Euphoria Turns Into Fear, Bitcoin Retraces From $25,000 High

17 Febbraio 2023 - 6:00PM

NEWSBTC

Bitcoin began the week climbing to its highest level in 2023.

Against all odds, the largest cryptocurrency on the market

reclaimed the $25,000 level for the first time since August 2022,

only to be rejected hours after reaching the milestone. What looked

like a full-throttle run to $27,000 has turned into fear. Coinglass

data shows that investors experienced Fear of Missing Out (FOMO)

liquidations in the last 24 hours, with $69 million liquidated in

Bitcoin alone. Related Reading: Dogecoin Down 3%, Here’s The Metric

That Signaled This Decline In Advance Can Bitcoin Continue Its Bull

Run And Reach New Yearly Highs? With the Federal Reserve’s (Fed)

efforts to control the pace of inflation not entirely successful,

its policies could lead to another 50 basis points (bps) interest

rate hikes and an extended period of the hawkish policy, which

would hurt the crypto market. This could freeze Bitcoin’s

uptrend price action and form a range at the $23,500 support line

or a significant drop down to the $19,000 support for a retest of

the level. Bitcoin is consolidating at the $23,500 level,

representing a 2.5% drop in price over the past 24 hours. However,

Bitcoin has remained in the green over the last seven days, with a

gain of 9.2% after the recent spike to $25,000. The billionaire and

Co-founder of the Gemini exchange Cameron Winklevoss, addressed the

recent Bitcoin price performance and the spike to $25,000, well

above the levels last seen when FTX collapsed. For Winklevoss, this

signals that the crypto industry has moved beyond the painful

chapter of the 2022 bear market and that the crypto space will “not

be defined by it.” What Has Caused the Spike In The BTC Price? The

recently increased Securities Exchange Commission (SEC) regulatory

actions towards the crypto industry and the exchanges providing

services in the U.S. jurisdiction caused capital to flee from the

stablecoins into the top cryptocurrencies in the market. According

to Bitazu Capital Co-founder Mohit Sorout, Bitcoin has triggered

the Dollar Cost Average (DCA) indicator, which measures the

performance of Bitcoin when investing on a dollar-cost averaging

basis. Sorout states that this indicator has only flashed three

times in the BTC market’s history. Each time this indicator signal

flashed, the price of Bitcoin displayed massive rallies. In 2015,

the price of Bitcoin jumped 7400%, in 2019 to 160%, and the last

time this indicator flashed, the price of Bitcoin reached its new

all-time high of $69,000 with a 640% rally. February 16 marked the

4th time this indicator signaled a possible start of a newly formed

bull market. Some investors attribute the recent rally to a “short

squeeze” and the fact that investors are regaining confidence in

the crypto industry and the opportunities to make profits amid the

current macroeconomic conditions. Related Reading: Bitcoin Price

Gets Rejected At $25,000, But Is This The End? Bitcoin is trading

at $23,800 at press time, testing the $23,500 support line; if it

holds, the price action can retest the resistance level at $25,000.

Despite the challenges the crypto industry has been experiencing,

investors seem optimistic and hungry to gain exposure to risk

assets. Featured Image from Unsplash, chart from

TradingView.

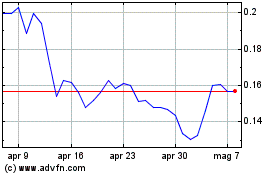

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Apr 2023 a Apr 2024