Bitcoin Bull Run Will Continue Until 2024 Expert Predicts, Can BTC Break $100,000?

10 Aprile 2023 - 11:00PM

NEWSBTC

Bitcoin (BTC) has been on a remarkable run during the first quarter

of 2023, with a year-to-date increase of 69%. Bitcoin is trying to

break its consolidation level and surpass its nearest resistance to

breach the long-awaited $30,000 psychological level, which will

introduce a new normal to the market and the new fully formed bull

run. As of this writing, the industry’s largest

cryptocurrency by market cap is trading at $29,200, posting a

profit of over 3% in the last 24 hours. Will Bitcoin continue its

bull run through 2023 and the 2024 halving cycle? Related Reading:

Is Ethereum Set to Rally After Shanghai? Data Suggests Bullish

Sentiment BTC’s Bull Run It’s Just Getting Started According to a

recent analysis by the CryptoQuant team, the correlation between

BTC and the technology-related index Nasdaq 100 has weakened,

dropping 60% from October’s 0.75 to the current value of 0.3.

This can indicate that Bitcoin is becoming increasingly independent

of traditional markets. According to the analysis, BTC’s market

behavior can be divided into two main phases over a longer time

frame; accumulation and distribution. During the accumulation

phase, it is known that investors buy and hold Bitcoin, which

causes its price to rise. In contrast, during the distribution

phase, investors sell, causing the price to fall. Bitcoin’s history

is characterized by halving events that occur approximately every

four years. As seen in the chart above, there is typically an

accumulation phase in which institutional investors increase their

Bitcoin purchases before each halving event. This trend has been

observed in recent months as more financial institutions have

adopted cryptocurrencies amidst the banking crisis that has

impacted the traditional financial system. Halving events are

significant because they reduce the rate at which new Bitcoin

enters circulation, making it more difficult for miners to earn

rewards for verifying transactions. This, in turn, leads to a

reduction in the supply of new Bitcoin on the market, which can

cause an increase in demand and therefore drive up the price.

If Bitcoin maintains its bullish momentum and consolidates above

the $30,000 mark, it could potentially align with the next halving

cycle. According to CryptoQuant analysis, if this happens, it could

be relatively straightforward to see BTC reaching $100,000 in the

aftermath of the 2024 halving event. Whales Lead The Rally

According to the crypto analysis and research firm Material

Indicators, the recent uptrend of Bitcoin to the $29,000 mark has

been led by “Mega Whales.” According to Material Indicators, the

rally has resulted in a shift in the ladders of ask liquidity,

which refers to the depth of sell orders at various price points.

This shift has made it easier for BTC’s price to increase,

indicating a positive market sentiment. However, according to

Materials, there is a lack of liquidity above $30,000, so there may

not be as much interest in clearing that level yet.

Furthermore, ask liquidity has been shifting upwards over the last

24 hours, indicating uncertainty, according to the analysis firm.

They further suggest that if Bitcoin’s price reaches an illiquid

zone, it could surge quickly, resulting in a rapid price

increase. Related Reading: Ethereum Staking Deposit Plummets

As Shanghai Upgrade Draws Near, Here’s Why Featured image from

Unsplash, chart from TradingView.com

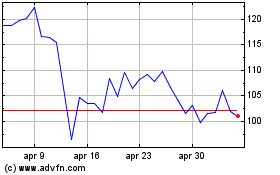

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2024 a Apr 2024

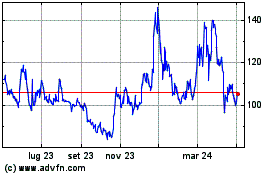

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Apr 2023 a Apr 2024