34 -

Current tax receivable 108 95 - -

Cash and cash equivalents 957 392 910 346

-------------------------------------- -------------- --------------- -------------- -------------

Total current assets 1,201 601 944 346

-------------------------------------- -------------- --------------- -------------- -------------

Total assets 1,856 1,391 6,714 5,645

-------------------------------------- -------------- --------------- -------------- -------------

Liabilities and equity

Current liabilities

Trade and other payables 165 177 60 4

-------------------------------------- -------------- --------------- -------------- -------------

T ot a l cu rrent li ab il i ti

es 165 177 60 4

-------------------------------------- -------------- --------------- -------------- -------------

Equity

Ave Ordinary shares 1,482 1,217 1,482 1,217

Share premium 5,055 4,443 5,055 4,443

Reorganisation reserve 2,715 2,715 - -

Warrant reserve 1,054 - 468 -

Share based compensation 37 586 37 -

Retained (deficit)/profit (8,651) (7,747) (388) (19)

-------------------------------------- -------------- --------------- -------------- -------------

Total equity attributable to equity

holders of the parent 1,691 1,214 6,654 5,641

-------------------------------------- -------------- --------------- -------------- -------------

Total liabilities and equity 1,856 1,391 6,714 5,645

-------------------------------------- -------------- --------------- -------------- -------------

N o S t a t eme nt of C omp r e h e ns i ve In c ome is

presented in these financial statements for the Parent Company as

provided by Section 408 of the Companies Act 2006. The loss for the

financial year dealt with in the financial statements of the Parent

Company was GBP369k (2020: GBP19k.)

C o nsolidated S ta t e m e n t of C h a n g es in E q u i ty

F o r t he y e ar en ded 31 M a rch 2021

Ordinary Share Reorganisation Warrant Share based Retained

shares premium reserve reserve compensation deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- --------- ----------- -------------- -------- ------------- ----------- ----------

Balance at 31 March

2019 25 7,305 - - 401 (6,727) 1,004

Total comprehensive

expense

for the period - - - - - (1,128) (1,128)

Transactions with

owners

Share issue -

acquisition

of Incanthera R&D

Limited 946 (3,663) 2,715 - - - -

Share issue - cash 180 554 - - - - 734

Share issue - creditor

swap 66 247 - - - - 313

Share based

compensation

- share options - - - - 293 - 293

Share based

compensation

- lapsed options - - - - (108) 108 -

Total transactions

with

owners 1,192 (2,862) 2,715 - 185 108 1,339

---------------------- --------- ----------- -------------- -------- ------------- ----------- ----------

Bala n ce a t 31 M a

rch

2 0 20 1,217 4,443 2,715 - 586 (7,747) 1,214

---------------------- --------- ----------- -------------- -------- ------------- ----------- ----------

Total comprehensive

expense

for the period - - - - - (905) (905)

Transactions with

owners

Warrant

reclassification - - - 586 (586) - -

Share issue- cash 264 612 - 468 - - 1,344

Share based

compensation

- share options - - - - 37 - 37

Total transactions

with

owners 264 612 - 1,054 (549) - 1,381

---------------------- --------- ----------- -------------- -------- ------------- ----------- ----------

Balance at 31 March

2021 1,482 5,055 2,715 1,054 37 (8,651) 1,691

---------------------- --------- ----------- -------------- -------- ------------- ----------- ----------

Consolidated and Company Statements of Cash Flow

F o r t he y e ar en ded 31 M a rch 2021

Gr oup C om pa ny

--------------------------------------------- ------------------------ --------------------------------

Y ear Y ear Y ear Y ear

---------------------------------------------

e nded en ded E nded En ded

3 1 March 3 1 M a 3 1 March 3 1 M a

r ch r ch

2021 20 20 2021 20 20

GBP ' GBP ' 000 GBP ' GBP ' 000

000 000

--------------------------------------------- --------- ------------- ------------------ ------------

Cas h fl o ws fr om ope r a ting a c t

i v i ties

Loss before taxation (1,016) (1,226) ( 369) ( 1 9)

Depreciation and amortisation 135 135 - -

Share based compensation 37 293 37 -

--------------------------------------------- --------- ------------- ------------------ ------------

( 332

(844) (798) ) ( 1 9)

Chang es i n w or k ing capit al

(Increase)/decrease in trade and other

receivables (21) (14) (504) (686)

Increase/(decrease) in trade and other

payables (12) (46) 56 4

Creditor swap - 313 - 313

--------------------------------------------- --------- ------------- ------------------ ------------

Cas h used i n ope r a tio ns (34) 253 (448) (369)

Taxation received 98 27 - -

N et cash used in ope r a ting a c t i

v i ties (779) (5 1 8) (780) (388)

Cas h fl o ws fr om fina ncing a c t i

v i ties

Proceeds from issue of shares 1,495 855 1,495 1,495 855

Issue costs (151) (121) (151) (121)

--------------------------------------------- --------- ------------- ------------------ ------------

N et cash g e n e r a ted fr om fina ncing

a c t i v i ties 1,344 734 1,344 734

--------------------------------------------- --------- ------------- ------------------ ------------

M o v e m en ts in cash a nd cash eq u

i v a lents in t he pe ri od 565 216 564 346

--------------------------------------------- --------- ------------- ------------------ ------------

Cash and cash equivalents at start of period 392 1 7 6 346 -

--------------------------------------------- --------- ------------- ------------------ ------------

Cas h a n d cash eq u i v a lents at end

of pe ri od 957 392 910 346

--------------------------------------------- --------- ------------- ------------------ ------------

Notes to the Financial Statements

1 . Basis of Preparation

T h e c o n so l i d a t e d fi n a nci al s t a t eme n ts h

ave b een p r e p a r ed in a cc o r d a n ce w i th I n t e r n at

ion al F i n a nci al Re p o r ti ng S t a n d a r ds ( ' I F R S

') as a do p t ed by the E u r ope an U n ion, I F R IC i n t e r p

r e t at io ns a nd the C om p ani es Act 2 006 a pp l i c a b le

to c om p ani es op er ati ng u n d er I F R S.

T h e c o n so l i d a t e d fi n a nci al s t a t eme n ts h

ave b een p r e p a r ed u n d er the hi s t ori c al c ost c o n v

e n t ion m o d ified by the r e v al u at ion of c e r t ain fi n

a nci al in s t r u m e n t s.

T h e c o n so l i d a t e d fi n a nci al s t a t eme n ts a re

p r e s e n t ed in S t er li ng ( GBP) a nd r o u n ded to the n e

a r est GBP00 0. T his is the p r ed o mi n a nt f u n c t ion al c

u r r en cy of the G r ou p a nd is the c u r r en cy of the pr i m

a ry e c ono m ic e n v i r o n me nt in w h ich it op er a t es. F

o r e ign t r an s a c t io ns a re a cc o u n t ed in a cc o r d a

n ce w i th the p o l ic i es s et out b el o w.

2. Lo ss per sh are

B a s i c loss per share is calculated by dividing the loss for

the period attributable to equity holders by the weighted average

number of ordinary shares outstanding during the year.

For diluted loss per share, the loss for the year attributable

to equity holders and the weighted average number of ordinary

shares outstanding during the year is adjusted to assume conversion

of all dilutive potential ordinary shares.

As at 31 March 2021, the Group had 15,359,417 (2020: 13,268,628)

share options, warrants and subscriptions outstanding which are

potentially dilutive.

The calculation of the Group's basic and diluted loss per share

is based on the following data:

As a t As at

---------------------------------------------------------

3 1 March 31 March

---------------------------------------------------------

2021 2021

GBP ' 000 GBP'000

--------------------------------------------------------- -------------- --------------

Loss for the year attributable to equity holders

for basic loss and adjusted for the effects of dilution (905) (1,128)

--------------------------------------------------------- -------------- --------------

As a t As at

3 1 March 31 March

2021 2021

GBP ' 000 GBP'000

--------------------------------------------------------- -------------- --------------

Weighted average number of ordinary shares for basic

loss per share 62,926,224 49,642,344

--------------------------------------------------------- -------------- --------------

Effects of dilution:

Share options - -

--------------------------------------------------------- -------------- --------------

Weighted average number of ordinary shares for basic

loss per share 62,926,224 49,642,344

--------------------------------------------------------- -------------- --------------

3 1 March 31 March

2021 2021

GBP ' 000 GBP'000

--------------------------------------------------------- -------------- --------------

Loss per share - basic and diluted (1.44) (2.27)

--------------------------------------------------------- -------------- --------------

The loss and the weighted average number of ordinary shares for

the years ended 31March2020 and 2021 used for calculating the

diluted loss per share are identical to those for the basic loss

per share. This is because the outstanding share options would have

the effect of reducing the loss per ordinary share and would

therefore not be dilutive under the terms of International

Accounting Standard ('IAS') No 33.

3. Dividend

No dividend is recommended (2020: nil) due to the early stage of

the development of the Group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXGPUCWAUPGPUM

(END) Dow Jones Newswires

May 18, 2021 02:00 ET (06:00 GMT)

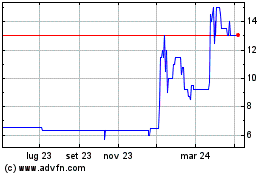

Grafico Azioni Incanthera (AQSE:INC)

Storico

Da Mar 2024 a Apr 2024

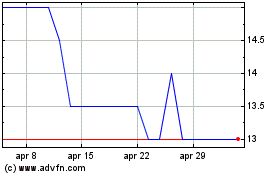

Grafico Azioni Incanthera (AQSE:INC)

Storico

Da Apr 2023 a Apr 2024