Can Russia Circumvent EU Sanctions Through Cryptocurrency?

02 Novembre 2022 - 12:00AM

NEWSBTC

Russia has seemingly turned to cryptocurrency since the West

decided to ‘punish’ the nation for its invasion of Ukraine. A list

of sanctions had been imposed upon the country by the United States

and the EU which worked to essentially cut Russia off from world

traders. However, with the rise in popularity of crypto, it has

provided a possible way for the country to evade these sanctions

which would have otherwise stuck when fiat currencies were the only

form of payment. Why Russia Could Turn To Cryptocurrency One thing

that has drawn investors to cryptocurrencies such as Bitcoin is the

fact that they are decentralized. A decentralized currency is not

controlled by an entity. Hence, sanctions do not apply to them

regardless of how severe they are. This has made it attractive to

those who want to evade detection by governments, or in this case,

countries trying to circumvent sanctions. Related Reading: Why The

Dogecoin And Meme Coin Rally May Not Be Over Just Yet Lately,

Russia has been warming up to crypto as a way to foster trade

around the sanctions. The most prominent of these have been the

sanctions on Russian gas purchases, which breeds the possibility of

the country accepting crypto as a form of payment for their oil and

gas. By using a cryptocurrency such as Bitcoin, Vladimir Putin

could be able to completely evade these sanctions and the

established banking system. Back in September, the US

Treasury’s assistant secretary for Terrorist Financing and

Financial Crimes, Elizabeth Rosenberg, told lawmakers that it was

possible for the Kremlin to actually evade sanctions levied against

it. Senator Elizabeth Warren also echoed this concern, pointing to

the fact that there was already widespread use by North Korea to

evade sanctions, and it was just as easy for Russia to do the same.

Market cap at $984 billion | Source: Crypto Total Market Cap on

TradingView.com Still An Important Player Even though there are

currently sanctions against Russia, the EU still relies heavily on

the supply of oil and gas from the Kremlin. Companies in Europe,

although they have shown support for Ukraine in the war, continue

to quietly acquire products from Russia. Given this, it is not a

stretch to say that Russia would have an abundance of customers if

it were to switch to crypto payments for its oil and gas. It is

already an established player in the oil and gas industry and

companies will not have an easy go of it having to change

suppliers. So it would make sense to go through the relatively

small inconvenience of converting fiat to crypto to pay Russia than

spending millions of dollars to change international suppliers.

Related Reading: Fed Could Hike Interest Rates By 75 BPS, Here’s

What It Means For Bitcoin Russia is already softening its stance on

cryptocurrencies since the war started. In September, it was

reported that the government had reached an agreement with the

central bank on a rule that would allow residents to carry out

cross-border payments using crypto. Trade Minister Denis Manturov

said back in May that the country would legalize digital asset

payments “sooner or later.” Featured image from PYMNTS, chart from

TradingView.com Follow Best Owie on Twitter for market insights,

updates, and the occasional funny tweet…

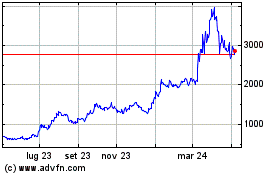

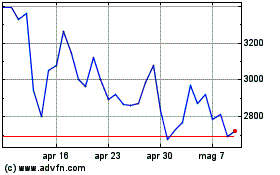

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Apr 2023 a Apr 2024