Bitcoin And Ethereum Correlation At A Staggering 97%, BTC Rally Incoming?

31 Marzo 2023 - 11:11AM

NEWSBTC

As Q1 2023 comes to a close, the Bitcoin and Ethereum correlation

stands at a staggering 97%, trackers indicate. The Bitcoin And

Ethereum Price Correlation Bitcoin and Ethereum are the world’s

most valuable coins by market cap. Because of their first mover

advantage, Bitcoin, the first blockchain network; and Ethereum, a

legacy smart contracting platform; their native currencies, BTC and

ETH, are also the most liquid and increasingly correlating in price

movements. At the time of writing on March 31, trackers show

that the average daily trading volumes of BTC and ETH trading

volumes across various exchanges stood at $19.7 billion and $8.4

billion, respectively. Related Reading: Bitcoin Price Shows Signs

of Weakness But Key Uptrend Support Intact The two coins are also

listed in almost all popular centralized cryptocurrency exchanges.

Notably, because of the smart contracting capability of Bitcoin,

the coin has been tokenized. Billions have been deployed on

Ethereum, and other smart contracting platforms. There, BTC holders

engage in DeFi and other activities not possible on the Bitcoin

mainnet. That Bitcoin and Ethereum prices have been moving in

lockstep over the past few months could be attributed to several

factors. However, what stands out is that these coins are the most

liquid in the space, with an active base justifying their mega

valuations. Their coins can also be quickly shuttled across

exchanges without liquidity concerns, attracting macro

investors. Why The Correlation? Bitcoin has long been viewed

as a store of value asset and a medium of exchange. The coin has a

limited total supply of 21 million, and over 90% have been mined.

Proponents hold that during a crisis in traditional finance, the

coin can be a hedge. This was recently observed following the bank

run at Silicon Valley Bank (SVB) and the closure of Signature

Bank. Besides, crypto holders also prefer the coin whenever

there are concerns in the industry. Days after the temporary

de-pegging of USDC, a stablecoin, Bitcoin prices rose. Meanwhile,

Ethereum is comparatively liquid and is becoming deflationary, a

reason why a section of its supporters say ETH, its native

currency, would become “ultra sound money,” better than BTC and

gold. “a large portion of the Ethereum ecosystem wants ETH to

be ultra sound money”pic.twitter.com/3MI2nDHaXe — ultra sound money

🦇🔊 (@ultrasoundmoney) July 5, 2021 Aside from liquidity, Ethereum

is the largest and most active smart contracting platform.

DeFiLlama data shows that over 50% of DeFi’s total value

locked (TVL) is in Ethereum-based dapps. Related Reading: Ethereum

Poised To Breach $2,000 Ceiling In Coming Months – Here’s Why The

correlation may continue rising in the months ahead as crypto gains

mainstream adoption. Macro investors would most likely gravitate to

BTC and ETH, lumping them as risk assets as they diversify their

portfolios. Regulatory clarity, with the United States Security and

Exchange Commission (SEC) chairman saying Bitcoin is a commodity

while the Commodity Futures Trading Commission (CFTC), in a lawsuit

against Binance and its CEO, Changpeng Zhao, also classifying ETH

as a commodity, could further boost this correlation. CFTC says

that Bitcoin, Ethereum, and Litecoin are Commodities

pic.twitter.com/nSNX2YIYLP — Conor (@jconorgrogan) March 27, 2023

Still, it is yet to be seen how Bitcoin prices will react ahead and

after the Shanghai Upgrade on Ethereum in mid-April. Feature

Image From Canva, Chart From TradingView

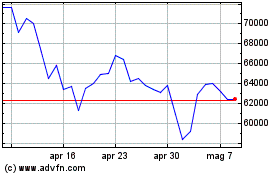

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Apr 2023 a Apr 2024