Bitcoin And The Golden Ratio Bottom | BTCUSD Analysis September 29, 2022

29 Settembre 2022 - 10:21PM

NEWSBTC

In this episode of NewsBTC’s daily technical analysis videos, we

examine how Bitcoin might have bottomed precisely at the 1.618

Fibonacci extension, using Elliott Wave Theory. Take a look at the

video below: VIDEO: Bitcoin Price Analysis (BTCUSD): September

29, 2022 Using the Fibonacci retracement tool not for retracement

but for extensions, we have found a golden discovery using math.

Related Reading: Bitcoin & The Global Currency Meltdown |

BTCUSD September 28, 2022 Did Bitcoin Bottom At The Golden Ratio?

In Elliott Wave Theory, corrections come in ABC patterns. Taking

the Fibonacci retracement tool to draw from the bottom to the top

of the A wave will provide a Fibonacci extension target for where a

C wave correction might end. The wick down to $17K touched

precisely at the 1.618 Fibonacci with pinpoint accuracy. 1.618 is

the golden ratio, also known as the divine proportion. Bitcoin

downtrend stops at precisely the golden ratio | Source: BTCUSD on

TradingView.com Past Bear Market Bottoms Pinpointed With Golden

Accuracy Shocked by this discovery, we used the same strategy to

examine the 2018 bear market. Lo and behold, the target terminated

at the golden ratio yet again. To demonstrate this, we have

drawn in the B wave descending triangle, and taken the Fibonacci

extension from the bottom of the A wave to the top where it began.

As you can see, this projected the bear market bottom perfectly.

Zooming out further, could this really have happened in the 2015

bear market also? Adding yet another ABC correction, the same

pattern fits, albeit not quite as precisely at the rest of the

analysis. Still, its accurate enough where the golden ratio could

clearly be a factor in where Bitcoin ultimately bottoms. Bitcoin

has bottomed at the golden ratio in each bear market | Source:

BTCUSD on TradingView.com Related Reading: Bitcoin & The Hunt

For A Green October | BTCUSD September 27, 2022 Could Fibonacci

Project The Next Major Peak In Crypto? We now know that projecting

extensions from the A wave gives us the C wave bottom… hopefully.

But how does this work when projecting a target to the upside?

Drawing from the 2017 peak to the bear market bottom, projected the

top of the 2021 bull market. If the same is true for the next bull

market, much like each bear market has repeated, the golden ratio

could take Bitcoin to a price of more than $161,000 per coin.

The next Bitcoin peak could be over $161,000 per coin | Source:

BTCUSD on TradingView.com Learn crypto technical analysis yourself

with the NewsBTC Trading Course. Click here to access the free

educational program. Here is a $49 discount pass to 21 Days To

Better Crypto Trading by @elliottwaveintl. It gets you instant

access to 3 learning resources on how to trade crypto using EW, the

Crypto Trader’s Classroom service, & on Oct.5, access to the

Crypto Pro Service ➡️https://t.co/ICKzvNnvG5

pic.twitter.com/gAyKxTdQNl — Tony "The Bull" Spilotro

(@tonyspilotroBTC) September 28, 2022 Follow @TonySpilotroBTC on

Twitter or join the TonyTradesBTC Telegram for exclusive daily

market insights and technical analysis education. Please note:

Content is educational and should not be considered

investment advice. Featured image from iStockPhoto, Charts from

TradingView.com

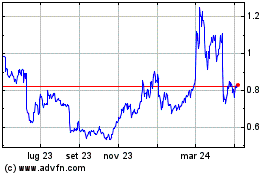

Grafico Azioni EOS (COIN:EOSUSD)

Storico

Da Mar 2024 a Apr 2024

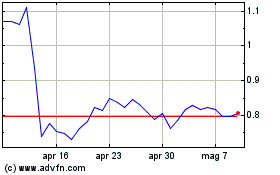

Grafico Azioni EOS (COIN:EOSUSD)

Storico

Da Apr 2023 a Apr 2024