Bitcoin Crashes Under $93,000: What’s Behind It?

27 Novembre 2024 - 1:00AM

NEWSBTC

Bitcoin has observed a plunge under the $93,000 level during the

past day. Here’s what the trend in an indicator suggests about what

could be behind this downturn. Bitcoin Coinbase Premium Gap Has

Gone Cold As pointed out by CryptoQuant community analyst Maartunn

in a new post on X, the Coinbase Premium Gap has returned to

neutral levels recently. The “Coinbase Premium Gap” here refers to

an indicator that keeps track of the difference between the Bitcoin

price listed on Coinbase (USD pair) and that on Binance (USDT

pair). This metric essentially tells us about how the buying or

selling behaviours differ between the user bases of the two

cryptocurrency exchanges. Coinbase’s main traffic is made up of

American investors, especially large institutional entities, while

Binance serves investors around the world. When the Coinbase

Premium Gap has a positive value, it means the US-based whales are

participating in a higher amount of buying or a lower amount of

selling than the Binance users, which is why the asset is more

expensive on Coinbase. Similarly, it being negative implies a net

higher buying pressure on Binance. Related Reading: Chainlink May

Reach New ATH If This Barrier Breaks, Analyst Says Now, here is a

chart that shows the trend in the Bitcoin Coinbase Premium Gap over

the past couple of days: As displayed in the above graph, the

Bitcoin Coinbase Premium Gap had been at notable positive levels

earlier, but during the past day, its value has declined to the

neutral zero mark. According to Maartunn, the source of the

positive premium was Microstrategy’s latest buying spree. Indeed,

the cooldown in the indicator matches up with the timing of the

completion of the $5.4 billion purchase by Michael Saylor’s firm.

The significant accumulation from the company had helped the

cryptocurrency maintain its recent highs, but with the buying

pressure depleted, Bitcoin has retraced to price levels under

$93,000. BTC and the Coinbase Premium Gap have held a close

relationship throughout 2024, so the metric could be to keep an eye

on in the near future, as where it goes next may once again

foreshadow the asset’s next destination. Naturally, a decline into

the negative region could spell further bearish action for its

price. In some other news, the Bitcoin Active Addresses indicator

has observed a sharp jump recently, as Maartunn has shared in

another X post. This metric keeps track of the daily number of

addresses that are participating in some kind of transaction

activity on the network. Related Reading: Bitcoin To Smash

$100,000? Rapid Stablecoin Exchange Inflows Continue Below is the

chart shared by the CryptoQuant analyst for the 14-day simple

moving average (SMA) of the Active Addresses: With this latest

surge, the 14-day SMA of the Bitcoin Active Addresses has reached

its highest point in eleven months. This suggests that a lot of

activity has recently occurred on the network. Given that the asset

has gone down in the past day, though, the most recent user

interest has certainly not come for buying. BTC Price At the time

of writing, Bitcoin is floating around $92,400, down almost 6% over

the last 24 hours. Featured image from Dall-E, CryptoQuant.com,

chart from TradingView.com

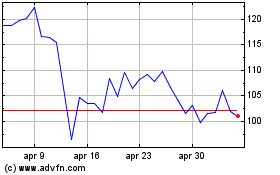

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Ott 2024 a Nov 2024

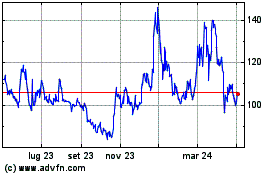

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Nov 2023 a Nov 2024