Amid FTX Rumors Tether’s USDT Peg Of $1 Wobbles – What’s Going On?

10 Novembre 2022 - 2:18PM

NEWSBTC

The crypto market still seems to be in the grasps of FTX and

Alameda. Currently, rumors are circulating that Tether’s stablecoin

USDT might be more affected by the downfall of FTX than it would

like to admit. Moreover, there currently seems to be an attack on

USDT as a result of which Tether (USDT) briefly lost its usual peg

to $1. The largest stablecoin by market cap was trading below

$0.9400 temporarily at Kraken, other exchanges saw minor

deviations. Sam Bankman-Fried company Alameda, which borrowed

$250,000 USDT from Aave and exchanged it on Curve this morning, may

be behind the attack. The address is clearly attributable to

Alameda. Related Reading: Bitcoin Plunges To $15,700 As Binance

Rejects FTX Takeover – Levels To Watch Speculation on Twitter has

it that Alameda is trying to initiate a USDT depeg with his

on-chain visible transaction to trigger fear. He could sell USDT

short, though it is not clear at this time what the company’s total

trading position is. Some voices in the crypto community suspect

that the strategy is multi-layered and a huge attempt to get

everything back in a single trading attempt. Anonymous trader

“Hsaka” provided the following thesis on Twitter: The 250k usdt

short is not the most important move imo, more about the second

order effect re usdt perps and related positioning around that

Especially assuming it is the ~$300m ftx withdrawal entity that

still holds $100m+ usdt. I still don’t know anything about CEX

activity. alameda trying to initiate a usdt depeg with a smol 250k

onchain visible tx that will generate fear usdt pairs start

risingsolusdt perps that had been giga shorted squeezealameda owns

a lot of solsell post squeeze, usdt recovers, profit? ALL

SPECULATION. I AM A CLUELESS WOLF https://t.co/tNoocbUnzO — Hsaka

(@HsakaTrades) November 10, 2022 FUD Is Nothing New For Tether At

the same time, voices are increasing that the aggressor

specifically wants to spread FUD in order to trigger a similar run

on Tether (USDT) as on FTX and its FTT tokens. However, a

short-term decoupling from the dollar peg is nothing new for Tether

and was always a reason for haters spreading rumors. Related

Reading: JP Morgan Predicts Bitcoin Crash To $13.000 Due To Cascade

Of Margin Calls Tether CEO Paolo Ardoino was quick to dismiss any

rumors. Already yesterday, Tether released a statement in which it

assured that it had no exposure to FTX. #tether processed ~700M

redemptions in last 24h.No issues.We keep going. — Paolo Ardoino 🍐

(@paoloardoino) November 10, 2022 After the LUNA crash, Tether

briefly grazed $0.90 and restored its peg within a couple of hours.

Due to the removal of Alameda/FTX as the main USDT market maker and

minter, there may be temporary major deviations. People are not

taking any chances and selling USDT for USDC or BUSD, just in case.

Alistair Milne, CIO of Altana Digital Currency Fund, commented:

Tether has been FUD’ed and attacked longer than FTX has existed.

They endured a bigger bank run than FTX and passed with flying

colours. Perhaps there’s a different reason they get so much

attention while FTX got a pass? Other voices believe that the

rumors will not lead to a full, prolonged depeg if Tether is indeed

hedged 1:1, as evidenced by the reserves. Even Vitalik Buterin

spoke up and defended Tether. I have to admit, I’ve been very

critical of @Tether_to in the past, and their transparency is still

not nearly what I think an asset-backed coin should have, but

especially given what’s happened to so many other big-money

hotshots this bear, they’ve exceeded my expectations! — vitalik.eth

(@VitalikButerin) November 9, 2022

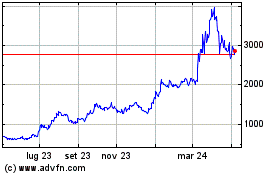

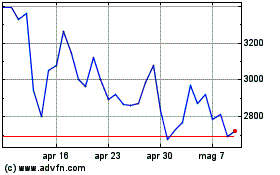

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Apr 2023 a Apr 2024