Ethereum Pushes Above Vital Resistance, Could Soon Revisit $1500

19 Luglio 2022 - 6:00AM

NEWSBTC

The bulls for Ethereum are back on the chart, the altcoin has

appreciated over the last 24 hours. Bitcoin’s northbound movement

has helped Ethereum gain some of its lost value. Other altcoins

have also followed a similar trading pattern. Ethereum recently

touched the $1500 mark but at press time, the coin was placed

slightly below the aforementioned level. In the past week, Ethereum

registered close to 30% increase in its value. The new week has

made market movers trade in the green. With consistent increase in

price, Ethereum left behind the $1280 resistance mark which the

coin previously struggled to move past. It faced resistance at the

aforementioned level a couple of times. Buying strength also

returned into the market which further helped ETH to maintain its

price action. For ETH to solidify its bullish stance, its important

Ethereum maintains its price above the $1500 mark. With Bitcoin

moving over $22,000 and ETH touching $1500, market capitalisation

also soared. The global cryptocurrency market cap today was at

$1.04 Trillion after more than a month with a positive 3% change in

the last 24 hours. Ethereum Price Analysis: Four Hour Chart ETH was

trading at $1476 at the time of writing. It was moving very close

to the $1500 mark which it touched few trading sessions ago.

Overhead price ceiling was at $1500, and climbing above the same

could intensify ETH’s bullish stance. On the flipside, if Ethereum

witnesses a correction, It would first fall to $1300 and then to

$1100 respectively. ETH has continued to register higher highs

which is a sign of a price uptrend. Amount of Ethereum traded

declined which meant that buyers dominated the market. Technical

Analysis ETH has recovered in terms of buying strength over the

past week. Buying pressure has consistently built up and remained

that way. The Relative Strength Index was over the overbought

territory as buyers continued to dominate. In the same vein, ETH’s

price was above 20-SMA portraying that buyers were driving the

price momentum on the four hour chart. Not only that, price of the

altcoin was stationed above the 50-SMA and 200-SMA lines too, this

marked bullish strength for the king of altcoins. Related Reading |

Liquidations Cross $230 Million As Ethereum Barrels Past $1,400

Growth in buying strength is often synonymous with increased

capital inflows of an asset. The indicator pictured the same

reading on the above chart. Chaikin Money Flow registers capital

inflows and outflows. The indicator was above the half-line which

meant that capital inflows were more compared to capital outflows

on the four hour chart. Awesome Oscillator marks the price

direction and potential reversal too. AO displayed green histograms

and that signified buyers were back as it also can be interpreted

as buy signal for Ethereum. Push above the $1500 mark remains

important for ETH along with buyers assistance in the market.

Related Reading | TA: Ethereum Outpaces Bitcoin, Why ETH Could Rise

To $1,500 Featured image from UnSplash, chart from TradingView.com

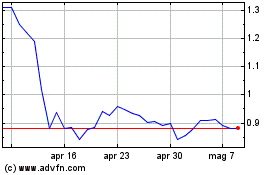

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Apr 2023 a Apr 2024