Bitcoin Expert Predicts Correction To $78,000 CME Gap, Reveals Date For Next Bear Market

15 Novembre 2024 - 8:30AM

NEWSBTC

Bitcoin (BTC) has recently experienced a massive surge, rising over

39% since November 5th to reach a new record high of $93,250 on

Wednesday. However, the largest cryptocurrency by market

capitalization has since experienced a pullback and is currently

trading around $88,800. Market analyst Quinten Francois has

suggested that this retracement could extend further, potentially

dropping below the $80,000 mark due to a significant CME gap

located beneath this level. 12% Retracement Ahead? CME

gaps refer to price discrepancies on the Chicago Mercantile

Exchange Bitcoin futures chart, where the closing price of one

trading day differs from the opening price of the next. These gaps

often arise following substantial price movements and are typically

filled as the market stabilizes. Francois has identified a CME gap

at the $78,000 level, which would represent a retracement of just

over 12% from current prices if filled in the coming days. Related

Reading: Solana Rising: Key Metrics Hint At Serious Ethereum

Competitor Such a correction could be healthy for BTC, as it often

liquidates long positions, setting the stage for future upward

movements. Historical patterns suggest that these pullbacks can

provide the necessary liquidity for the cryptocurrency to advance

further. However, if Bitcoin sees increased selling pressure at

this level, additional support levels are identified at $72,000 and

$69,000. The potential for a drop below these levels would take BTC

back to the prices seen before Donald Trump’s election victory on

November 5th, which many believe was a catalyst for the recent

price spike. Could Trump’s Bitcoin Strategy Influence Future

Price Movements During his presidential campaign, Trump

continuously expressed his intention to support the growth of

digital assets, positioning Bitcoin as a central element of his

next administration’s economic policy. One

of Trump’s promises includes establishing Bitcoin as a

strategic reserve asset for the United States. Pro-crypto

Senator Cynthia Lummis has taken this initiative to the Senate by

introducing the Bitcoin Act, which aims to increase US Bitcoin

reserves to 1 million coins, potentially reducing market supply and

positively impacting the BTC price. Related Reading: Dogecoin Price

Could See Swift 175% Surge As DOGE/BTC Pair Records Major Breakout

Francois has also forecasted a bear market for the broader

cryptocurrency sector, predicting it could emerge between 2026 and

2027. This suggests that the next two years will likely witness an

extended bull run for Bitcoin and the overall digital asset

ecosystem. However, the expert cautioned that if the $78,000

CME gap is not filled before a significant price rally, it may need

to be addressed in the subsequent bear market phase, suggesting

further price fluctuations ahead. Featured image from DALL-E, chart

from TradingView.com

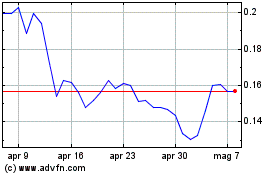

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Nov 2023 a Nov 2024