Bitcoin & The Hunt For A Green October | BTCUSD September 27, 2022

27 Settembre 2022 - 10:59PM

NEWSBTC

In this episode of NewsBTC’s daily technical analysis videos, we

examine the reason for today’s volatility and rally rejection. We

also look ahead at the factors that could give Bitcoin price a

green October. Take a look at the video below: VIDEO: Bitcoin Price

Analysis (BTCUSD): September 27, 2022 This morning, Bitcoin

began with a large, more than 5% move to the upside, taking the top

cryptocurrency to back over $20,000. Before bulls could at all

breath a sigh of relief, bears swatted the rally back down a full

thousand plus dollars to just under $19,000. Related Reading:

Bitcoin Shows Resilience In Dollar-Driven Bloodbath | BTCUSD

September 26, 2022 Bears And Bulls Battle Over Control Of Momentum

The strong showing by both bears and bulls makes sense, given the

potential for a bullish crossover in daily momentum on the LMACD.

Crossovers in the past have been used as bait to liquidate

over-eager traders and it has happened once again. The severity of

the showdown is due to the same situation happening across several

timeframes. The 3-Day LMACD also shows momentum teetering between

bear and bull along the zero line. BTC compared to other asset

classes | Source: BTCUSD on TradingView.com Today’s Rejection

Resembles Crypto Winter Bottom On weekly timeframes, there is also

such a potential bullish crossover on the LMACD. Bears have

repeatedly defended this signal. Before the rejection today,

Bitcoin was back in the green and beyond the zero-line.

Interestingly, the current weekly candle also closely resembles the

corresponding candle that appeared at the bullish crossover at the

2018 bear market bottom. Once again, there is a long upside

wick coinciding with the crossover. The crossover was ultimately

confirmed despite being defended by bears, and a bottom of the last

major crypto winter was in. Several weekly indicators could suggest

the bottom is in | Source: BTCUSD on TradingView.com Related

Reading: Can Bitcoin Withstand Continued Dollar Strength? | BTCUSD

September 22, 2022 Why Bitcoin Could Close October In The Green

Finally, on monthly timeframes, although we are far away from any

type of a bull cross, bears must maintain momentum or risk allowing

bulls to take back control over crypto. With only three days

left in the monthly timeframe, and bullish crossovers on the daily,

3-day, and weekly, the hunt for a green October is on. Out of the

last twelve Octobers, Bitcoin closed only four of them red.

Currently, no monthly candles have closed below the former all-time

high set back in 2017, but this is what bears are salivating over.

If bulls can prevent a close below this level, they could send

bears back into hibernation for at least another three months. Even

if bulls close below the critical support level, the resulting

candle will look just like the monthly candle where the tides did

ultimately turn, and a new uptrend began. Is the Bitcoin forming an

Adam and Eve bottom? | Source: BTCUSD on TradingView.com Learn

crypto technical analysis yourself with the NewsBTC Trading Course.

Click here to access the free educational program. Follow

@TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram

for exclusive daily market insights and technical analysis

education. Please note: Content is educational and should not

be considered investment advice. Featured image from

iStockPhoto, Charts from TradingView.com

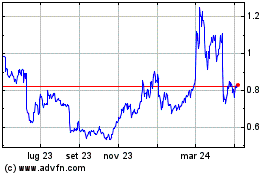

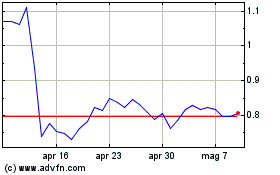

Grafico Azioni EOS (COIN:EOSUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni EOS (COIN:EOSUSD)

Storico

Da Apr 2023 a Apr 2024