BUREAU VERITAS - Strong start to the year; 2023 outlook confirmed

PRESS RELEASE

Neuilly-sur-Seine, France – April 20, 2023

Strong start to the

year;

2023 outlook

confirmed

Q1 2023 Key

figures1

- Revenue of EUR 1,404.5 million in

the first quarter of 2023, up 8.9% year on year and up 8.5%

organically

- Strong organic growth from Marine

& Offshore +13.5%, Industry +12.5%, Certification +11.2%,

Buildings & Infrastructure +9.0% and Agri-Food &

Commodities +7.7% divisions, compared to the first quarter of 2022;

lower Consumer Products Services (3.5)%, due to fewer new product

launches and volumes

- The scope effect was a positive

1.5%, reflecting bolt-on deals realized in the past few

quarters

- The currency impact was negative by

1.1% mainly due to the depreciation of some emerging countries’

currencies against the euro

Q1 2023 Highlights

- Growth driven by the vast majority

of the portfolio across all geographies (Americas, Middle East,

Europe, Africa and Asia Pacific)

- Sustained strong momentum for

Sustainability and ESG-related solutions across all businesses,

representing 55% of Group sales through the BV Green Line of

services and solutions

- Launch of a certification scheme

dedicated to renewable hydrogen, ensuring that it is produced under

safe and sustainable practices, and from renewable energy

sources

- Accreditation obtained by Bureau

Veritas to certify the “anti-food waste” label created in France

(as part of the Anti-Waste for a Circular Economy law)

2023 Outlook

confirmedBased on a healthy sales

pipeline and the significant growth opportunities related to

Sustainability, and taking into account the current macro

uncertainties, Bureau Veritas expects for the full year 2023 to

deliver:

- Mid-single-digit organic revenue

growth;

- A stable adjusted operating

margin;

- A strong cash

flow, with a cash conversion2 above 90%.

Hinda Gharbi, Deputy Chief Executive Officer,

commented:

“Bureau Veritas maintained a strong growth

trajectory in the first quarter of 2023, combining sustained

organic development with the contribution of targeted acquisitions

realized in the past few quarters, notably in the US. The diversity

of our portfolio, our strong sales pipeline and our leadership in

Sustainability and energy transition put us in a good position to

continue to grow steadily over the medium term.

Bureau Veritas is at the forefront of the energy

transition and of all stakeholders’ societal aspirations. During

the quarter, we supported our clients through various initiatives,

such as the launch of a certification scheme for renewable hydrogen

and the accreditation for a new 'anti-waste' label.

Looking ahead, and considering evolving

macroeconomic uncertainties impacting our clients, we confirm our

outlook for 2023.”

-

Q1 2023 KEY REVENUE FIGURES

|

|

|

|

GROWTH |

|

IN EUR MILLIONS |

Q1 2023 |

Q1 2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Marine & Offshore |

113.1 |

101.4 |

+11.5% |

+13.5% |

- |

(2.0)% |

|

Agri-Food & Commodities |

302.7 |

280.7 |

+7.8% |

+7.7% |

- |

+0.1% |

|

Industry |

295.3 |

269.5 |

+9.6% |

+12.5% |

- |

(2.9)% |

|

Buildings & Infrastructure |

431.6 |

388.2 |

+11.2% |

+9.0% |

+2.0% |

+0.2% |

|

Certification |

106.9 |

97.3 |

+9.9% |

+11.2% |

- |

(1.3)% |

|

Consumer Products |

154.9 |

153.0 |

+1.2% |

(3.5)% |

+7.1% |

(2.4)% |

|

Total Group revenue |

1,404.5 |

1,290.1 |

+8.9% |

+8.5% |

+1.5% |

(1.1)% |

Revenue in the first quarter of 2023 amounted to

EUR 1,404.5 million, an 8.9% increase compared with Q1 2022.

Organic growth was 8.5%, led by sustained strong momentum for

Sustainability and energy transition across all businesses.

Half of the portfolio (Agri-Food &

Commodities and Buildings & Infrastructure) was up 8.4%

organically on average, benefiting from strong trends for both Opex

and Capex activities. More than a third of the portfolio

(Certification, Industry and Marine & Offshore) delivered a

12.5% average organic revenue growth led by new energies and

decarbonization trends. Less than a sixth of the portfolio

(Consumer Products Services) declined 3.5% organically, impacted by

high inventory levels and reduced product launches.

By geography, activities in Americas were strong

(28% of revenue; up 13.9% organically), led by a 7.8% increase in

the US (Buildings & Infrastructure driven) and by a 26.5%

increase in Latin America (led by Brazil and Chile notably). Europe

(35% of revenue; up 6.7% organically) was primarily led by high

activity levels in Southern Europe and in the Netherlands. In Asia

Pacific (28% of revenue; up 4.3% organically), extremely robust

growth was achieved in Australia as well as in South-East Asian

countries while China returned to growth in the quarter. Finally,

activity was also strong in Africa and the Middle East (9% of

revenue, up 14.0% organically) primarily driven by Buildings &

Infrastructure and energy projects in the Middle East.

The scope effect was a positive 1.5%, reflecting

bolt-on acquisitions realized in the past few quarters.

Currency fluctuations had a slight negative

impact of 1.1%, mainly due to the depreciation of some emerging

countries’ currencies against the euro.

At the end of March 2023, the Group's adjusted

net financial debt slightly increased compared with the level at

December 31, 2022. The Group had EUR 1.6 billion in available cash

and cash equivalents and EUR 600 million in undrawn committed

credit lines. Bureau Veritas has a solid financial structure with

the bulk of its maturities beyond 2024 and 100% at fixed interest

rates.

Based on a healthy sales pipeline and the

significant growth opportunities related to Sustainability, and

taking into account the current macro uncertainties, Bureau Veritas

expects for the full year 2023 to deliver:

- Mid-single-digit organic revenue

growth;

- A stable adjusted operating

margin;

- A strong cash

flow, with a cash conversion3 above 90%.

-

BUREAU VERITAS’ NON-FINANCIAL PERFORMANCE

Corporate Social Responsibility

(CSR) key indicators

|

|

UNITED NATIONS’ SDGS |

Q1 2023 |

FY 2022 |

2025 TARGET |

|

SOCIAL & HUMAN CAPITAL |

|

|

|

|

|

Total Accident Rate (TAR)4 |

#3 |

0.27 |

0.26 |

0.26 |

|

Proportion of women in leadership positions5 |

#5 |

29.6% |

29.1% |

35.0% |

|

Number of training hours per employee (per year)6 |

#8 |

4.2 |

32.5 |

35.0 |

|

ENVIRONMENT |

|

|

|

|

|

CO2 emissions per employee (tons per year)7 |

#13 |

2.32 |

2.32 |

2.00 |

|

GOVERNANCE |

|

|

|

|

|

Proportion of employees trained to the Code of Ethics |

#16 |

96.6% |

97.1% |

99.0% |

-

MARC ROUSSEL APPOINTED EXECUTIVE VICE-PRESIDENT OF BUREAU VERITAS

COMMODITIES, INDUSTRY AND FACILITIES DIVISION IN FRANCE AND

AFRICA

On March 1st, Marc Roussel became Executive

Vice-President of Commodities, Industry and Facilities (CIF),

France and Africa. He reports to Hinda Gharbi, Deputy Chief

Executive Officer of Bureau Veritas and joined the Group Executive

Committee. Marc Roussel joined Bureau Veritas in 2015 as Senior

Vice President, Commodities, Industry & Infrastructure,

Africa.

For more information, the press release is

available by clicking here.

MARINE & OFFSHORE

|

IN EUR MILLIONS |

|

Q1 2023 |

Q1 2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

|

113.1 |

101.4 |

+11.5% |

+13.5% |

- |

(2.0)% |

The Marine & Offshore business delivered a

strong 13.5% organic revenue increase in the first quarter of 2023

with the following trends:

- A mid-single digit

increase in New Construction (39% of divisional

revenue), supported by a strong orderbook made of various types and

sizes of vessels;

- Core

In-service activity (47% of divisional revenue) posted a

solid double-digit growth, benefiting from a Covid-19 delayed

occasional surveys and positive pricing. At March end, the fleet

classified by Bureau Veritas comprised of 11,524 ships,

representing 144.8 million of Gross Register Tonnage (GRT);

-

Services (14% of divisional revenue, including

Offshore) recorded a mid-single-digit growth, benefiting from the

extension of non-classification services.

New orders totaled 2.3 million gross tons at the

end of March 2023 (similar to the prior year period) in a shipping

market down in the first quarter. This brings the order book to

21.2 million gross tons at the end of the quarter, up 5.5% compared

to December 2022. It remains highly diversified and composed of LNG

fueled ships, container ships and specialized vessels.

Over Q1 2023, the Marine & Offshore division

pursued its efforts to leverage digitalization following the

Group’s partnership with the global maritime software provider NAPA

that enables prescriptive rule checks and calculations utilizing 3D

model tools. In early 2023, Damen Engineering announced the

completion of their first vessel design to be entirely created,

reviewed and class-approved by Bureau Veritas using 3D models.

Sustainability achievements

The division continued to benefit from its

market leader positioning on alternative fuels, mainly LNG and

methanol dual propulsion over the course of the first quarter.

Bureau Veritas has issued an Approval in

Principle (AIP) to Viridis Bulk Carriers, supporting a new standard

for zero carbon short sea bulk logistics by utilizing ammonia as

fuel. This is a major milestone, enabling the uptake of ammonia as

fuel to decarbonize the maritime industry.

In March 2023, the Group announced that it will

provide full plan approval and design support to class two

diesel-electric propulsion, double hull, double end ferries for

operation in Hong Kong. One of the ferries will be built with

hybrid diesel-electric propulsion and will be zero emission when

sailing within pier boundaries, while both will be equipped with

battery and solar power technology.

AGRI-FOOD & COMMODITIES

|

IN EUR MILLIONS |

Q1 2023 |

Q1 2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

302.7 |

280.7 |

+7.8% |

+7.7% |

- |

+0.1% |

The Agri-Food & Commodities business

achieved organic revenue growth of 7.7% in the first quarter of

2023, with positive trends for all activities.

The Oil & Petrochemicals

segment (O&P, 30% of divisional revenue) recorded

mid-single-digit organic growth. The O&P Trade market reported

a steady growth, driven by higher volumes and pricing. A very good

performance was delivered in Europe, which benefited from the trade

flow route changes triggered by the war in Ukraine. Strong activity

was achieved for non-trade related services such as Verifuel bunker

quantity services and sustainability-driven solutions which

continued to expand across O&P.

The Metals & Minerals

segment (M&M, 33% of divisional revenue) achieved

mid-single-digit organic growth overall. The Upstream business

(nearly two-thirds of M&M) showed solid growth (up 3.4%

organically).

The exploration activity slowed down as a result

of tightening financial conditions for junior explorers while large

mining companies continued to be active. In mining related testing,

the activity continued to be driven by a mix of gold, energy

transition metals and bulk minerals. The Group’s on-site labs

business expanded further in Q1 with key wins in Latin America

notably. Trade activities recorded double digit organic revenue

growth (up 12.1% organically), fueled by all the main commodities

(copper, coal and non-ferrous metals), with strong trade volumes in

Asia, the Middle East and Southern Africa as well as by pricing

initiatives. The demand continues to be driven by the mega-trends

of urbanization, electrification/energy transition.

Agri-Food (22% of divisional

revenue) grew mid-single digit on an organic basis, with strong

performance in Agricultural trade activities and Food inspection.

The agricultural inspection activities grew strongly, across the

board, benefiting particularly from solid trends in Asia and in the

Middle East. The Food business saw improving trends, mainly driven

by the Asia Pacific region and the Middle East. Southeast Asian

countries benefited from a government contract on food safety. In

the Group’s largest Australian hub, the diversification strategy

contributed to growth.

Government services (15% of

divisional revenue) delivered a double-digit organic growth in the

quarter across most geographies. It benefited from the ramp-up of

both several VOC (Verification of Conformity) contracts (Nigeria,

Zimbabwe, Iraq) and Single Window contracts in Democratic Republic

of the Congo (DRC), Togo and Armenia. In addition, strong activity

level on existing contracts fueled the growth in DRC.

Sustainability achievements

In the first quarter of 2023, Bureau Veritas was

awarded a Food Safety and Quality Control contract in the Middle

East to support regional farmers and producers to comply with the

standards and regulations demand of a new sustainable city.

INDUSTRY

|

IN EUR MILLIONS |

Q1 2023 |

Q1 2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

295.3 |

269.5 |

+9.6% |

+12.5% |

- |

(2.9)% |

Industry was amongst the best performing

business within the Group’s portfolio in the first quarter of 2023

with an organic growth of 12.5%, with growth in all segments.

By geography, most regions delivered strong

growth in the quarter, with Latin America leading the way alongside

Australia, North America and Europe.

By market, Power &

Utilities (15% of divisional revenue) remained a key

growth driver of the portfolio with double digit organic

performance achieved in the first quarter for both Opex and Capex

activities. In Latin America (Chile and Argentina notably), the

activity was strongly supported by the ramp-up of contract wins

with various Power Distribution clients (Opex utility field

operation services), volume increases on existing contracts and

price renegotiation. In Europe, the nuclear power generation

segment grandly contributed to the growth in both France and the

UK.

Renewable Power Generation activities (solar,

wind, hydrogen) continued to accelerate with high double-digit

organic performance delivered across most geographies. This was

notably the case in the US, with a very dynamic activity from

Bureau Veritas’ Bradley Construction Management (solar energy

construction projects), benefiting from easing supply chain

restrictions and early opportunities from the Inflation Reduction

Act investment expectations. Opportunities around hydrogen, carbon

capture and storage projects are promising.

In Oil & Gas (33% of

divisional revenue), double digit organic revenue growth was

achieved in the quarter. Two-thirds of the business related to Opex

services increased 14.2% as they continue to benefit from the

conversion of a solid sales pipeline and a healthy backlog.

Capex-related activities, including Procurement Services, grew high

single digit organically, essentially attributable to the startup

of new projects.

Sustainability

achievements

In the first quarter of 2023, the Group signed

Memorandum of Understanding with KPMG in Singapore, Maybank and the

National University of Singapore to co-develop plug-and-play

decarbonization solutions in Southeast Asian Nations (ASEAN). The

aim is to assist companies from the energy, transport and real

estate sectors to assess and mitigate the impact of climate change

on their businesses.

BUILDINGS &

INFRASTRUCTURE

|

IN EUR MILLIONS |

Q1 2023 |

Q1 2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

431.6 |

388.2 |

+11.2% |

+9.0% |

+2.0% |

+0.2% |

The Buildings & Infrastructure (B&I)

business achieved strong organic growth of 9.0% in the first

quarter, primarily fueled by the Americas and by the Middle

East.

Double-digit organic revenue growth was

delivered in Construction-related activities (55%

of divisional revenue) and mid-single-digit growth in

Buildings In-service activities (45% of divisional

revenue).

The Group delivered a significant step up in

organic growth in the Americas (27% of divisional revenue) fueled

by most countries. Bureau Veritas US operations recorded high

single digit organic revenue growth benefiting from its diversified

portfolio of activities (data center commissioning services,

project management assistance and transactional activity for

Opex-related services, etc…). A particularly strong momentum was

achieved in the technical control and station product conformity

services for Electric Vehicle Charging Stations. In Latin America,

the Group delivered a very strong growth fueled by the ramp-up of

large Capex contracts for project management assistance signed in

the second half of 2022.

Growth in Europe (50% of divisional revenue) was

robust overall, benefiting from a solid mix of businesses in both

construction and buildings in-service activity. Double digit growth

was delivered in the UK, Spain and Italy. In France, the growth was

primarily driven by the In-service activity (around three quarters

of the French business) as it benefited from positive pricing and

from the dynamic performance of the Group solutions for energy

related services (technical assistance, consulting services). The

Capex-related work delivered growth led by technical control and

its higher weighting towards infrastructure and public works

against residential buildings.

The Asia pacific region (19% of divisional

revenue) recorded a 7.9% organic revenue increase led by

South-Eastern Asian countries. In China, the business remained

subdued. The sales pipeline is on the upward trend. The activity

performed strongly in India (up 29% organically).

Lastly, in the Middle East & Africa region

(4% of divisional revenue), the Group continued to deliver very

high growth primarily led by Saudi Arabia, and by the United Arab

Emirates (UAE), benefiting from the development of numerous

projects. In Saudi Arabia, the Group remained strongly engaged in

delivering QA/QC Services for the NEOM project, a smart city that

will be powered by renewable energy and become a center for

biotechnology, media and entertainment.

Sustainability achievements

The Group has developed an Audit Framework and

Gap Analysis service for the Climate Neutral Data Centre Pact

(CNDCP) in collaboration with the European Data Center Association

(EUDCA) and Cloud Infrastructure Service Provider in Europe

(CISPE). The framework will enable to assess and verify the

compliance of data centers with the Pact’s Self-Regulatory

Initiative (SRI), ensuring their sustainability and efficiency.

Bureau Veritas designed this framework to help its data center

owner and/or operator clients implement a compliance strategy

aligned with various regulations: the EU Taxonomy, the EU Energy

Efficiency Directive (EED) and the EU Corporate Sustainability

Reporting Directive (CSRD).

CERTIFICATION

|

IN EUR MILLIONS |

Q1 2023 |

Q1 2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

106.9 |

97.3 |

+9.9% |

+11.2% |

- |

(1.3)% |

The Certification business achieved a strong

organic growth of 11.2% in the first quarter of 2023. The growth

was supported by both volume and robust pricing across most

geographies and schemes.

All geographies grew organically. The Americas

and Asia Pacific performed above the divisional average, led by a

solid commercial development and strong traction for

Sustainability-driven services. Very high growth was recorded in

countries where the offering has been expanded with new schemes

(with the shift from traditional QHSE schemes towards new

services). This was illustrated by Brazil (second party audits),

Australia, Vietnam and China (Sustainability driven).

Within the Group’s portfolio, double-digit

growth was recorded for both QHSE schemes (back to

a normal year post recertification) and Supply Chain &

Sustainability while Food certification

(led by Food Safety) grew high single-digit organically. In

Australia, the Group was awarded a large outsourcing contract with

the Aged Care Quality and Safety Commission to undertake audits of

aged care facilities against the Aged Care Quality Standards.

The search for more brand protection, data

transparency, and social responsibility commitments all along the

supply chain continued to support the demand for Bureau Veritas

services. In Q1, the growth of its Sustainability services remained

strong (up 17.8%). It reflected a high demand for verification of

Greenhouse gas emissions and supply chain audits on ESG topics.

Supported by regulatory changes, the Group’s

portfolio diversification continued in the quarter and was a growth

enhancer. The momentum was particularly strong on solutions

dedicated to companies around Anti-bribery, IT Service Management

Information Security and Business Continuity. In particular, the

cybersecurity offering posted a 33.5% organic revenue growth in Q1,

led by an extremely robust commercial development and by rising

demand for more control on security systems.

Sustainability achievements

In the first quarter of 2023, Bureau Veritas

granted the first French “anti-food waste” label to a Carrefour

supermarket, following a successful audit of the store and head

office. Valid for a period of three years, it recognizes best

practices in three fields: procurement and purchasing of food

merchandise from suppliers, marketing of food items in stores, and

management and donation of unsold items. The Group has also been

accredited by UKAS, the National Accreditation Body for the United

Kingdom, to deliver ISO 19443 certificates to control quality

throughout the external service chain of the nuclear industry.

Bureau Veritas also announced the launch of a

certification scheme dedicated to renewable hydrogen. This

certification aims to support the industry to ensure that hydrogen

is produced under safe and sustainable practices, and from

renewable energy sources.

The Group was also awarded a large contract from

an Oil & Gas company to ensure Safety, Health and compliance

environmental audits on more than 30 customer sites in seven states

all around Brazil.

CONSUMER PRODUCTS

|

IN EUR MILLIONS |

Q1 2023 |

Q1 2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Revenue |

154.9 |

153.0 |

+1.2% |

(3.5)% |

+7.1% |

(2.4)% |

The Consumer Products Services division posted a

(3.5)% organic revenue performance over the first quarter of 2023,

with varying geographical and service trends.

Asia is the region most impacted by the global

economic slowdown, especially China, Korea and Southeastern

countries, while Americas (especially Latin America) and the Middle

East continue to benefit from the diversification strategy

implemented over the last years and from the structural

near-shoring market trends.

Softlines, Hardlines

& Toys (48% of divisional revenue) saw mid-single

digit organic decrease in the first quarter of 2023, due to the

lower volumes and the resulting high inventory levels, even though

the activity in China started to improve somewhat after the easing

of Covid restrictions.

Health, Beauty & Household

(8% of divisional revenue) delivered solid double-digit organic

growth in Q1. This promising performance is complemented by

the successful ramp-up of Advanced Testing Laboratory (ATL) and

Galbraith Laboratories Inc. which were both acquired last year in

the US. These help strengthen Bureau Veritas’ position in this

growing sector.

Inspection and Audit services

(12% of divisional revenue) maintained their good, high-single

digit organic growth momentum revolving around CSR audits over the

course of the first quarter of 2023, while

Technology (32%) was affected by the global

decrease in demand for electrical and wireless equipment as well as

the resulting temporary reduction in new product launches. The New

Mobility sub-segment is still posting a solid double-digit growth

on the back of good traction on testing on electric vehicle

engines, dashboards or charging stations.

The Group continued to pursue its geographical

diversification strategy to take advantage of the structural

sourcing shifts currently unfolding in South and Southeast Asia. In

this respect, Bureau Veritas recently opened a new lab in Hanoi

which will be fully dedicated to connectivity and wireless

testing.

-

PRESENTATION

- Q1 2023 revenue

will be presented on Thursday, April 20, 2023, at 6:00 p.m. (Paris

time)

- A video conference

will be webcast live. Please connect to: Link to video

conference

- The presentation

slides will be available on:

https://group.bureauveritas.com/investors/financial-information/financial-results

- All supporting

documents will be available on the website

- Live dial-in

numbers:

- France: +33 (0)1 70

37 71 66

- UK: +44 (0) 33 0551 0200

- US: +1 786 697

3501

- International: +44

(0) 33 0551 0200

- Password: Bureau

Veritas

-

2023 FINANCIAL CALENDAR

- Shareholder’s

Meeting: June 22, 2023

- H1 2023 Results:

July 26, 2023

- Q3 2023 Revenue:

October 25, 2023

About Bureau Veritas Bureau

Veritas is a world leader in laboratory testing, inspection and

certification services. Created in 1828, the Group has more than

82,000 employees located in nearly 1,600 offices and laboratories

around the globe. Bureau Veritas helps its 400,000 clients improve

their performance by offering services and innovative solutions in

order to ensure that their assets, products, infrastructure and

processes meet standards and regulations in terms of quality,

health and safety, environmental protection and social

responsibility.Bureau Veritas is listed on Euronext Paris and

belongs to the CAC 40 ESG, CAC Next 20 and SBF 120

indices.Compartment A, ISIN code FR 0006174348, stock symbol:

BVI.For more information, visit www.bureauveritas.com, and follow

us on Twitter (@bureauveritas) and LinkedIn.

|

|

Our information is certified with blockchain technology.Check that

this press release is genuine at www.wiztrust.com. |

|

ANALYST/INVESTOR CONTACTS |

|

MEDIA CONTACTS |

|

|

|

Laurent Brunelle |

|

Caroline Ponsi

Khider |

|

|

|

+33 (0)1 55 24 76 09 |

|

+33 (0)7 52 60 89 78 |

|

|

|

laurent.brunelle@bureauveritas.com |

|

caroline.ponsi-khider@bureauveritas.com |

|

|

|

|

|

|

|

|

|

Colin Verbrugghe |

|

Primatice |

|

|

|

+33 (0)1 55 24 77 80 |

|

thomasdeclimens@primatice.com |

|

|

|

colin.verbrugghe@bureauveritas.com |

|

armandrigaudy@primatice.com |

|

|

|

Karine Ansart+33 (0)1 55 24 76

19karine.ansart@bureauveritas.com |

|

|

|

|

This press release (including the appendices)

contains forward-looking statements, which are based on current

plans and forecasts of Bureau Veritas’ management. Such

forward-looking statements are by their nature subject to a number

of important risk and uncertainty factors such as those described

in the Universal Registration Document (“Document d’enregistrement

universel”) filed by Bureau Veritas with the French Financial

Markets Authority (“AMF”) that could cause actual results to differ

from the plans, objectives and expectations expressed in such

forward-looking statements. These forward-looking statements speak

only as of the date on which they are made, and Bureau Veritas

undertakes no obligation to update or revise any of them, whether

as a result of new information, future events or otherwise,

according to applicable regulations.

-

APPENDIX 1: Q1 2023 REVENUE BY BUSINESS

|

IN EUR MILLIONS |

Q1 2023 |

Q1 2022 |

CHANGE |

ORGANIC |

SCOPE |

CURRENCY |

|

Marine & Offshore |

113.1 |

101.4 |

+11.5% |

+13.5% |

- |

(2.0)% |

|

Agri-Food & Commodities |

302.7 |

280.7 |

+7.8% |

+7.7% |

- |

+0.1% |

|

Industry |

295.3 |

269.5 |

+9.6% |

+12.5% |

- |

(2.9)% |

|

Buildings & Infrastructure |

431.6 |

388.2 |

+11.2% |

+9.0% |

+2.0% |

+0.2% |

|

Certification |

106.9 |

97.3 |

+9.9% |

+11.2% |

- |

(1.3)% |

|

Consumer Products |

154.9 |

153.0 |

+1.2% |

(3.5)% |

+7.1% |

(2.4)% |

|

Total Group revenue |

1,404.5 |

1,290.1 |

+8.9% |

+8.5% |

+1.5% |

(1.1)% |

-

APPENDIX 2: DEFINITION OF ALTERNATIVE PERFORMANCE INDICATORS AND

RECONCILIATION WITH IFRS

The management process used by Bureau Veritas is

based on a series of alternative performance indicators, as

presented below. These indicators were defined for the purposes of

preparing the Group’s budgets and internal and external reporting.

Bureau Veritas considers that these indicators provide additional

useful information to financial statement users, enabling them to

better understand the Group’s performance, especially its operating

performance. Some of these indicators represent benchmarks in the

testing, inspection and certification (“TIC”) business and are

commonly used and tracked by the financial community. These

alternative performance indicators should be seen as a complement

to IFRS-compliant indicators and the resulting changes.

GROWTH

Total revenue growth

The total revenue growth percentage measures

changes in consolidated revenue between the previous year and the

current year. Total revenue growth has three components:

- organic

growth;

- impact of changes

in the scope of consolidation (scope effect);

- impact of changes

in exchange rates (currency effect).

Organic growth

The Group internally monitors and publishes

“organic” revenue growth, which it considers to be more

representative of the Group’s operating performance in each of its

business sectors.

The main measure used to manage and track

consolidated revenue growth is like-for-like, or organic growth.

Determining organic growth enables the Group to monitor trends in

its business excluding the impact of currency fluctuations, which

are outside of Bureau Veritas’ control, as well as scope effects,

which concern new businesses or businesses that no longer form part

of the business portfolio. Organic growth is used to monitor the

Group’s performance internally.

Bureau Veritas considers that organic growth

provides management and investors with a more comprehensive

understanding of its underlying operating performance and current

business trends, excluding the impact of acquisitions, divestments

(outright divestments as well as the unplanned suspension of

operations – in the event of international sanctions, for example)

and changes in exchange rates for businesses exposed to foreign

exchange volatility, which can mask underlying trends.

The Group also considers that separately

presenting organic revenue generated by its businesses provides

management and investors with useful information on trends in its

industrial businesses, and enables a more direct comparison with

other companies in its industry.

Organic revenue growth represents the percentage

of revenue growth, presented at Group level and for each business,

based on constant scope of consolidation and exchange rates over

comparable periods:

- constant scope of

consolidation: data are restated for the impact of changes in the

scope of consolidation over a 12-month period;

- constant exchange

rates: data for the current year are restated using exchange rates

for the previous year.

Scope effect

To establish a meaningful comparison between

reporting periods, the impact of changes in the scope of

consolidation is determined:

- for acquisitions

carried out in the current year: by deducting from revenue for the

current year revenue generated by the acquired businesses in the

current year;

- for acquisitions

carried out in the previous year: by deducting from revenue for the

current year revenue generated by the acquired businesses in the

months in the previous year in which they were not

consolidated;

- for disposals and

divestments carried out in the current year: by deducting from

revenue for the previous year revenue generated by the disposed and

divested businesses in the previous year in the months of the

current year in which they were not part of the Group;

- for disposals and

divestments carried out in the previous year: by deducting from

revenue for the previous year revenue generated by the disposed and

divested businesses in the previous year prior to their

disposal/divestment.

Currency effect

The currency effect is calculated by translating

revenue for the current year at the exchange rates for the previous

year.

1 Alternative performance indicators are

presented, defined and reconciled with IFRS in appendix 2 of this

press release.

2 Net cash generated from operating

activities/Adjusted Operating Profit.

3 Net cash generated from operating

activities/Adjusted Operating Profit.

4 TAR: Total Accident Rate (number of accidents

with and without lost time x 200,000/number of hours worked).

5 Proportion of women in leadership positions

(number of women on a full-time equivalent basis in a leadership

position/total number of full-time equivalents in leadership

positions).

6 Indicator calculated over a 3-month period

compared to a 12-month period for FY 2022 and 2025 target

values.

7

Greenhouse gas

emissions from offices and laboratories, tons of CO2 equivalent per

employee and per year for Scopes 1, 2 and 3 (emissions related to

business travel). Indicator calculated over a 12-month rolling

period.

- 2023 04 20_Press Release_Q1 2023 Revenue_vDEF (0.3 Mo)

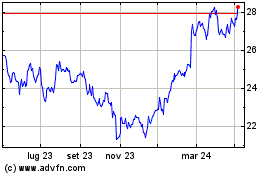

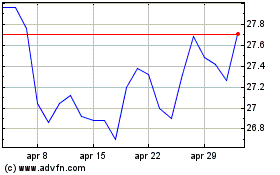

Grafico Azioni Bureau Veritas (EU:BVI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Bureau Veritas (EU:BVI)

Storico

Da Apr 2023 a Apr 2024