Groupe Berkem Announces the Successful Completion of €50 Million Financing Package, Including €43.5 Million Senior Debt and €6.5 Million Recovery Bonds

26 Luglio 2022 - 6:00PM

Business Wire

Regulatory News:

Groupe Berkem, a leading player in bio-based chemicals

(ISIN code: FR00140069V2 - Ticker: ALKEM) (Paris:ALKEM), today

announced the successful completion of a financing with a pool of

six French banks, as well as the issuance of Recovery Bonds in

France.

Anthony Labrugnas, Chief Financial Officer of Groupe Berkem,

stated: "The success of the Group's senior financing

demonstrates the attractiveness of the Company and the confidence

of our banking partners. With its new financial resources, the

Group now has expanded resources to carry out future external

growth operations.”

The financing operation consists of the setting up, for the

benefit of Berkem Developpement, a wholly-owned subsidiary of

Groupe Berkem, of a Refinancing Loan for a total amount of

€12 million (including two tranches of respectively €7.8 million to

be amortized and €4.2 million in fine), a €6.5 million

investment credit facility (including two tranches of €4.2

million and €2.3 million respectively), a €5 million revolving

credit facility and a €40 million external growth credit

facility, of which €20 million are confirmed.

TP ICAP Midcap was the exclusive financial advisor to Berkem

Développement and coordinator of the transaction. Caisse Régionale

de Crédit Agricole Mutuel d'Aquitaine and Helia Conseil were

mandated co-arrangers. The banking pool is composed of 6 lenders:

Caisse Régionale de Crédit Agricole Mutuel d'Aquitaine, Caisse

d'Épargne et de Prévoyance Aquitaine Poitou Charentes, Banque

Palatine, Banque Populaire Aquitaine Centre Atlantique, Crédit

Lyonnais and Banque Postale.

Fieldfisher advised Berkem Développement on senior debt and bond

issues, and Bryan Cave Leighton Paisner advised the senior banking

pool.

€6.5 million of Recovery Bonds subscribed by the

Obligations Relance France fund (an investment fund managed by

Eurazeo Investment Manager) and by the Obligations Relance France -

Eurazeo Investment Manager fund.

Kramer Levin acted as advisor to Eurazeo Investment Manager.

ABOUT THE FRENCH RECOVERY BOND FUND

The French Recovery Bond fund, endowed with €1.7 billion,

subscribed by 19 insurers members of the Fédération Française de

l'Assurance (FFA) and by Caisse des Dépôts, finances SMEs affected

by the health crisis, which invest in their development and

transformation. Part of the Recovery Plan of the Ministry of the

Economy, Finance and Recovery, the French Recovery Bond fund was

created by the insurers and Caisse des Dépôts, in cooperation with

the French Treasury. It benefits from a partial guarantee from the

State.

The Recovery Bonds have a term of eight years; they are

redeemable at maturity; they offer SMEs-ETIs unsecured subordinated

financing which can be obtained from the asset management companies

delegated to manage the fund.

ABOUT GROUPE BERKEM

Founded in 1993 by Olivier Fahy, Chairman and Chief Executive

Officer, Groupe Berkem is a leading force in the bio-based

chemicals market. Its mission is to advance the environmental

transition of companies producing the chemicals used in everyday

lives (cosmetics, food and beverages, construction, public hygiene,

etc.). By harnessing its expertise in both plant extraction and

innovative formulations, Groupe Berkem has developed bio-based

boosters—unique high-quality bio-based solutions augmenting the

performance of synthetic molecules. Groupe Berkem achieved a

revenue of €46 million and an EBITDA margin close to 20% in 2021.

The Group has almost 170 employees working at its head office

(Blanquefort, Gironde) and three production facilities in Gardonne

(Dordogne), La Teste-de-Buch (Gironde), and Chartres

(Eure-et-Loir).

Groupe Berkem has been listed on Euronext Growth Paris since

December 2021 (ISIN: FR00140069V2 – ALKEM)

www.groupeberkem.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220726005821/en/

Groupe Berkem Olivier Fahy,

Chief Executive Officer Anthony Labrugnas, Chief Financial Officer

Tel.: +33 (0)5 64 31 06 60 investisseurs@berkem.com

NewCap Investor Relations

Mathilde Bohin / Nicolas Fossiez Tel.: +33 (0)1 44 71 94 94

Berkem@newcap.eu

NewCap Media Relations

Nicolas Merigeau Tel.: +33 (0)1 44 71 94 94 Berkem@newcap.eu

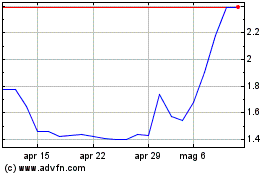

Grafico Azioni Groupe Berkem (EU:ALKEM)

Storico

Da Mar 2024 a Apr 2024

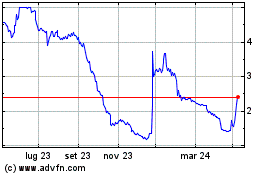

Grafico Azioni Groupe Berkem (EU:ALKEM)

Storico

Da Apr 2023 a Apr 2024