Whales Across These Five Chains Are Heavy On Stablecoins, Should You Be Too?

18 Ottobre 2022 - 1:00AM

NEWSBTC

Crypto whales all across the board have been seemingly taking more

conservative positions in stablecoins since the bear market

started. This has evolved into larger holdings in dollar-pegged

cryptocurrencies which have very low volatility. These digital

assets have since become a safe haven for investors who are looking

to escape highly volatile tokens but still keep their funds in the

crypto market. Crypto Whales Move To Stablecoins Usually,

there has been a marked increase in the stablecoin holdings of the

top Ethereum whales but this trend of moving into stablecoins seems

to not be localized to just Ethereum whales alone. Data shows that

the holdings of whales across 5 blockchains are increasingly

skewing towards stablecoin holdings. Related Reading: Bitcoin

Shakes Off Bears Following CPI Release, But Will This last? The 5

blockchains in this report are Ethereum, Fantom, BNB Chain,

Avalanche, and Polygon, and takes a look at the holdings of the top

1,000 whales. The holdings of the largest whales across all of

these chains are mostly in the native tokens of the chain, but

stablecoins such as USDT and USDC are increasingly important to

them. For the top 1,000 ETH whales, USDC and USDT currently account

for $842 million (26.9%) and $710 million (22.7%) of their holdings

respectively. BNB Chain whales leaned even more heavily with BUSD

making up 41.19% ($365 million) and USDT making up 16.22% ($144

million) of their holdings. USDT market dominance at 7.68% |

Source: Market Cap USDT Dominance on TradingView.com Fantom (FTM)

whales were more into USDC with 30.75% ($12 million) of their

holdings in the stablecoin, and 4.67% ($1.8 million) in fUSDT.

Avalanche whales hold 74.2% ($265 million) of their holdings in

USDT, and 5.68% ($20.3 million) in USDC. Polygon whales allocated

the least to stablecoins with only 6.09% ($19.1 million) held in

USDC. Time To Flee For Safety? Whale holdings and their investment

trends can often sway investor sentiment because it shows what

these large holders are thinking about the crypto market. Their

recent move to stablecoin holdings shows that they expect the

market prices to go much lower in the near future. Related Reading:

Why You Should Start Paying Attention To Football Fan Tokens This

is not strictly out of line given that indicators show that the

crypto market has yet to see its bottom. Previous bear markets have

seen the prices of digital assets such as bitcoin and Ethereum

falling more than 80% each, putting the market bottom of bitcoin at

around $13,000. Given this, and the fact that the market follows

the price of bitcoin, if it is not at the bottom, it is a good time

to seek safe haven in these digital assets. It helps investors

preserve the value of their funds while waiting for better market

conditions to start reinvesting. Featured image from Schroders,

chart from TradingView.com Follow Best Owie on Twitter for market

insights, updates, and the occasional funny tweet…

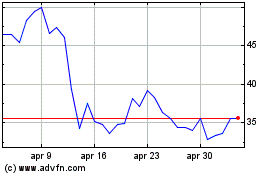

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Apr 2023 a Apr 2024