Bonduelle - First Quarter FY 2022-2023 Revenue: Growth driven by

price increases in the first quarter

BONDUELLE A French SCA

(Partnership Limited by Shares) with a capital of 57 102 699,50

EurosHead Office: La Woestyne 59173 Renescure, FranceRegistered

under number: 447 250 044 (Dunkerque Commercial and

Companies Register)

First Quarter FY

2022-2023

Revenue(July 1 - September 30,

2022)

Growth driven by price increases

in the first quarter

- Growth in activity driven

by Europe and long life business activities, and strengthened by

exchange rate

- Summer weather favorable

for ready-to-use fresh products in Europe, but lower activity in

North America

- Confirmation of a difficult

2022 harvest

In accordance with

IFRS 5, the 2021-2022 income statement items relating to the North

American canned and frozen activities, which were sold on June 30,

2022, of which the group now holds 35%, have been restated and

combined under "net profit from discontinued operations". Revenue

reported in the 2021-2022 consolidated income statement therefore

excludes these "discontinued operations", according to the IFRS

terminology.

Based on the group's new scope of activities,

the Bonduelle Group’s revenue for the 1st quarter of financial year

2022-2023 amounted to € 571.3 million, representing a growth of

10.9% at current exchange rates and 4.4% at constant exchange

rates. The strengthening of the Russian ruble compared with the

first quarter of the previous year and the continued weakening of

the euro against the US dollar generated an additional growth due

to exchange rates evolution of +6.5%.Activity grew in all of the

group's business units, except for Bonduelle Fresh Americas (BFA),

which was still penalized by a loss of volumes, partially offset by

price increases.The summer was once again marked in many parts of

the world by record heat waves, rainfall deficits and other drought

phenomena that had never been seen before. These elements have

weighed on volumes as well as agricultural and industrial

yields.

Activity by Geographical

Region

|

Total consolidated revenue(in €

million) |

From July 1 to September 30,

2022 |

From July 1 to September 30,

2021 |

VariationReported figures |

VariationLike for like

basis* |

|

Europe Zone |

348.7 |

320.5 |

+8.8% |

+9.5% |

|

Non-Europe Zone |

222.6 |

194.6 |

+14.4% |

-4.-% |

|

Total |

571.3 |

515.- |

+10.9% |

+4.4% |

Activity by Operating Segments

|

Total consolidated revenue(in €

million) |

From July 1 to September 30,

2022 |

From July 1 to September 30,

2021 |

VariationReported figures |

VariationLike for like

basis* |

|

Canned |

240.1 |

205.1 |

+17.1% |

+11.4% |

|

Frozen |

61.6 |

53.5 |

+15.2% |

+14.6% |

|

Fresh processed |

269.5 |

256.4 |

+5.1% |

-3.3% |

|

Total |

571.3 |

515.- |

+10.9% |

+4.4% |

Europe ZoneIn the first quarter

of the year, the Europe zone, representing 61.-% of the business

activity, posted an overall growth of 8.8% on a reported figures

and 9.5% on a like for like basis* in slightly lower volumes, with

growth benefiting from price increases to offset inflation.While

retail sales remained solid, they were once again particularly

dynamic in food service (+15.5%).The brands (Bonduelle and

Cassegrain) continued to grow, fueled by favorable summer weather

for the Bonduelle brand in the ready-to-use fresh segment, and for

Cassegrain by the ongoing referencing of the new frozen range.

Non-Europe ZoneRevenue in the

non-Europe zone, representing 39.-% of the business activity in the

first three months of the year, posted a variation of +14.4% on a

reported figures and -4.-% on a like for like basis*.In Eurasia,

the Bonduelle brands, and in particular Globus, are still

experiencing a solid growth in both volume and value. In the United

States, the ready-to-use fresh business activity of Bonduelle Fresh

Americas (BFA) business unit recorded a drop in volumes comparable

to the one recorded at the end of the previous financial year,

following the cessation of the same contracts and a less dynamic

market. These volume declines were partially offset by price

increases. The improvement in the service rate, penalized in

particular by workforce shortages, should make it possible to

maintain the customer base served, as evidenced by the renewal of

contracts recorded since the beginning of the financial year, but

also by the referral of new delivery centers to existing customers

and the winning of new contracts.

Other significant information

Universal Registration Document

publicationThe Universal Registration Document (URD) for

the 2021-2022 financial year can be consulted on the website

www.bonduelle.com. For the second year, the group is also

publishing an integrated report, also available on the website,

describing Bonduelle's business model and its approach in terms of

financial and non-financial performance.

Annual General MeetingThe SCA

Bonduelle's shareholders are invited to attend the Annual General

Meeting scheduled for December 1, 2022, during which a dividend of

€ 0.30 per share will be proposed for payment on January 5, 2023.

All documents relating to the General Meeting can be viewed on the

company's website www.bonduelle.com.

Outlooks

The extreme heat events observed in the various

areas where the Bonduelle Group operates and the resulting water

shortages have weighed on harvest yields and consequently on the

volumes processed. The geographical diversification of the harvest

areas and the irrigation systems in place in certain areas have

partially mitigated these effects. Nevertheless, the costs induced

by these adverse climatic conditions, as well as persistent and

widespread inflation (energy, salaries, packaging, logistics, etc.)

will require further price increases during the financial year and

will limit the growth of sales volumes. Despite this context of

possible product shortages and strong uncertainties regarding

consumption levels, and subject to the acceptance of these

necessary increases, the Bonduelle Group is maintaining its annual

revenue growth objective of 8% to 11% and a target operating margin

before non-recurring items of 2.5%, that is to say an increase in

operating profitability before non-recurring items of 15%, both at

constant exchange rate and scope of consolidation.

* at constant currency exchange rate and scope

of consolidation basis. The revenues in foreign currency over the

given period are translated into the rate of exchange for the

comparable period. The impact of business acquisitions (or gain of

control) and divestments is restated as follows:

- For businesses acquired (or gain of

control) during the current period, revenue generated since the

acquisition date is excluded from the organic growth

calculation;

- For businesses acquired (or gain of

control) during the prior fiscal year, revenue generated during the

current period up until the first anniversary date of the

acquisition is excluded;

- For businesses divested (or loss of

control) during the prior fiscal year, revenue generated in the

comparative period of the prior fiscal year until the divestment

date is excluded. In the specific case of the loss of control of

the long life activities in North America, the IFRS 5 standard

having been applied to the historical data, the revenue is already

restated in the historical elements;

- For businesses divested (or loss of

control) during the current fiscal year, revenue generated in the

period commencing 12 months before the divestment date up to the

end of the comparative period of the prior fiscal year is

excluded.

Alternative performance indicators: the group

presents in its financial notices performance indicators not

defined by accounting standards. The main performance indicators

are detailed in the financial reports available on

www.bonduelle.com.

Next financial

events:

- Annual General

Meeting: December

1, 2022- 2022-2023 1st Half Year

Revenue: February

2, 2023 (after stock exchange trading session)- 2022-2023 1st Half

Year

Results: March

3, 2023 (prior to stock exchange trading session)

About

the Bonduelle Group

We want to inspire the

transition toward a plant-based diet, to contribute to people’s

well-being and planet health. We are a French family business with

11,900 employees and we have been innovating with our farming

partners since 1853. Our products are cultivated on 73,000 acres

and marketed in 100 countries, with a revenue of € 2,203 million

(data as of June 30, 2022).

Our 4 strong brands

are: Bonduelle, Ready Pac Foods, Cassegrain and Globus.

Bonduelle is listed on

Euronext compartment BEuronext indices: CAC MID & SMALL - CAC

FOOD PRODUCERS - CAC ALL SHARESBonduelle is part of the Gaïa

non-financial performance index and employee shareholder index

(I.A.S.)Code ISIN: FR0000063935 - Code Reuters : BOND.PA - Code

Bloomberg : BON FP

Find out about the

group’s current events and news on Twitter @Bonduelle_Group, and

its financial news on @BonduelleCFO

This document is a free translation into English

and has no other value than an informative one. Should there be any

difference between the French and the English version, only the

French-language version shall be deemed authentic and considered as

expressing the exact information published by Bonduelle.

- Bonduelle - First Quarter FY 2022-2023 Revenue

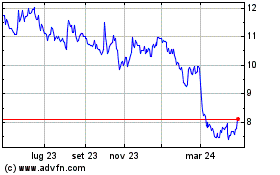

Grafico Azioni Bonduelle (EU:BON)

Storico

Da Mar 2024 a Apr 2024

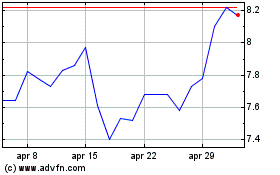

Grafico Azioni Bonduelle (EU:BON)

Storico

Da Apr 2023 a Apr 2024