Cardano Network Transactions Surge Despite Market Downturn

29 Aprile 2023 - 2:05PM

NEWSBTC

Cardano (ADA) is in a downtrend as it sheds some of its recent

price gains. Despite the price decline, it is experiencing a surge

in transaction volume on the network. The network holds the

enviable reputation of being a developer’s hub, with several

exciting projects launched on its network. However, it is

still subject to the general economic factors influencing

cryptocurrencies, such as the Consumer Price Index (CPI).

Crypto Analyst Reviews ADA’s Performance A crypto analyst on

Twitter, Elite XBT, noted that Cardano transaction volume has

increased since the start of 2023. However, he stated that market

volatility had put the price under significant pressure.

According to the chart, the transaction volume fell below 10B ADA

in January 2023. However, it has risen above 20B ADA and possibly

reclaimed its 50B ADA at its all-time high (ATH) value last year.

Related Reading: Terra Classic (LUNC) Down 4% As Developer Accuses

Terraport Of Rugpull According to another analyst, the increase in

transaction volume is a function of increased activities from the

whales and institutional holders. He believes the increased volume

is a bullish sign and supports ADA’s swing into an uptrend. Also,

Input Output Global (IOG), responsible for Cardano’s research and

development, shared its weekly development report. The report

revealed that Cardano’s network had processed 65.4 million

transactions within the past week. Notably, Cardano surpassed 4

million wallets on its network in March 2023. It indicates the

continued growth potential of the Cardano network as more investors

sign up. Twitter user Alexander Legolas also believes that

the current trend would shift from bear to bull as the protocols

and upgrades become more attractive to users. What Next For ADA?

ADA is still trading in the red today, forming a second consecutive

red candle on the daily chart. The bears have returned to push

their price down in the last two days. Its Relative Strength Index

(RSI) is 51.24 in the neutral zone. Notably, the indicator is

moving downwards due to bearish pressure. Related Reading: Terra

Classic Recent Efforts Could Benefit LUNC’s Growth Potential ADA’s

Moving Average Convergence/Divergence (MACD) has dropped below its

signal line, a bearish sentiment. However, despite its price slump,

ADA has remained above its 50-day and 200-day Simple Moving

Averages (SMA). It implies that its short and long-term outlook

remains bullish, and the decline might be a brief retracement for

consolidation. The $0.3512 support will prove critical to prevent a

further decline and might act as a price pivot to resume the

uptrend. However, ADA must overcome the $0.4186 resistance to

continue its uptrend. ADA will likely resume its uptrend in

the coming days based on the positive activities and increased

transactions on its network to fuel the rally. Featured image from

Pixabay and chart from TradingView

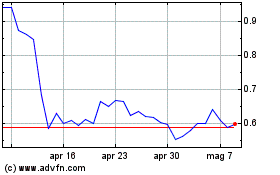

Grafico Azioni Terra (COIN:LUNAUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Terra (COIN:LUNAUSD)

Storico

Da Apr 2023 a Apr 2024