Stacks (STX) Climbs Another 9% Amid Bitcoin Rally, How High Can It Go?

20 Marzo 2023 - 5:15PM

NEWSBTC

The Stacks (STX) bulls are currently riding the Bitcoin rally.

Within the last seven days, the Stacks token is up 70%, 255% over

the last 30 days, and a whopping 456% over the last three months.

Without a doubt, the layer-2 technology has benefited from

Bitcoin’s strength during the recent move; BTC dominance has

increased from around 40% at the beginning of the year to nearly

46% at the moment. With the brewing banking crisis and optimism

towards Bitcoin, there is a strong case for Stacks to continue

rising in the medium term. However, the 1-week chart shows that STX

is approaching an important level where it could face a strong

headwind. At press time, Stacks was trading at $1.22 and targeting

the 38.2% Fibonacci retracement level at $1.40. At this price, the

STX bulls may stall and a pullback may occur. This is also

supported by the overbought RSI on the weekly chart at 83. In the

worst case scenario, a retracement towards the 23.6% level at $0.94

could be in play, which could provide an excellent buying

opportunity for bulls. However, if Stacks blows past the $1.40

level with ease, $1.78 (50% Fibonacci) and $2.16 (61.8% Fibonacci)

would be the next targets for a bull market rally. Before tackling

the all-time high of $3.38 from November 2021, the price level of

$2.70 would be the last major hurdle. Looking at the 1-day chart

reveals that Stacks bulls are showing some hesitation at the

moment. The range between $1.30 and $1.32 is the area which is

preventing a push towards the 38.2% Fibonacci retracement level at

$1.40 in the weekly chart for the moment. Related Reading: Stacks

(STX) Reclaims $1 As First DeGods Ordinal NFT Mints For 3.2 BTC A

consolidation down to $1.09 would be healthy to bring down the RSI

of 72 in the daily chart, before a bigger rally can continue.

Stacks Exhibits Persistent Strong Narrative In 2023 The much

anticipated Stacks 2.1 update was successfully activated yesterday.

It introduces several improvements to stacking that will eliminate

inefficient or confusing aspects of stacking, PoX rewards, and the

security mechanism. In addition, Clarity has been enhanced with a

wealth of new keywords, including writing Clarity contracts that

respond to Bitcoin transactions and writing Clarity contracts that

ingest off-chain data. 🚨 #Stacks 2.1 Activated 🚨 Strengthening The

Connection to #Bitcoin ⭐️ Stacking Improvements⭐️ New Clarity

Functions⭐️ Better Bridges⭐️ Decentralized Mining⭐️ #Bitcoin-native

Assets Find out more 👇 1/7 — stacks.btc (@Stacks) March 19, 2023

The 2.1 upgrade also lowers the barrier the entry to mining by

providing the two key building blocks for decentralized mining

pools. It provides miners with the ability to mine with a native

Segwit or Taproot UTXO. This not only reduces the Bitcoin

transaction fee by about 25%, but is also an important building

block for decentralized mining pools. Related Reading: Stacks (STX)

Down By 14% Ahead Of Upcoming Hard Fork Upgrade Last but not least,

Stacks 2.1 unlocks the ability to send Stacks assets directly to

Bitcoin addresses. Remarkably, more major upgrades for Stacks will

follow this year. Subnets are scheduled to be enabled in the second

quarter of 2023. These are a layer 2 scaling solution in the Stacks

blockchain that provide low latency and high throughput for

workloads. It enables developers to build fast and reliable

experiences. In the fourth quarter of 2023, the eagerly awaited

Nakamoto release is expected to arrive. The Nakamoto release adds

important capabilities that will increase the performance of stacks

as a Bitcoin layer. Additionally, it will introduce a trustless

Bitcoin peg (sBTC). Featured image from iStock, charts from

TradingView.com

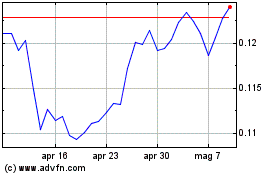

Grafico Azioni TRON (COIN:TRXUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni TRON (COIN:TRXUSD)

Storico

Da Apr 2023 a Apr 2024