Lateral Movement Of Uniswap, When Is There A Chance Of Correction?

21 Luglio 2022 - 6:00AM

NEWSBTC

Uniswap has displayed tight trading conditions for over the last 24

hours. The coin has been consolidating and it recorded minor losses

over the last day. Although Uniswap performed well over the past

week securing more than 30% gain, recently, the bulls seem to be

resting. Recently UNI broke past the $6.00 mark and it could be

eyeing the $8.00 price ceiling now. Buying strength displayed

slight decline but buyers were still more in number than sellers in

the market. Bitcoin’s price action has helped many altcoins to

rally but continued support from the buyers still remain crucial.

Going by the technical indicators, it seems though that UNI might

hover around the same price zone at least over the upcoming trading

sessions. After the rally, chance of a pullback cannot be ruled

out, Currently UNI hasn’t witnessed a pullback but consistent

consolidation could drag the coin to the nearest support level. If

it manages to clear its immediate resistance, there are chances for

UNI to trade beyond the $8.00 price mark. Uniswap Price Analysis:

Four Hour Chart UNI was trading at $7.41 at press time and the coin

was still optimistic on its chart. The current range of

consolidation was between $7.33 and $7.49 respectively. A slight

push from the buyers could help Uniswap to zoom past the $7.57

resistance mark. If that happens, reaching $8.00 becomes easy and

there could be a chance that UNI would trade above the $8.00 mark.

On the flipside, the local support for the coin was at $7.08 and

then at $6.47. A break below the $6.47 will push Uniswap near

$5.38. Volume of UNI traded declined slightly pointing towards a

slight fall in buying pressure. Technical Analysis UNI has

witnessed growing buying strength on the chart ever since the coin

rallied. There is a small downtick in the number of buyers even

then buyers are still in control of the market. The Relative

Strength Index was above the half-line and that meant buying

pressure exceeded selling pressure. Price of UNI was also above the

20-SMA line which signalled that buyers were driving the price

momentum in the market. UNI was also above 50-SMA and 200-SMA which

meant that the coin was trading on a bullish momentum. Related

Reading | Bitcoin Barrels Towards $24k As Miners Move $300 Million

From Wallet UNI was positive in terms of the buying strength

however some indicators suggested otherwise. Chaikin Money Flow

determines the capital inflows and outflows of the asset. Chaikin

Money Flow was below the half-line and that meant a decline in the

capital inflows. Moving Average Convergence Divergence picture the

price momentum and a change in price trend. MACD underwent bearish

crossover and red histograms were seen below the half-line. This

reading is connected to a change in the current price direction

over the upcoming trading sessions and also a sell signal. If

Uniswap has to remain in the bullish zone, buyers need to be

present along with support from the broader market. Related Reading

| Bitcoin Dominance Dives As Ethereum Takes Up More Space Featured

image from Forbes India, chart from TradingView.com

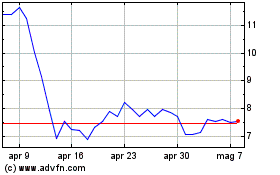

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Apr 2023 a Apr 2024